Amazon’s Revenue Is Roughly Half that of Walmart, AMZN Stock Yawns

| Source: Shutterstock

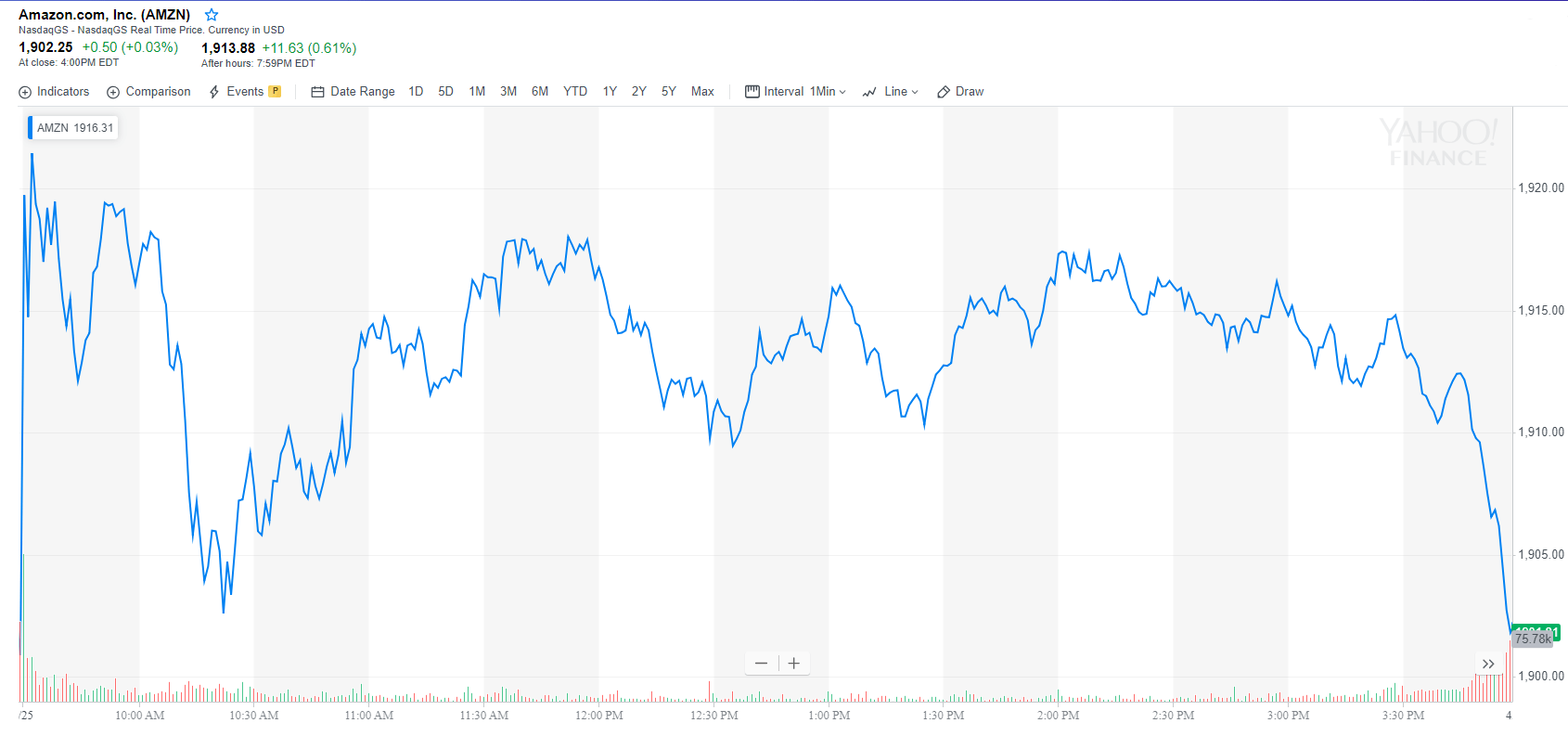

By CCN.com: Amazon’s stock is flat in after-hours trading after the company destroyed earnings estimates, beating them by a sizable amount – more than 50%.

Amazon continues to conquer the world with nearly $60 billion in revenue in the first quarter alone, skyrocketing 17% from the comparable quarter last year. Amazon’s annual revenue is now roughly half that of Walmart’s. More than 80% of Amazon’s revenue comes from its e-commerce business. Its Q1 revenue has increased 15-fold over the past 11 years.

Unparalleled Metrics That You Must See

This astonishing increase in revenue filtered through Amazon’s entire results. Amazon’s stock isn’t showing it yet, but shares had already rallied 8% in the month leading up to the highly anticipated announcement.

Operating cash flow had a breathtaking increase of 89% to $34.4 billion from the previous year, comparing favorably to the $18.2 billion for the year-ended March 31, 2018.

Amazon’s operating cash flow translated into a jaw-dropping tripling of free cash flow over the same period, rising to $23 billion compared with $7.3 billion.

Operating income more than doubled to $4.4 billion in the quarter compared to $1.9 billion in last year’s first quarter.

Amazon may not show it yet, but its bottom line, which CEO Jeff Bezos never seems terribly concerned about, roared to $3.6 billion in the quarter, increasing a mind-blowing 130% from $1.6 billion in the same quarter last year.

Vindication for Bezos Over Skeptics

There appears to be no stopping Amazon or Jeff Bezos. One of the big contributors to earnings was Amazon’s cloud computing business. Despite Microsoft’s surge in this arena, Amazon’s cloud revenue jumped 41%. It provides computing services for Netflix, Pinterest, and is vying for a major U.S. military contract.

Amazon’s reach is staggering. Jeff Bezos took an online bookseller and has built it into an online empire, with tendrils reaching into multiple disciplines. One look at all of Amazon’s accomplishments in the quarter, from its press release, demonstrates the grip Jeff Bezos has on multiple elements of human life. It even can deliver food to SNAP participants in New York!

The element Jeff Bezos seems most excited about – and is of major concern to privacy advocates – is the extent to which Alexa is growing and being integrated into daily life.

Will AMZN Surge or Crash?

The perpetual question surrounding Amazon’s stock is its valuation. How does an investor value a company that, until recently, wasn’t concerned about net income? How does an investor evaluate AMZN stock if Bezos can throttle net income up or down at will?

With $12 billion in trailing 12-month net income and a market cap of $919 billion net of cash, one can argue that paying 86x earnings is pure insanity. That’s true.

However, when compared to analysts’ five-year annualized growth rate of 91%, creating a PEG ratio of 0.95, one could also argue AMZN stock presents a value.

Amazon’s stock also trades at 3.7x revenue, compared to Alphabet Inc.’s 5.5x revenue, again arguably creating a value.

Given that Bezos has repeatedly demonstrated Amazon’s ability to execute on just about anything the company launches, betting on long-term success for AMZN stock seems like a slam dunk.