Dow Lumbers Higher as Bubble Fears Launch Gold Price to $1,800

Fears about the long-term damage caused by the pandemic persist behind the scenes. Why else would demand for gold, a perceived haven, be through the roof? | Source: AP Photo/Richard Drew

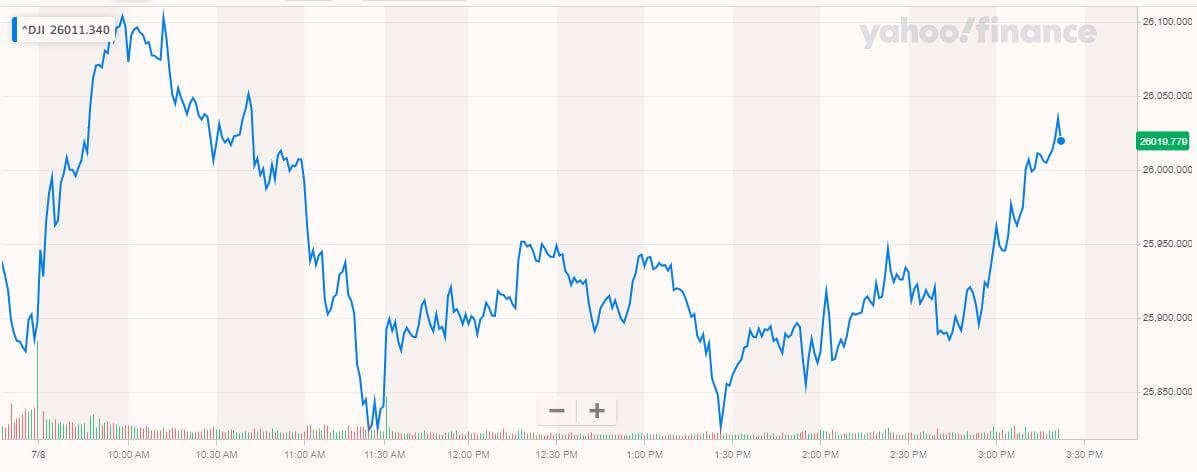

- The Dow rose to session highs just before the closing bell.

- Elsewhere in the U.S. stock market, the Nasdaq soared to another extraordinary gain.

- A massive rally in the gold price suggests investors aren’t as confident as equity prices indicate.

The Dow Jones struggled sideways midweek, though it crept higher in late afternoon trading as Wall Street did its best to buy the dip.

While rampant speculation continues in tech stocks, a soaring gold price betrays two very different dynamics playing out in financial markets.

Dow Jones Creeps Higher, Nasdaq Roars

Among Wall Street’s major indices, the Nasdaq was the clear outperformer. The tech-heavy index exploded 1.21% higher to 10,469.95.

The S&P 500 rose 0.63% to 3,165.01, while the Dow lumbered to a gain of 127.63 points (0.49%) to trade at 26,017.81.

This divergence among the stock market’s bellwether indices is becoming a trend. Speculation in growth stocks has put considerable distance between the Nasdaq and the broader market.

While the Nasdaq is up more than 16% in 2020, the Dow and S&P 500 are both still in the red.

Gold Price Breaches $1,800 as Demand Soars

The Nasdaq’s incredible run belies some very real threats to the U.S. economy. Virus cases have shot past 3 million in the United States, and Wednesday brought a new daily record above 60,000 .

The economic impact of social distancing continues to play havoc in the real economy. Bankruptcies, the danger of another wave of lay-offs, and households tightening their purse strings remain ever-present concerns for U.S. policymakers.

While equity valuations imply that stock market bulls haven’t been bothered by troubles on Main Street, that’s not the whole story.

Fears about the long-term damage caused by the pandemic persist behind the scenes. Why else would demand for gold, a perceived haven, be through the roof?

Breaching the $1,800 level today to set a new nine-year high, it is clear that investors can’t get enough of the yellow metal.

Investment bank ING highlighted the massive inflows to gold investments in a new report:

In its latest update, the World Gold Council showed that gold-backed ETFs recorded their seventh consecutive monthly increase, with inflows of 104t in June, which took global holdings to a new record of 3,621t. During 1H20, global ETF net inflows totalled 734t; exceeding the previous annual record of inflows, as well as surpassing the levels of net gold purchases seen from central banks in 2018 and 2019.

Another worry for the Dow can be found in commodity data.

Today’s U.S. crude oil inventories reading showed a surprising build of 5.6 million barrels. That decimated expectations of a 3 million barrel draw.

Given the United States’ enormous energy sector, the prospect of weak crude oil prices over the long term remains a significant concern for Wall Street, as events earlier in the year demonstrated.

Dow 30: Apple & Microsoft Put the Market on Their Back

On a generally poor day for the Dow 30, mega-cap stocks kept the index from succumbing to a meaningful loss.

Apple and Microsoft stock both rose more than 2%. That’s not surprising; the tech sector continues to drive most of the growth on Wall Street.

Apparel manufacturer Nike enjoyed a 1.5% rally. Aside from Disney (+2.3%), it was the last of the big winners in the Dow Jones.

Elsewhere, it was a much less rosy picture. Walmart (-1.5%) gave back a portion of its massive gains from Tuesday. Pharma giants Merck and Pfizer traded around 0.9% lower. Dow Inc. lagged with a sizable 3.6% loss.

Next week will be a busy one for the U.S. stock market; 17 huge names are set to release their earnings.

Given all that is going on, a considerable amount of interest will be placed on the results.

Dow giants Johnson & Johnson, UnitedHealth, JPMorgan Chase, and Goldman Sachs are all reporting.