Tinder’s Parent Attracts Investors’ Love in Pre-Market Excitement

Tinder's parent is getting plenty of love from investors on Monday's early trading. | Rafapress/Shutterstock.com

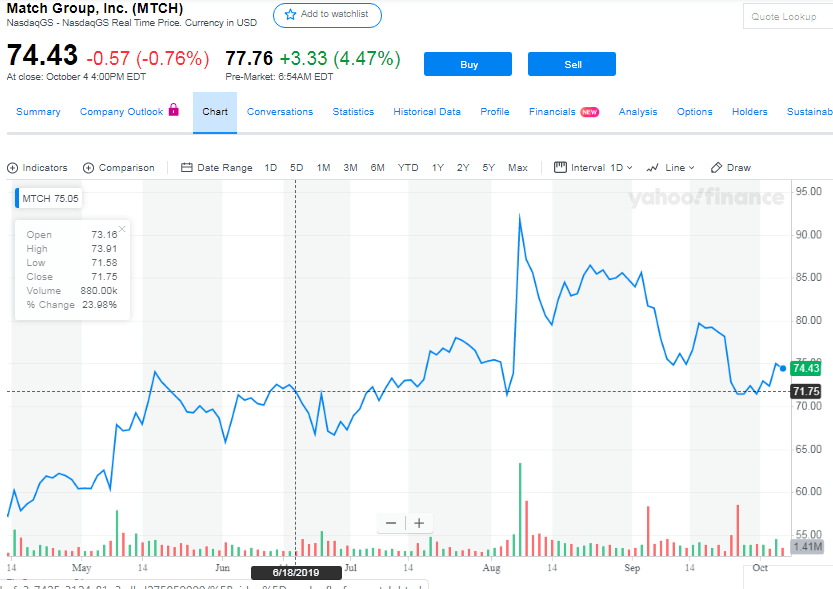

Match Group Inc (NASDAQ: MTCH), the parent company of dating app Tinder and OkCupid, is leading the pack of gainers in Monday’s premarket hours after recording a rise of nearly 5%.

Ahead of the opening bell, the online dating group that owns such properties as Tinder, OkCupid, Match, Pairs, Hinge, OurTime, PlentyofFish and Meetic rose by 4.47% to reach $77.46. The stock had closed Friday’s trading session at $74.43.

The premarket gain coincides with the stock getting an upgrade from a Wall Street firm. Per The Street , Nomura Instinet stocks analyst Mark Kelley upgraded Match Group from a neutral rating to a buy. Additionally, Nomura Instinet raised the price target from $81 to $88. Relative to Friday’s close, this would be a gain of 18.23%.

$60 million fine for Match Group not a turn-off: Analyst

Kelley brushed off a proposed fine emanating from a recent lawsuit filed by the Federal Trade Commission (FTC) terming it ‘insignificant’. The lawsuit which accuses the dating firm of relying on fake accounts set up by fraudsters to lure new users has weighed on the stock the past few days.

According to the FTC, these fraudulent accounts constitute between 25% to 30% of the membership spread across Match Group’s sites and apps. Per the FTC’s Bureau of Consumer Protection Director, Andrew Smith, the group was aware of the practice:

We believe that Match.com conned people into paying for subscriptions via messages the company knew were from scammers.

The FTC is pushing for a $60 million fine over the ‘romance scams’ that are allegedly prevalent on Tinder, OkCupid and other Match Group’s brands.

https://youtube.com/watch?v=lbhsxGSHUc8

Dating Giant’s stock Climaxed in August

Prior to the lawsuit being filed, the stock of the online dating firm had reached its all-time high in early August when it hit $85.43 per share. After news of the lawsuit broke, the dating firm’s stock plummeted to a two-month low of $72.41.

Besides Nomura Instinet, Match Group’s stock has also been upgraded to a buy by Deutsche Bank’s research analysts . Deutsche Bank has set a price target of $91 down from a previous target of $93. The current price target would constitute a 22.3% appreciation from Friday’s close.