5 Reasons Why Tesla Stock Skyrocketed 60% in 90 Days

The shorts piled into Tesla, and Elon Musk's company made them pay. | Source: Mark RALSTON / AFP

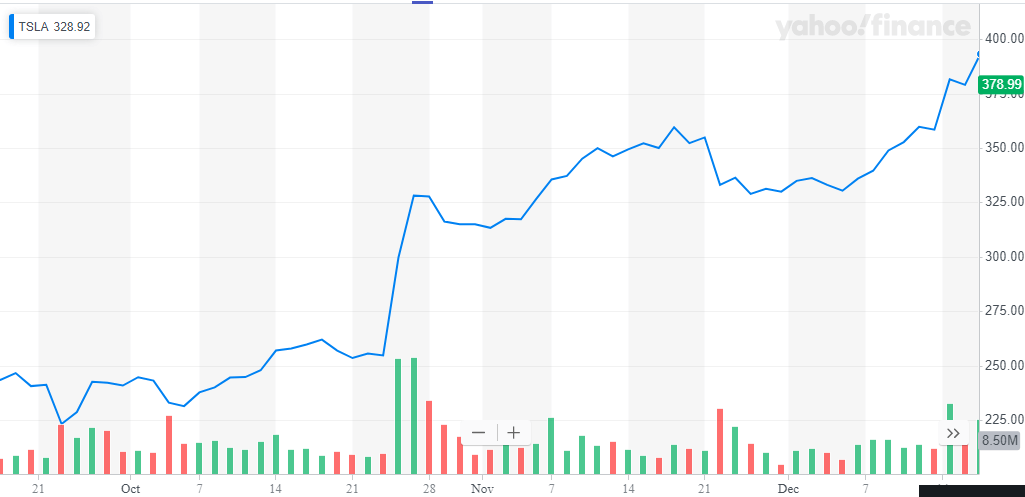

- After having a terrible start to the year, Tesla stock has rocketed to new all-time highs.

- The stock is up over 60% in the last 90 days.

- There are five key reasons behind the recent stellar performance.

Tesla stock (NASDAQ: TSLA) has had a very volatile 2019.

The EV stock endured a brutal drawdown in the first half of the year, only to reach new all-time highs by December. TSLA’s rise has particularly gathered pace over the last three months, soaring over 60% in that period.

Looking back, there have been five main catalysts behind this rapid climb.

1. Tesla Has Piggy-Backed on a Broader Stock Market Rally

The Nasdaq Composite Index has performed very nicely in the last three months. Driven in part by November’s blowout jobs report and the incessant tweeting from President Trump about trade war optimism, the Nasdaq is up almost 10% since mid-September.

In the stock market, a rising tide lifts all boats. And given that Tesla has had a very volatile year, the recently Nasdaq rally has benefited the stock massively.

2. Tesla Stock Broke Out of a Consolidation Pattern

Tesla’s downtrend came to an end when it hit multi-year lows near the $180 price level in June. The price level has acted as a strong support for the stock in the past.

The stock then consolidated over the next six months, forming a symmetrical triangle pattern. It finally broke out of the pattern in October and hasn’t looked back since.

In technical analysis, the longer a stock takes to form a consolidation pattern, the stronger the breakout eventually is. Tesla has definitely respected this rule.

3. Elon Musk Revealed a Surprise Profit in Third Quarter

Tesla posted a surprise profit in the third quarter of 2019, and that has undoubtedly been the primary reason behind the stock jumping 60% jump in 90 days.

Heading into third-quarter earnings, the sentiment surrounding Tesla was extremely bearish. Wall Street was expecting the company to post a big loss of $0.46 per share. Even the biggest Tesla bulls were unloading the stock.

So when the company posted a stunning profit of $1.91 per share, smashing analysts’ estimates, the stock skyrocketed 30% in the next two days.

4. High TSLA Short Interest Added Fuel to the Fire

Tesla has always been one of the most-shorted stocks on Wall Street. Short sellers had piled onto Tesla in the first half of the year. With the stock having lost close to 40% of the value since the start of 2019, shorts were betting on that trend to continue.

Over 37 million Tesla shares were sold short as of October 15. That figure has since fallen to under 28.7 million as the shorts were squeezed on the back of a strong third quarter. This means Tesla short sellers have been forced to buy close to 9 million shares to cut their losses. This additional demand for shares added fuel to the stock’s rally.

5. The CyberTruck Attracted a Stunning Number of Pre-Orders

Tesla launched the CyberTruck late in November, and the event was a disaster . Initially, the CyberTruck was not well-received, and there were questions about its design. Forbes even called it “ugly as sin.”

However, Tesla fanatics quickly warmed up to the vehicle, as pre-orders crossed the 250,000 mark just days after the launch. Although the pre-orders don’t count for much – Tesla is only taking refundable $100 deposits – it made for a nice headline.

And in a world where high-frequency trading (HFT) firms are extremely prevalent, a good headline can often send a stock, or even the entire market, soaring.