Summertime Stock Market Crash Is Coming, Analysts Warn

The stock market’s recent rally looks more like a bull trap than anything else. Analysts are warning of further pain ahead. | Image: Spencer Platt/Getty Images/AFP

- The number of warnings on Wall Street is steadily increasing.

- Analysts are worried that traders aren’t realistic.

- Exuberant optimism is characteristic of past bubbles and their resulting stock market crashes.

U.S. stock market futures were relatively flat Monday after both the Dow Jones Industrial Average and the S&P 500 posted a 4% rise last week.

Investors appeared keen to continue pushing equities higher despite grim economic data out last week. The Federal Reserve’s commitment to keeping markets afloat has been successful so far. Still, several analysts have started to hit the panic button in recent days, warning not to chase this rally.

Most notably was BlackRock CEO Larry Fink, who, behind closed doors, told some of the nation’s wealthiest investors to beware of pain as the long-term economic damage of coronavirus starts to materialize. Fink also pointed to rising corporate and individual tax rates as the U.S. government tries to fill the enormous gap carved out by its multi-trillion stimulus efforts.

Stock Market Could Crash by Year-End

But Fink’s quiet warning isn’t the only call for caution on Wall Street. Fund Manager Michael Gayed, who accurately predicted both the market’s crash and rise over the past few weeks, says this rally will end in tears by the end of the year:

This feels like a home construction project. It’s going to cost more money and take longer than any estimates. In the absence of a vaccine, behavior’s changed in a way that will make any longer-term gains unjustified no matter how much money Papa Powell prints

He believes investors haven’t fully accepted the impact that coronavirus will have on most businesses. When they do, he says, the result could be disastrous.

It’s Starting to Look A Lot Like the Dot-Com Bubble

Societe Generale economist Albert Edwards issued a similar warning , pointing to the “ludicrous” valuations seen in today’s market:

We are in the midst of a monetary and fiscal ideological revolution. Nose-bleed equity valuations are being supported by nothing more than a belief that a new ideology can deliver. Meanwhile the gap between the reality on the ground and expectations grows wider.

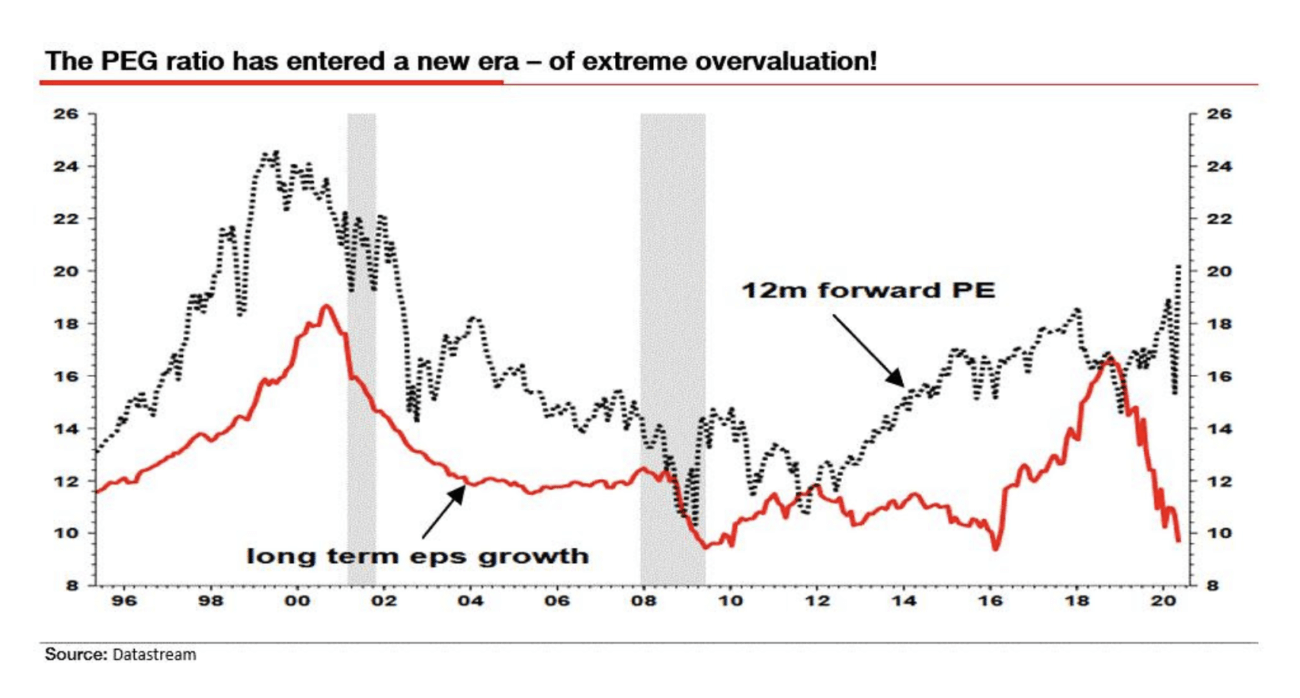

Edwards says the PEG ratio, which measures the S&P compared to long-term earnings growth, bears a striking resemblance to the dot-com bubble. The only difference, he says, is that back then, there was a flimsy reality supporting the stretched valuations. In today’s market, equities are trading on an “ideological dream.”

Former Goldman Sachs analyst Will Meade also said the market looks eerily similar to the dot-com bubble of 2000 . Back then, the market crashed and quickly rebounded, Warren Buffett had built up a war-chest of cash, and presidential elections were on the horizon:

The Nasdaq in 2000 did a similar bear market bounce as stocks this year — dropped 40%, then bounced 42% off the bottom retracing 61.8% of its drop. It stalled then fell 43%, making a new low four months later

Summer Looks Gloomy for Investors

Nomura Managing Director Charlie McElligott isn’t quite so pessimistic, but he still cautioned that the summer looks particularly dangerous for the stock market. He warned against chasing the current rally, saying we’re likely to see a sizable move lower in the weeks ahead.

In a note to clients, McElligott warned that deteriorating economic data and a wave of white-collar layoffs over the summer would be a shock to the system. He cautioned that the fall back to reality would be a harsh one as investors absorb how much damage U.S. businesses sustained:

I think for retail investors who probably missed that rally last month and are scratching their heads on why we rallied, the danger is now they try to chase, and think the rally has more legs from here, because much of the macro hedge fund space is really setting up for a move lower again

Second Wave Worries

Notably, none of those gloomy predictions take into account the second wave of coronavirus infections in the U.S., which, by all accounts, would cripple both the economy and the stock market.

Moody’s Mark Zandi said a second wave, even if it’s not bad enough to cause another shutdown, could be enough to push the U.S. economy into a depression. Without a vaccine, the economy can’t fully recover, Zandi says.

Zandi’s word of warning might sound extreme, but the chances of a second wave are likely. In Germany, where a well-funded healthcare system and excessive testing have prevented a high death toll, they’re already seeing the start of second waves after loosening restrictions over the past few weeks.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.