Dow Spikes as Trump Teases New ‘Economy Boosting’ Tax Cut

The Dow raced toward a third straight triple-digit rally while Trump did his best to boost stock market appetites by teasing a new tax cut. | Source: AFP PHOTO / Brendan SMIALOWSKI

The Dow strung together its third straight triple-digit advance on Friday, seeking to end the week with a bang after President Trump teased a new tax cut that supporters say would grow the economy, extending the longest expansion in US history.

Dow Strings Together Third Straight Rally

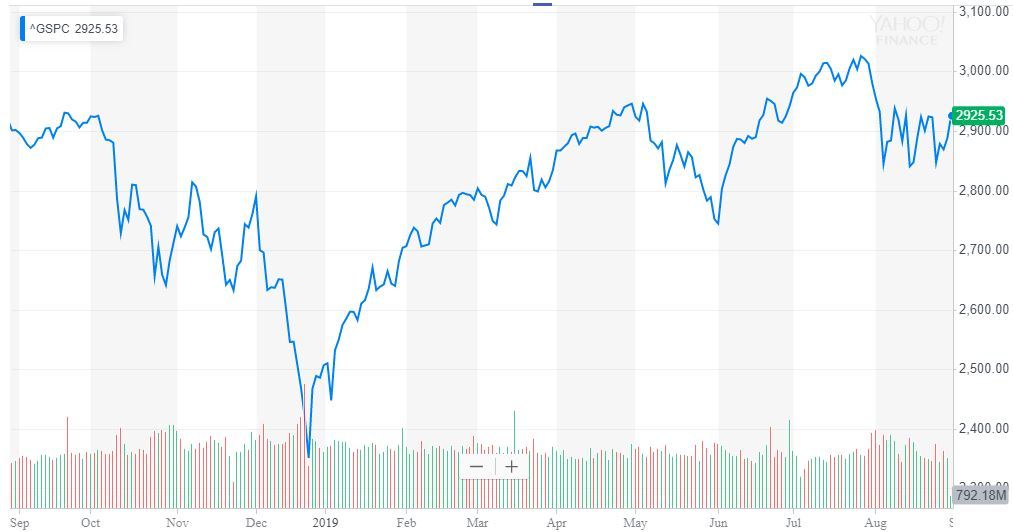

Wall Street’s three most closely watched indices rose in tandem during the week’s final trading session. As of 10:36 am ET, the Dow Jones Industrial Average had gained 103.12 points, lifting the DJIA 0.39% to 26,465.37.

The S&P 500 rose 9.56 points or 0.33% to 2,934.14. Ten of 11 primary sectors reported gains. Materials outperformed with a 0.94% jump.

The Nasdaq added 9.18 points or 0.12% to reach 7,982.65. The tech-heavy index had cleared the 8,000-point level earlier in the session, only to pare most of its gains.

Trump Flirts With Capital Gains Indexing

Stocks continued to climb on optimism that the icy US-China trade negotiations are beginning to thaw, even as the White House moves ahead with plans to hike tariffs on Chinese goods.

President Trump is doing his best to keep the bullish times rolling despite the market’s disdain for tariffs.

This morning, Trump stirred investor appetites by teasing that he is considering a new tax cut that supporters say would bolster investment and boost economic growth: capital gains indexing .

Trump retweeted an op-ed written by Americans for Tax Reform President Grover Norquist and Senator Ted Cruz advocating for capital gains indexing , which would reduce capital gains taxes by adjusting the cost basis to account for inflation.

“An idea liked by many?” Trump tweeted.

By indexing capital gains to inflation, investors would retain more of their profits when they sell investments. Since capital gains after often reinvested (e.g., following dividend payments), indexing would immediately increase economic investment. That would juice the Dow and other stock market indices heading into a difficult reelection campaign.

It could also spur additional long-term investing by fattening after-tax profit margins.

“Over the longer term, a capital gains tax cut spurs the growth of new businesses, increases the wages of workers, enhances consumer purchasing power, and grows the economy at large, resulting in more overall gains to be taxed,” Norquist and Cruz wrote.

However, critics allege that capital gains indexing would exclusively benefit the wealthy since few lower-income Americans own taxable investments. By the op-ed’s own admission, just 54% of Americans have invested in the stock market, for example.

Moreover, poorer investors are already exempt from long-term capital gains , so long as their taxable income including investment profits does not exceed certain thresholds ($39,375 for single filers or $78,750 for joint filers).

This morning’s tweet wasn’t the first time that President Trump has flirted with using executive action to implement capital gains indexing. Earlier this month, he said that he was considering the controversial tax cut.

He walked back that remark the next day.