Netflix Shares Have Risen Every Session of 2019 – 35% up and on a Winning Streak

With Netflix raising subscription rates (again), could Disney's new streaming service be the real winnter? | Source: Shutterstock

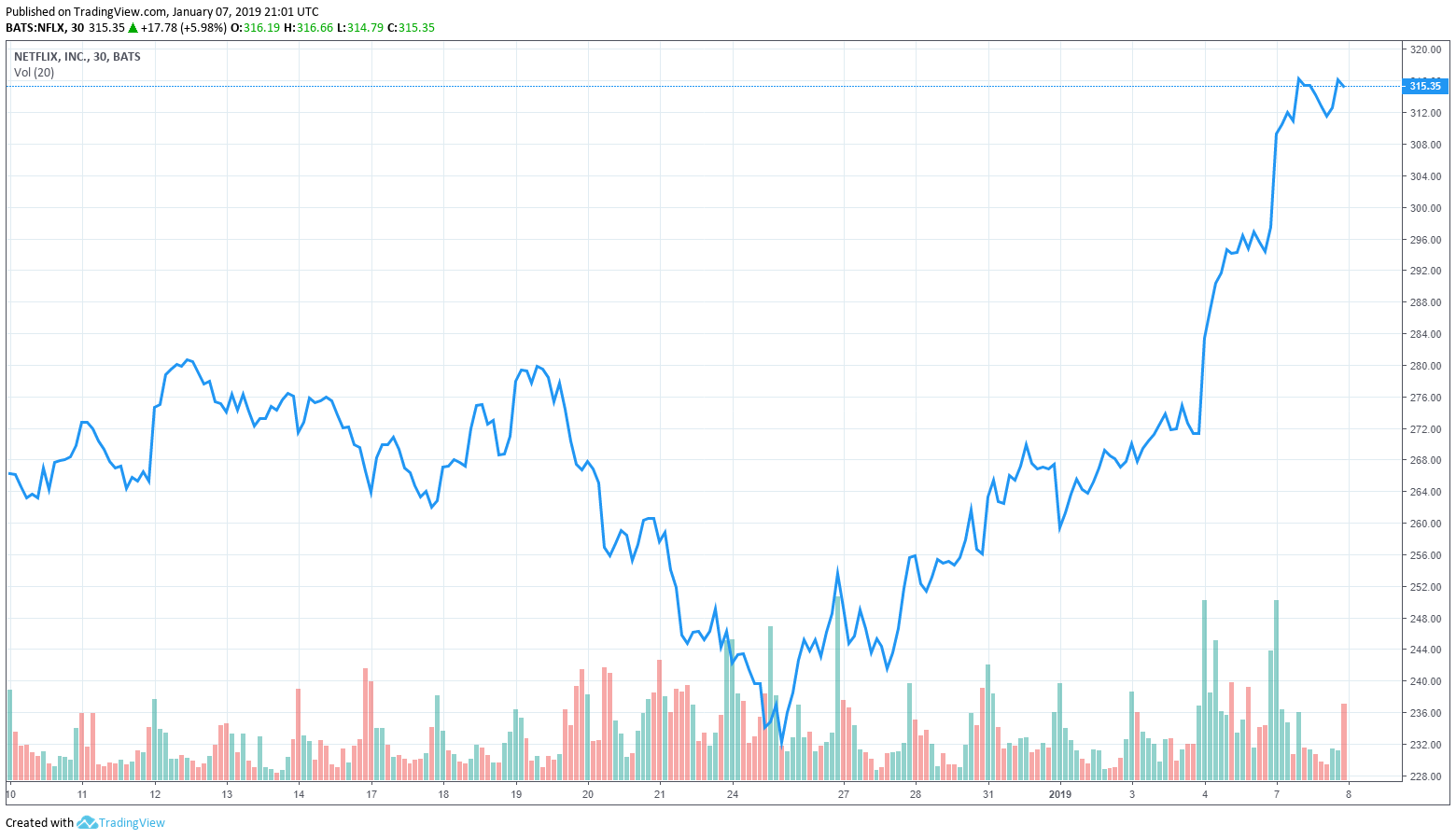

Netflix shares have formed an impressive start to 2019, rising in every trading session so far. Granted, that’s only a handful of sessions. But, given the volatility of FAANG shares and the wider stock market, Netflix appears to be on a winning streak. Netflix shares are up nearly 6% today and had risen to $315 from just $230 on Dec. 24, 2018.

The media giant’s shares are actually on an eight-day winning streak, including one day unchanged. NFLX has risen 35% across this trading period. However, it is still 25% below a record value of $418 in July 2018.

Analysts are bullish on NFLX stock, expecting the media company to perform better than its FAANG rivals. According to CNN , 23 out of 40 analysts give a “buy” sign for Netflix with only one analyst saying “sell.”

Bullish on Netflix Shares

There are a number of potential reasons for confidence in Netflix shares.

Netflix met market expectations for third-quarter revenue results, and year-on-year reported a $4 billion revenue growth figure. The company is reporting subscriber growth in the U.S. and internationally. And, it has a significant expansion opportunity in Europe according to Bloomberg Intelligence.

Netflix expects subscriber growth to add 9.4 million users globally in the last quarter of 2018. This compared to analyst’s expectations of 7.64 million.

The streaming platform also won five Golden Globes at Sunday’s awards for its original content. These were share across Netflix titles “The Kominsky Method” and “Roma.” In comparison, Amazon Prime Video picked up just two awards.

In an earnings call in October 2018, Chief Content Officer for Netflix Ted Sarandos said:

When we invest in an original show, we find, we’re having a better payback in terms of people watching and appreciating Netflix and valuing their subscription.

That strategy appears to be working for the company, although it is set to lose some of its licensed Disney content this year.

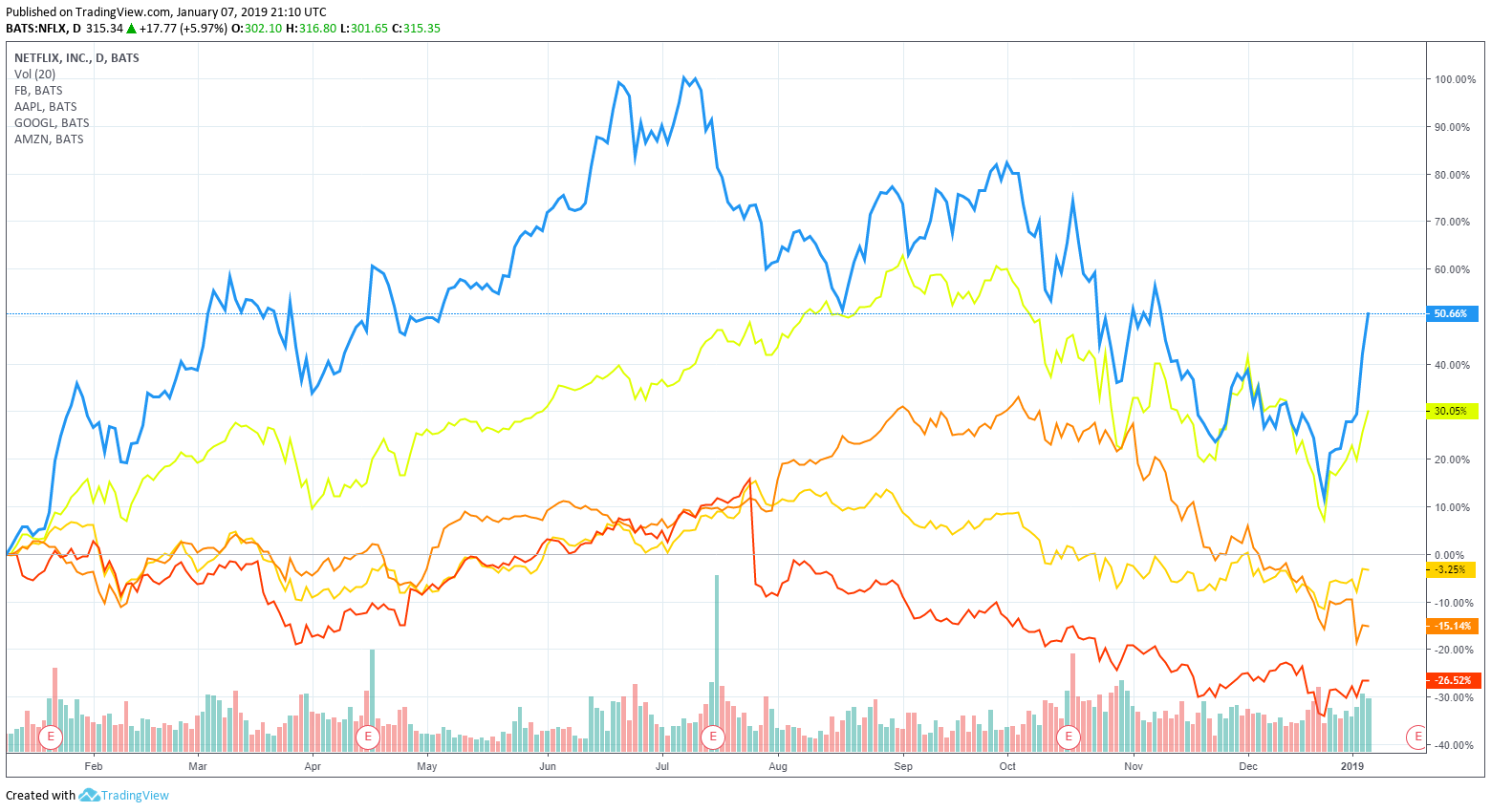

Netflix is Breaking Away from FAANG Rivals

Comparing NFLX to its FAANG rivals today, the chart says it all.

One analyst, David Miller, wrote in a note to investors in November 2018:

We would advise investors ignore the noise around ‘FAANG,’ and instead, focus on core fundamentals, which for Netflix, are quite healthy.

That too seems to be playing out for Netflix which is breaking away from its FAANG counterparts.

However, several analysts have recently improved their confidence rating in Google parent Alphabet’s shares from “hold” to “buy.” Google, like Amazon, looks set to benefit from increased digital advertising revenue in 2019.

Conversely, Apple hasn’t started 2019 quite so well by revising its sales revenue forecast for the first quarter of 2019 downwards. Amazon also had a terrible last quarter of 2018, its worst since 2008. But it did end the year with its share price up 28%. For 2019, Amazon’s share price is showing a slightly steeper price hike than Facebook and Apple.

The very latest analysis for Facebook’s share price from equity research firm Pivotal Research Group, just hours ago, expects Facebook’s stock to crash 18%.

Featured Image from Shutterstock. Price Charts from TradingView.