Treasury Yields Surge to Five-Week Highs as U.S., China Push to Formalize Trade Deal

The architects of the 'phase one' trade agreement between the U.S. and China are confident that it will become formal soon. | Image: Mark Schiefelbein / POOL / AFP

Demand for haven assets declined on Monday, pushing bond prices down and yields higher as investors sifted through better than expected corporate earnings and positive dialogue around a formal U.S.-China trade agreement.

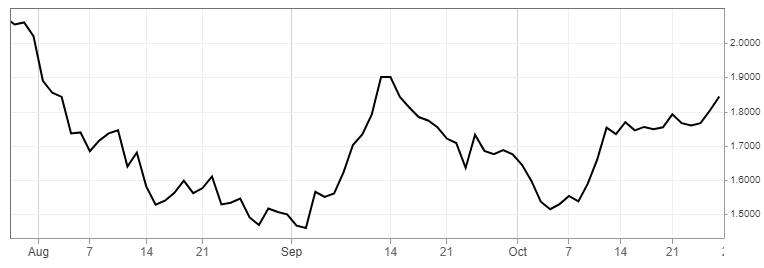

U.S. Yield Curve Rises

The yield on the benchmark 10-year Treasury note peaked at 1.86%, its highest in almost six weeks, according to CNBC data. It was last spotted up more than 4 basis points at 1.844%. Since crashing to more than three-year lows in September, the 10-year yield has recovered more than 40 basis points.

The yield on the 2-year note reached a high of 1.67%. It was last up nearly 2 basis points at 1.644%.

Yields have seen a steep recovery since the summer, when a frightful inversion between short- and long-dated Treasurys triggered the recession alarm. Despite the correction, the U.S. yield curve is behaving exactly as it would just before a major downturn hits. Yields also remain well below the most widely-followed inflation metrics, a phenomenon that usually boosts demand for risk-off assets like gold.

U.S. and China Finalizing ‘Phase One’ Trade Deal

Wall Street and global stocks rallied on Monday amid news that the United States and China are “close to finalizing” some sections of a preliminary trade agreement.

The positive speculation is tied to a high-level phone conversation between U.S. and Chinese officials on Friday. China’s commerce ministry has since confirmed that the phase one deal is “basically completed” and waiting to be formalized.

The office of U.S. Trade Representative Robert Lighthizer added that officials have “made headway on specific issues,” but didn’t disclose what they were.

Although the preliminary agreement doesn’t end the trade war, it provides exporters with some cost certainty regarding tariffs. It’s the first tangible breakthrough in a bitter feud that tilted the global economy off course for the better part of 2019.

Issues facing the global economy extend far beyond trade. Virtually every major central bank has reverted to some form of low-rate stimulus, which is usually a reliable indicator that policymakers are concerned about growth. On Wednesday, the Federal Reserve is expected to lower interest rates for the third time in as many meetings, undoing nearly a year of rate hikes in 2018.