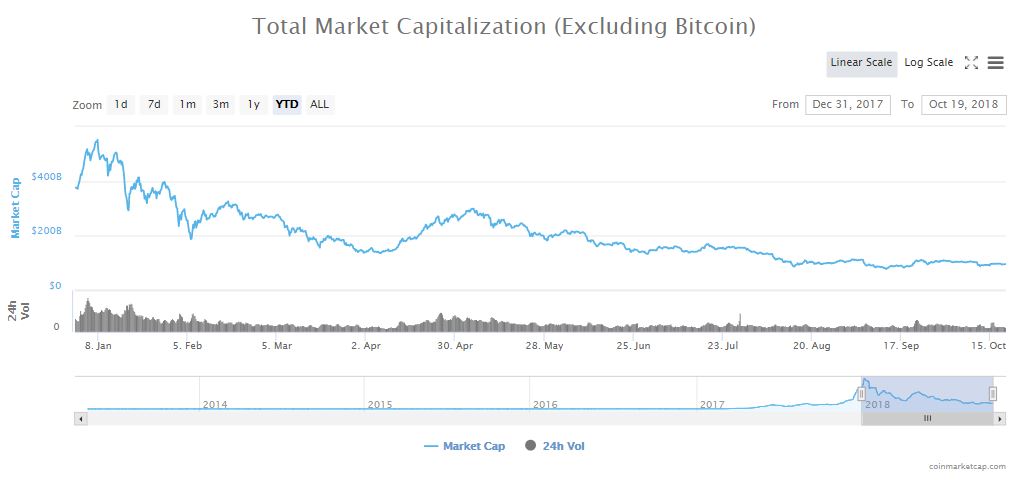

86% of ICO Tokens Now Worth Less than Initial Cryptocurrency Exchange Listing Price

Global professional services firm Ernst & Young (EY) has released a report on the performance of ICOs over the last year , and in keeping with the bear market for cryptocurrency assets, the trend was predictably downward.

Just 10 Tokens Count for 99% of All ICO Gains

EY released a report on ICOs back in December 2017 , which included a total of 372 projects. Within those projects were 110 standout ICOs that accounted for 87 percent of all funds raised among all projects analyzed. They dubbed this collection of more successful projects the “Class of 2017,” and in this latest report, released this week, they examined where that class is now in terms of value and progress.

Unfortunately, if you had created a portfolio of the Class of 2017, you would have lost about two-thirds of your investment relative to the value of the tokens when they were first listed on a cryptocurrency exchange. And, perhaps more significantly given the wider market downtrend, only 25 of the 110 projects have any kind of working product or prototype.

Further highlighting the risk-reward gamble of investing in ICO tokens, 86 percent are now worth less than their initial exchange listing price. In fact, only 10 projects accounted for 99 percent of any positive gains, so there was less than a one in ten chance of picking the right projects that would prove to be more valuable than their initial offering price. These projects were mostly in the blockchain infrastructure area, indicating that there is still a lot of foundational groundwork being done in the crypto space.

ICO Tokens Not a Better Investment than Ethereum

The 13-page presentation available online goes on to point out that even the most successful of the projects have barely made any impact when compared to ethereum, which has the most development, support, and market capitalization by a very large margin.

However, in spite of overall poor performance from the ICOs available since the end of 2017, there doesn’t seem to be any lack of demand for new projects through 2018. The first have of this year has seen over $15 billion USD put into blockchain and cryptocurrency related projects, with most funding coming through ICOs, and some through more traditional venture capital.

Nobody investing in cryptocurrency would be surprised to know that returns were a long shot, or that most projects will fail. Just like the dotcom boom of two decades ago, there were far more losers than winners. Of more concern is the fact that so few projects seem actually to be generating products. It’s one thing to try and fail; it’s another not even to be able to get in the game.

Hopefully, some of the projects that raised significant amounts of money in 2017 will still produce working prototypes to test in the market. But after a year, legitimate questions start to be raised about how well the resources within these projects are being allocated.

Featured Image from Shutterstock