The Stock Market May Run Out of Gas – But Not This Gold Rally

Gold prices are within touching distance of an all-time high and veteran investors and analysts alike are predicting the rally to continue. | Source: Shutterstock.com

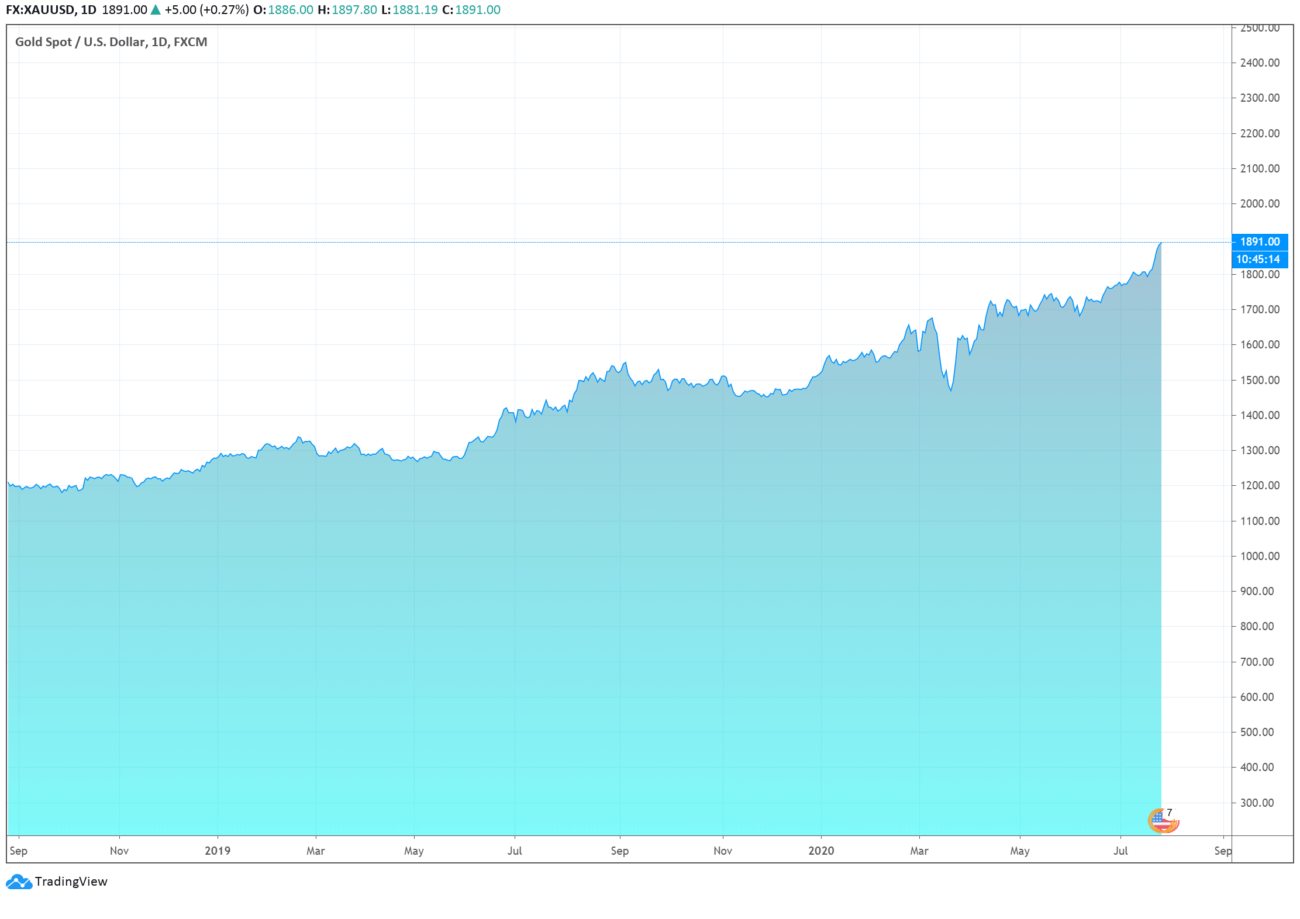

- The price of gold is a mere $30 away from reaching a new record high against the U.S. dollar.

- The precious metal is up by more than 30% in the last four months, but investors say the rally is only just beginning.

- Executives in the mining industry are significantly more optimistic about the precious metal, even more so than Wall Street.

The price of gold has rallied by 30% since March 20, from $1,454 to $1,892. It is now merely $30 away from reaching a new record high for the first time since 2011.

Investors believe the rally of the precious metal will not slow down in the near-term for three key factors. They are fears of inflation, rattled markets as a result of geopolitical risks, and stalled economic recovery.

As Long As Interest Remains Near-Zero, Gold is Attractive

Historically, the precious metal has consistently acted as a compelling hedge against inflation.

If interest rates in the U.S. and Europe remain at near-zero, Wall Street investors say the metal will stay attractive.

Mark Mobius, the co-founder of Mobius Capital Partners, said in an interview on Bloomberg TV:

When interest rates are zero or near zero, then gold is an attractive medium to have because you don’t have to worry about not getting interest on your gold, and you see the gold price will rise as uncertainty in the markets are rising. I would be buying now and continue to buy because gold is really on a run, it’s doing well.

Earlier this week, analysts at Citigroup and Goldman Sachs raised a similar argument. They said that gold is a primary beneficiary of low-interest rates.

Ed Morse, the global head of commodity research at Citigroup, said gold achieving a new all-time high is imminent.

The price of the precious metal already achieved new highs against many reserve currencies in previous months. Morse said a record high gold price against the U.S. dollar is merely a matter of time.

Executives in the precious metal and mining industries are significantly more optimistic about the precious metal.

Evolution Mining’s executive chairman Jake Klein said he believes the rally is just starting. He said:

Gold has a long way to go, and prices will be strong.

Stock Market Fear Will Not Affect the Precious Metal

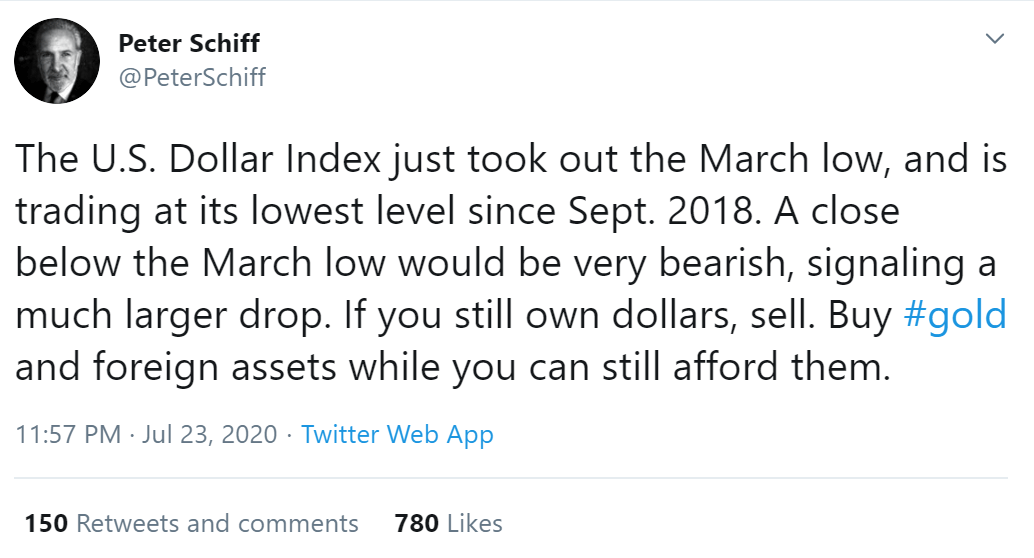

Peter Schiff, the chairman of SchiffGold, said the fundamentals backing gold are different from that of stocks.

In recent weeks, Wall Street traders have increasingly expressed fear towards an over-valued stock market.

But Schiff believes gold stocks are cheap, and stagnation in the stock market is unlikely to affect the precious metal.

Schiff said :

Since gold stocks rose with the market, traders sell them when the market falls. But the fundamentals for gold stocks are much different than for the overall stock market. While the stock market is over-priced, gold stocks are still cheap, and stagflation is bullish for gold.

Economists, like Joe Brusuelas at RSM International, said premature actions to reopen the U.S. economy led to slower growth.

Virus cases are surging again, prompting U.S. President Donald Trump to shift his rhetoric around the usage of masks. Some analysts argue that a slowing economy could further catalyze the safe-haven asset, despite its negative effect on stocks.

A confluence of concerns around inflation, lagging economic growth, and a potential stock market downturn could benefit gold in Q4.

Disclaimer: This article reflects the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.