After Last Year’s Mempool Drama, Batched Bitcoin Transactions Finally on the Rise

When bitcoin transaction fees hit record costs in mid-to late-2017, a race for solutions was in force. The most workable one came in the form of batching bitcoin transactions, and batching’s popularity has increased in the background of a general bear market that started in early 2018.

Technical Underpinnings of Batching

At the time, it was noticed that blocks were not used to their fullest potential. This inefficiency led to higher fees across the network. As CCN.com reported, the Coinbase exchange was called out for dragging their feet on batching, which increased the fees everywhere since Coinbase engaged in massive transaction volume.

Miners are limited to 2MB worth of transactions per block, which also creates the economic gain for them. Batching relieves fee costs because multiple transactions in a single block take up less space than if they were spread across multiple blocks. Exchanges were congesting the mempool with smaller transactions that weren’t optimized in batches.

David Harding explained the solution in August 2017. While average bitcoin users couldn’t implement batching with bitcoin wallets, the work fell on exchanges to implement batching as “good stewards of the bitcoin network.”

Findings on the Batching Adoption

Batching is taking hold gradually, according to a recent analysis .

With a time frame starting from November 2017, the analysis looked at total output value of all transactions and separated out batched transactions from unbatched. The increase in batching is not as dramatic when you look at the number of transactions. However, the report’s biggest finding was the increase value amount in btc of the transactions processed as batches.

It states:

“…even though batched transactions make up an average of only 12% of all transactions, they move between 30%-60% of all Bitcoins, at peak times even 70%.”

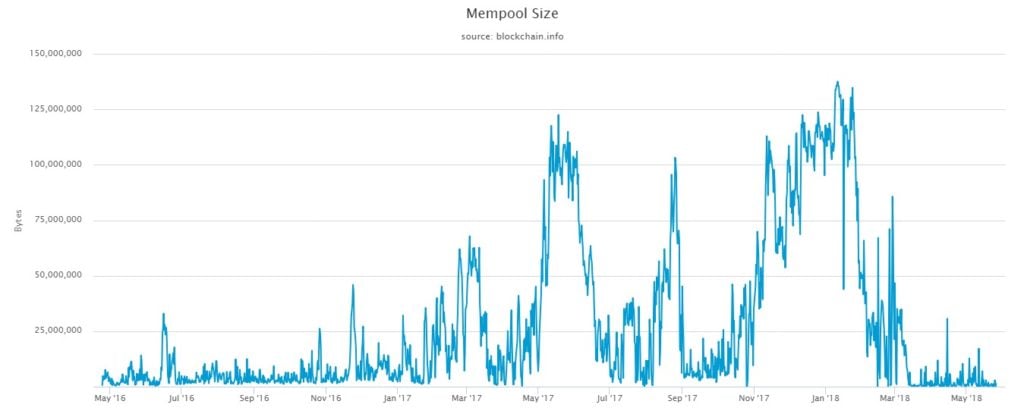

The finding is evidence for a huge stress relief on the network, along with SegWit adoption. As reported last year, the mempool drama let to $700 million being stuck as unconfirmed transactions. As everyone knows, nobody likes it when they are confused about where their money is. While the fiasco had a few issues at play, batching transactions as a custom could help minimize it from happening again if the bitcoin network is ever attacked with fake transactions or another surge of volume.

Exchanges are stepping up to the call, probably helped by the fact that batching helps business.

Additionally, in contrast to some in-fighting about the scaling debate, batching stands as an accomplishment for the bitcoin community as a whole. As an organic effort, users put pressure on exchanges and other high-volume users to take up batching, and that pressure appears to be working.

Featured Image from Shutterstock