80% of Bitcoin Mined and Multi-Billion Dollar Firms are Now Joining the Party

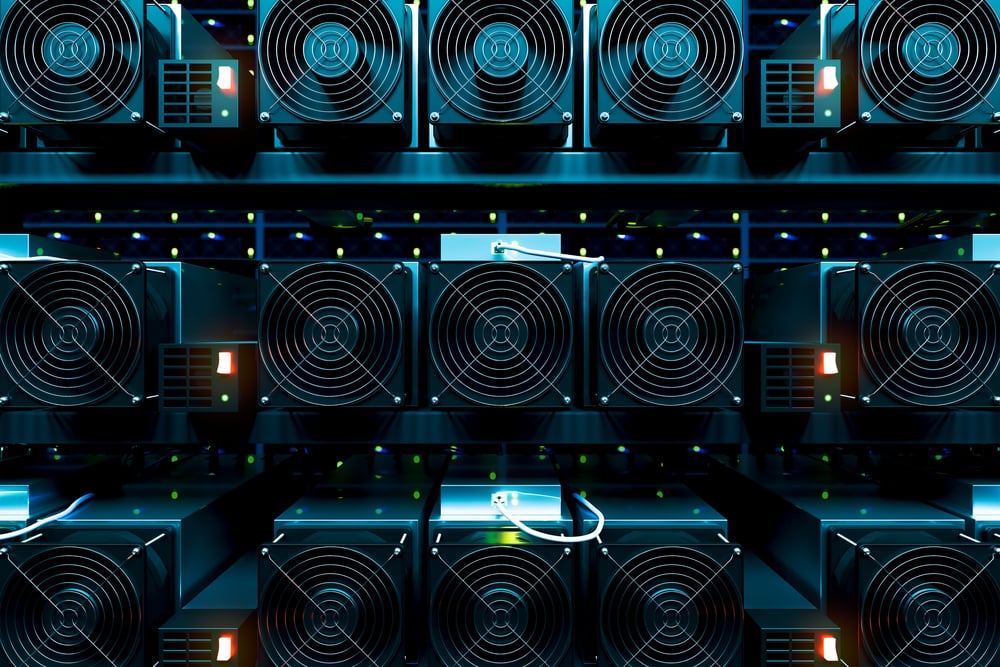

Bitcoin Mining Farm

80 percent of bitcoin has officially been mined and more than 16.8 million bitcoins are in circulation. While the majority of bitcoin mined in the early days were produced by individual miners, multi-billion dollar firms are starting to enter the global mining sector.

Evolution: From Individual Miners to Multi-Billion Dollar Facilities

Traditional assets and currencies are controlled and issued by central entities. Consequently, their supplies can be altered and manipulated by the authorities. The US dollar in particular, the reserve currency of the global economy, has its supply controlled by the Federal Reserve Bank through a method called quantitative easing, a complex term for a simple concept of printing more cash.

Unlike traditional currencies and assets, the supply of bitcoin is fixed and the rules of the cryptocurrency are determined by its decentralized protocol. Bank of Finland researchers described bitcoin as “a monopoly run by a protocol, not by a managing organization.”

While analysts and critics of bitcoin and other cryptocurrencies consistently state that the value of bitcoin is not backed by anything, the value of bitcoin originates from a basic economic concept of supply and demand. In the global market, intrinsic value simply does not exist. Value is always subjective and it solely depends on the supply and demand of the market.

Bitcoin is valuable because of its security, computing power, fixed monetary supply, and rising demand from the global economy. Because only 21 million bitcoins can ever exist, despite the rising demand, more bitcoins cannot be mined or produced once the supply of bitcoin hits 21 million.

In the early days of bitcoin, individual miners with small-scale mining setups were able to mine many bitcoins with low electricity costs, because at the time, there wasn’t enough computing power contributing to the Bitcoin network and as result, the difficulty level of bitcoin mining was low.

The difficulty level in bitcoin mining is automatically calculated based on the amount of computing power contributed to the network. This particular system prevents the absence of large mining facilities from impacting the global Bitcoin network.

For instance, hypothetically, if Chinese bitcoin miners and mining pools shut down, it would have minimal impact on the production and mining of bitcoin because then it would be easier for existing miners to mine bitcoin, as the difficulty level decreases.

Established Industry

But, the bitcoin mining sector has grown to a major industry and it is highly unlikely that the computing power of bitcoin suddenly decreases overnight by large margins. In the upcoming months, some of the largest technology conglomerates in Japan are expected to enter the bitcoin mining sector, allocating billions of dollars in producing ASIC miners and establishing large-scale mining centers.

The entrance of major conglomerates would evenly distribute the power of miners and mining equipment manufacturers within the global bitcoin mining market, which is currently dominated by a few companies including Bitmain.

Hash power or computing power of bitcoin represents the stability of the Bitcoin blockchain network. As the bitcoin network, market, and mining industry mature, bitcoin will evolve into a major currency, store of value, and a medium of exchange.

Featured image from Shutterstock.