$10,915: Bitcoin Price Destroys Key Milestone to New 2019 High, What’s Next?

Another day, another yearly high for bitcoin. | Source: Shutterstock

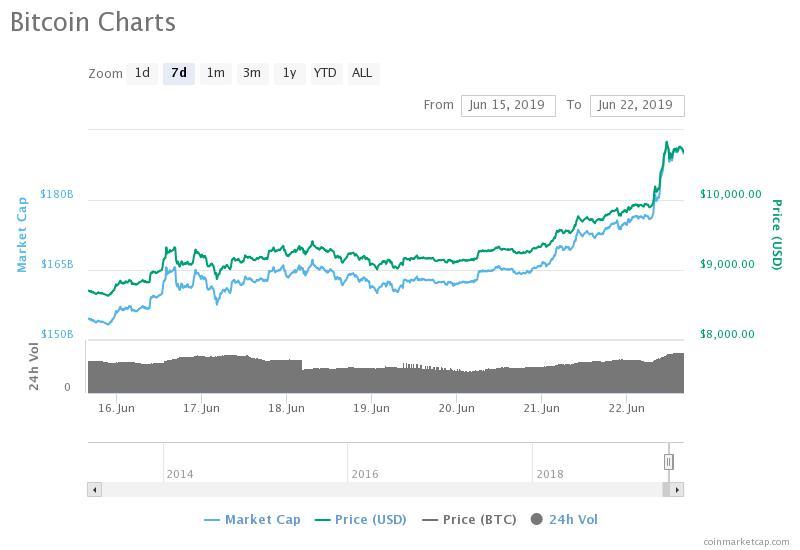

By CCN.com: On major crypto exchanges in the likes of Bitstamp and Coinbase, the bitcoin price has achieved a new 2019 high at $10,915 in an overnight rally.

As the bitcoin price surpassed the $10,000 mark, a level that has been regarded as a key psychological level by prominent investors and analysts including Tyler Winklevoss and Thomas Lee, the sentiment around the near term trend of the crypto market has significantly improved.

What’s next for bitcoin price?

Technical analysts anticipate bitcoin to move past its current all-time high at $20,000 in the upcoming months, possibly by 2020.

Crypto traders Josh Rager and Peter Brandt have pointed the range between $60,000 to $100,000 as potential long term targets for the dominant crypto asset, indicating that the bull market of the asset class has begun.

“Bitcoin takes aim at $100,000 target. $btcusd is experiencing its fourth parabolic phase dating back to 2010. No other market in my 45 years of trading has gone parabolic on a log chart in this manner. Bitcoin is a market like no other,” Brandt said .

Although global markets analyst Alex Krüger said in May that bitcoin has officially begun a new bull trend following its breakout above $6,800, bitcoin price above $10,000 is expected to appeal to retail and individual investors.

Throughout the past 12 months, crypto investment firms have seen a large inflow of capital from institutional investors.

Grayscale’s Bitcoin Investment Trust (GBTC) surpassed $2 billion in assets under management as it achieved a record high daily volume and more than 70 percent of investments in the first quarter of 2019 came from institutional investors.

Vinny Lingham, a general partner at Multicoin Capital, noted that considering the aggressive upside movement of bitcoin price, it may test $12,000 shortly but the asset is expected to remain stable at $10,000 for a while.

“This BTC action looks aggressive. Makes me think that we may blow through $10k and test $12k very soon, but $12k is a very heavy resistance level, so I would expect consolidation around the $10k level for some time if $12k is (likely) rejected,” Lingham said .

Catalysts above $10,000 is needed

As said by Tyler Winkelvoss, there exists a possibility that the sheer momentum of the crypto market carries bitcoin price from $10,000 to $15,000 in the near term.

However, having already recorded a 189 percent year-to-date gain against the U.S. dollar, a strong catalyst is needed for the asset to sustain its momentum.

Brian Kelly, the CEO of BKCM, said on CNBC’s Fast Money that bitcoin miners are prepared to hold onto BTC without liquidating much of it to finance operations throughout the next year.

“I’ve talked to a lot of miners around the world, a lot of them have said they have sold enough bitcoin to get us through the next year or so and we are going to hoard bitcoin at this point in time and we are not going to sell it and the supply of bitcoin will get cut in half. Just real simple economics: lots of demand hitting little supply, price goes higher,” said Kelly.

If miners continue to be reluctant towards selling BTC generated by their operations in the global exchange market, the decline in the circulating supply of the asset may act as another factor behind the upside movement of bitcoin price.