Tesla Worries Wall Street as Employees are Blindsided by Store Closures

Tesla has a slew of announcements but its rapid pivots are concerning Wall Street analysts and employees alike. | Source: Shutterstock

Last week, Tesla CEO Elon Musk slashed the price of the Model 3 to $35,000 as a part of a larger strategy to compete against conventional car makers and increase profitability.

In a letter sent to employees, Musk disclosed that the company generated its first profit in the third quarter of last year and will prioritize financial stability in the years ahead.

The substantial cut in the pricing of the Model 3, which the company hopes will increase the sales of its most affordable model in the global market, still poses a risk to the firm’s profitability.

To alleviate the pressure the cut in the pricing of the Model 3 puts on Tesla, Musk announced that the company will shut down its physical stores and switch to an online model.

But, strategists have voiced concerns towards the abrupt change in the business model of Tesla

Shifting All Sales Online is Risky For Tesla

According to Whitney Tilson, a hedge fund manager at Kase Capital Management, the aggressive strategy of Tesla to shift all sales online with the sole intent of cutting down pricing demonstrates the company is running out of options.

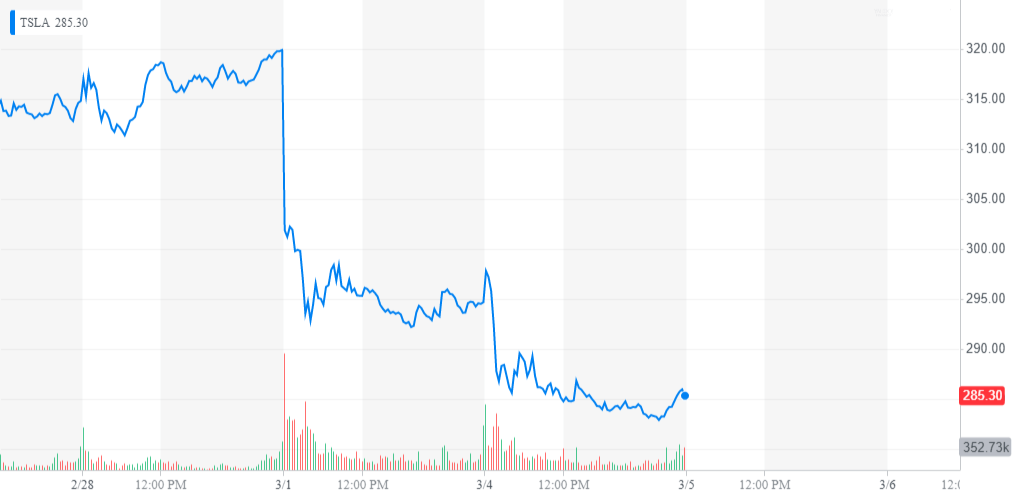

The strategist predicted the stock price of Tesla to plunge to $100 by the year’s end, by 64 percent within an 11-month span.

“I think Musk has no more rabbits to pull out of his hat and therefore it’s all downhill from here. I predict that by the end of the year, the stock, today at $295, will be under $100,” she said .

But, not all investors remain pessimistic on the trend of Tesla. Top fund manager Cathie Woods of ARK Invest said the company could rally to $4,000 in the upcoming years.

In its annual report, Tesla previously said that it will increase the number of service centers and physical stores as it could increase the demand for the company’s vehicles.

“Our Tesla stores and galleries are highly visible, premium outlets in major metropolitan markets, some of which combine retail sales and service. We have also found that opening a service center in a new geographic area can increase demand. As a result, we have complemented our store strategy with sales facilities and personnel in service centers to more rapidly expand our retail footprint,” the annual report read.

Within several months, Tesla went from rapidly expanding retail services and physical stores to shifting all sales online, in a drastic 180 change.

In a public statement that caught Tesla employees off guard, the company wrote:

Shifting all sales online, combined with other ongoing cost efficiencies, will enable us to lower all vehicle prices by about 6% on average, allowing us to achieve the $35,000 Model 3 price point earlier than we expected.

Over the next few months, we will be winding down many of our stores, with a small number of stores in high-traffic locations remaining as galleries, showcases and Tesla information centers.

A decline in Visibility and Demand

The major concern towards the new strategy of Tesla is that the sudden closure of galleries, stores and service centers could drastically decrease the visibility of the company and its vehicles in the near-term.

Despite its expenses, Apple, one of the most profit-driven companies in the U.S. market, had never considered eliminating its physical stores to decrease the pricing of its model.

Even throughout the past 6 months, during a period in which the demand for the new iPhone models declined due to plateauing mobile phone development, the talks of dropping physical stores in the global market weren’t carried out.

But, Oppenheimer analyst Colin Rusch remains positive on the long-term growth of Tesla and has said that the shift to online sales is a sign of maturation for the company.

The analyst said:

“Part of what’s happening here as they close stores is that they’re just maturing into what looks like the rest of the auto supply chain in terms of having more service centers and areas where folks can interact with the car, rather than having these stores that really are more of a branding and marketing exercise.”