Virgin Galactic’s Surge Exposes Everything Wrong with the Stock Market

Virgin Galactic's rally, even more than Tesla's, encapsulates everything that's wrong with the stock market. | Source: Drew Angerer/Getty Images/AFP

- Virgin Galactic is now worth $6.7 billion, despite reporting just $3 million in revenue last year.

- The space tourism stock is worth $1 billion more than Macy’s, which isn’t sexy – but is profitable.

- This disparity exposes everything wrong with the stock market.

Think Tesla’s bewildering rally is the best evidence that the stock market is getting uncomfortably bubbly? Richard Branson’s Virgin Galactic has a message for you: Hold my beer.

The space tourism stock (NYSE: SPCE) has surged roughly 200% since ringing in 2020, pushing its market cap to $6.7 billion on Wednesday afternoon.

Space Is Sexy – Dividends Aren’t

As noted by Compound Capital Advisors founder and CEO Charlie Bilello, that makes Virgin Galactic more than $1 billion more valuable than department store chain Macy’s (NYSE: M) .

That’s frankly ridiculous.

The iconic department store is more than 160 years old, with 130,000 employees and $25 billion in revenue.

Most importantly, it reported $1.1 billion in net income last year, currently offers an eye-watering forward dividend yield of 9.4%, and has a PE ratio of less than 5.25.

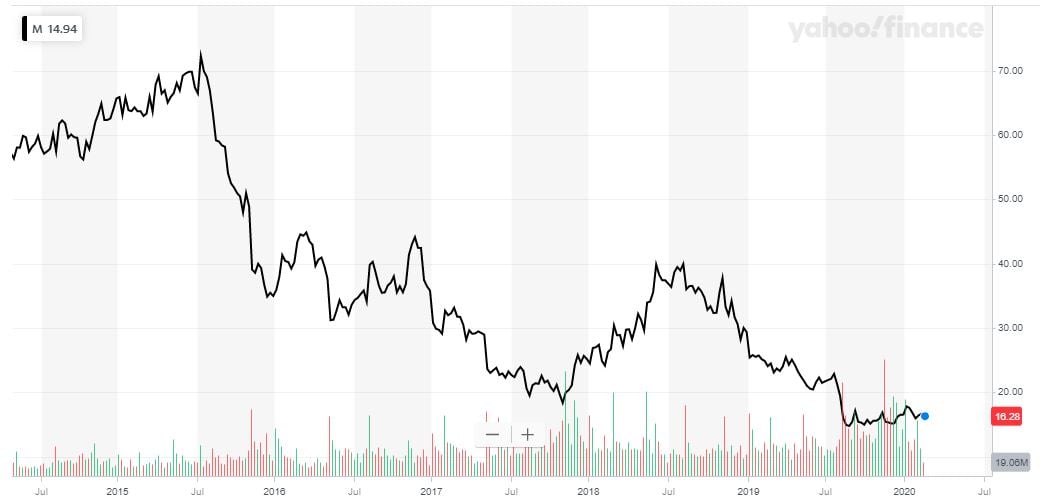

That’s not to say the stock hasn’t fallen on tough times.

Brick-and-mortar retail isn’t exactly a growth industry. That’s especially true for department stores like Macy’s, which long anchored foot traffic at now-vacant shopping malls.

M shares currently trade 38% off their 52-week highs as the company implements a painful turnaround strategy that will require massive cuts.

It seems inevitable that Macy’s will have to cut its dividend, maybe even when it reports earnings next week. And just this week, S&P Global cut its credit score to junk grade status (BB+) .

It’s an understatement to say that Macy’s doesn’t have great fundamentals. It’s not sexy. But it’s cheap . And at least it has fundamentals.

What Virgin Galactic has is a charismatic figurehead – and lots and lots of questions.

With virtually no revenue to speak of, investors are bidding up SPCE stock for one reason, and one reason only – speculation.

Virgin Galactic Is a Microcosm of Everything Wrong with the Stock Market

This rally, even more than Tesla’s, encapsulates everything that’s wrong with the stock market.

The S&P 500 keeps setting new record highs, but not because corporate profits are rising accordingly. In fact, just five stocks account for the index’s entire earnings growth . Investors are just greedily stomaching larger and larger PE ratios .

And it’s not as though economic forecasts vindicate those overextended valuations.

The stock market is priced for 3% growth , making investors even more optimistic than the Trump administration – whose predictions have been far too bullish three years running.

And that’s before you account for the downside risks from the coronavirus outbreak , which the stock market has all but ignored.

Like Virgin Galactic’s rally, that doesn’t seem sustainable .

The only question is when the other shoe will drop.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.