‘Tesla Blows’: Elon Musk’s Joke Haunts Him in Mind-Numbing Q1 Miss

Tesla's Q1 earnings miss was the size of the Grand Canyon. | Source: REUTERS/Mike Blake

By CCN.com: Tesla’s first-quarter earnings miss was about the size of the Grand Canyon. Yet, investors are not punishing Tesla’s stock. Far from it, in fact, as TSLA shares are currently meandering in and out of positive territory in after-hours trading. Tesla reported a Q1 loss per share of a whopping $2.90 vs. estimates for a less horrible $0.69 per-share loss, according to CNBC . Elon Musk’s company also missed on the top line, generating $4.54 billion in revenue compared to Wall Street’s expectations for $5.19 billion.

At least the Tesla CEO still has his sense of humor. Good thing the U.S. SEC didn’t read too much into his pre-earnings tweet.

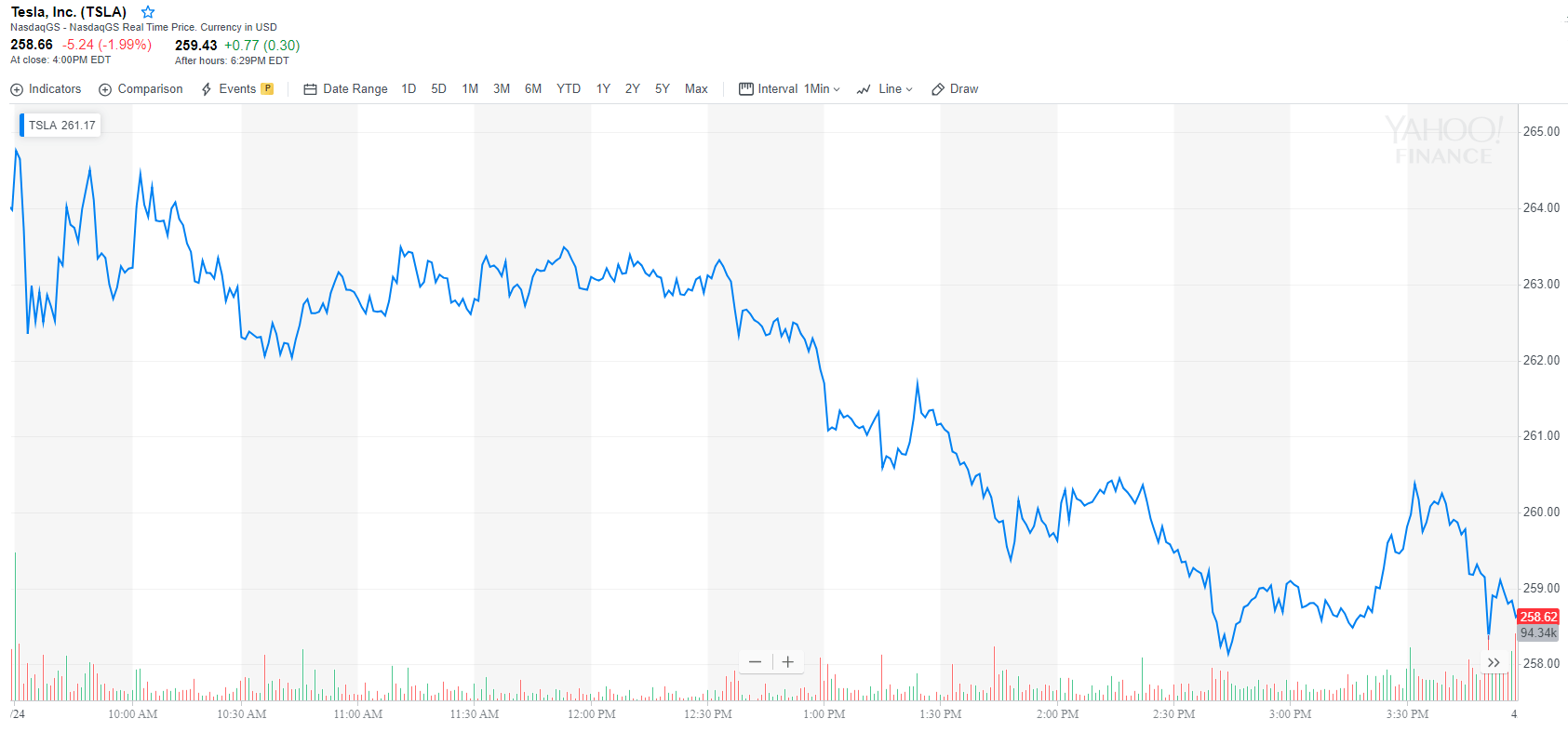

Tesla was hit with a one-two punch of weakened demand and the slashing of a tax credit for customers. Not only that, but Elon Musk has been tangled up in regulatory red tape for crossing the line on social media. Investors appear to be focused on two things – vehicle price and demand. That has cost Tesla’s stock 16% year to date. But TSLA shares live to see another day after shellshocked investors kept it together. Tesla’s stock fell approximately 2% during the trading session and is holding its own in the after-market.

Elon Musk’s Personal Touch

It’s not that shocking that investors are not abandoning Tesla’s stock after an embarrassing Q1. Tesla CEO Elon Musk knows how to engage a community on social media, and he’s no different with investors. Tesla opened up the floor to questions from retail investors during the earnings call, not just Wall Street analysts. This personalized touch can go a long way with the little guy whose voice and vote can get drowned out by more sophisticated investors. The move drew cheers on social media:

“This is how every company should conduct Q&A in earnings calls. Congrats Tesla for moving finance forward.”

It’s Tesla’s way of “democratizing the earnings calls’ and “letting the best questions get voted to the top even if they’re submitted by small shareholders,” according to one follower on Twitter. Questions from the community surrounded the Model 3 and self-driving technology. Of course, plenty of followers took jabs, too –

“When will you file for Chapter 11 or will your CEO drag this company down to Chapter 7?”

Meanwhile, Tesla can use all the good PR it can muster with alleged videos of a Tesla vehicle erupting into flames in China. While the veracity of the videos hasn’t been proven, the psychology around Tesla’s stock is equally important.

Model 3 Deliveries

Tesla warned investors about lower demand and pricing issues prior to the earnings report, so the disappointment may be already priced in. The company only delivered 63,000 vehicles in the quarter, which was 13,000 below expectations. Investors are taking bets on whether Tesla can make its Model 3, whose base price is $35,000, profitable.

Business Insider reports that deliveries for this base model have begun and Musk has been unusually mum about this development. That’s not the Musk we know and love but whatever he’s doing seems to be working based on Tesla’s stock’s reaction to the earnings report.