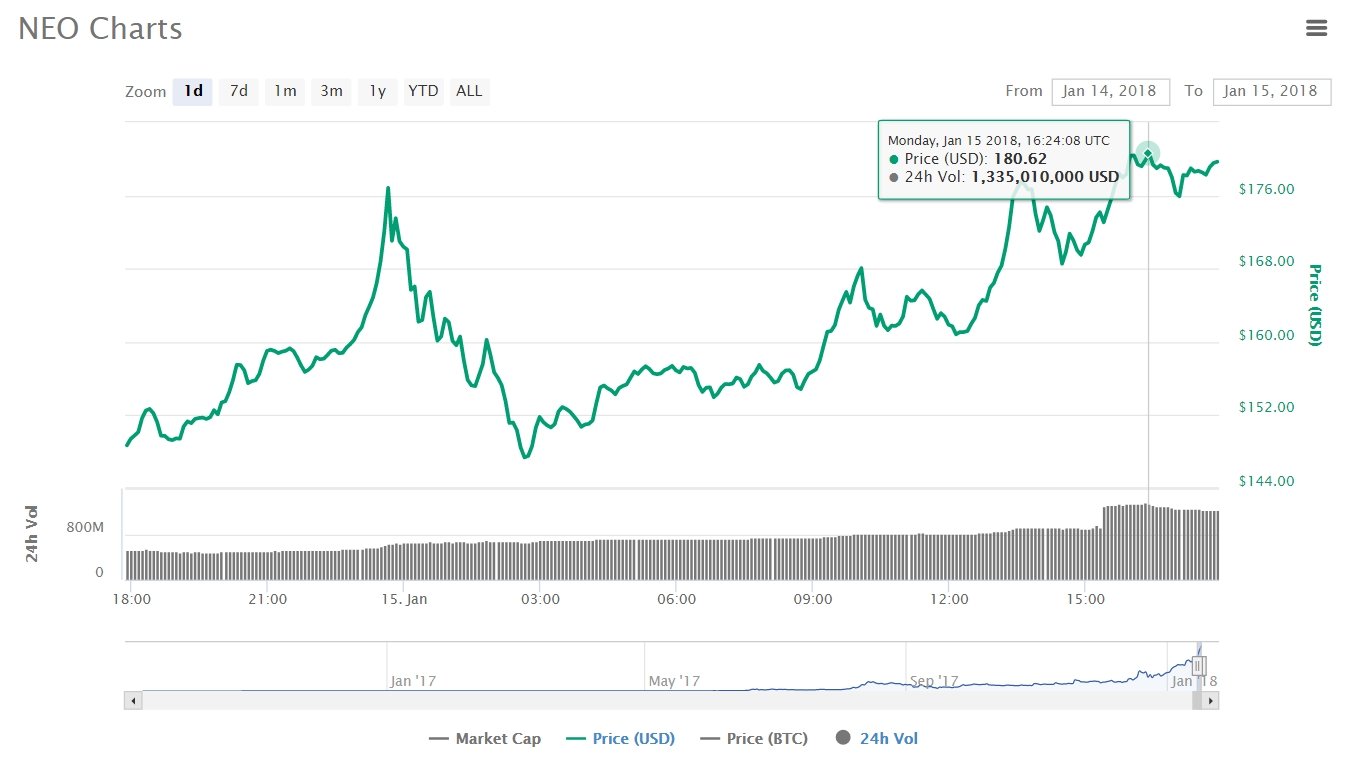

$180: NEO Hits New All-Time High Despite Market Slump

Amid a broader cryptocurrency market slump, NEO has risen 25% to $180 over the past 24 hours at the time of writing, providing the only resistance to what is perceived as a widespread market correction.

NEO, often referred to as the Chinese Ethereum (ETH), was rebranded in 2017 from AntShares, and is being developed as a project ‘to realize a “smart economy” with a distributed network’. Being a native Chinese currency it is also expected to benefit from the size of the Chinese market, the second largest consumer market in the world.

Possible Factors

So what is the explanation for NEO’s resilience in this market-wide correction? Increasingly, ICOs are looking to launch on NEO rather than ETH platforms, as it is faster and transaction fee-free. NEO’s GAS tokens – in finite supply – will be used by ICOs to fuel their smart contracts. Holders of NEO earn dividends from the use of GAS.

Furthermore, developers looking to write smart contracts on Ethereum need to learn that platform’s proprietary programming language Solidity. NEO, on the other hand, is written in C# and Java, making it far more accessible to developers wanting to join the community to support its development. As argued in a reddit thread : BTC was crypto 1.0, ETH was crypto 2.0, and NEO is crypto 3.0.

Long-term investors in the cryptocurrency community are no strangers to wild market volatility and many consider it part of the growing pains of a new industry. However, this current bearish run sees no sign of abating. Then again, normal market signals that inform most markets tend to have little impact on the cryptocurrency market.

NEO’s momentum in spite of this bearish run could signify that crypto traders have identified a coin with superior technology and a usability case. It could also be, however, merely an aberration indicative of a new and speculative marketplace. It is not the only currency to have had its moment in the sun. Only time will tell.

With its record high price, NEO is now the ninth largest cryptocurrency by market cap and has benefited from the bullish trend in digital currencies over the last few months of 2017. That sentiment has swung for the worst for many currencies, however, in the early days of the new year.

The past week has presented a number of challenges to cryptocurrencies. These include fears of a possible ban on cryptocurrency trading in South Korea, the Kraken exchange meltdown, and Warren Buffett’s prediction of cryptocurrencies facing a ‘bad ending’ and his overall dismissal of the new landscape.

In addition, the Chinese government has announced plans to clamp down on coin mining activities under a number of guises, including electricity usage and land tax reforms. China and South Korea have banned ICOs, and Japan is considering following suit. A number of high-profile ICO scams have rattled investor confidence and dented credibility in the market.

According to coinmarketcap , the current correction has wiped over $50 billion dollars from the market since January 13th.

This correction follows on from a pre-Christmas correction that saw values plummet across the board. Currently, Bitcoin is hovering at around US$14,000, down from it’s December 17th all-time high of just under US$20,000. Ripple XRP, a coin that rose rapidly in December, has had a horrid run since January 8th, falling from a high of US$2.56 to its price at the time of writing of US$1.83, despite a strategic partnership announcement with MoneyGram only days ago.

Shanghai image from Shutterstock.