Economists: You Don’t Need to Worry About a Recession – Yet

Economists at First Trust say that the recent yield curve inversion doesn't mean you need to panic about a recession - at least not yet. | Source: REUTERS / Carlos Barria

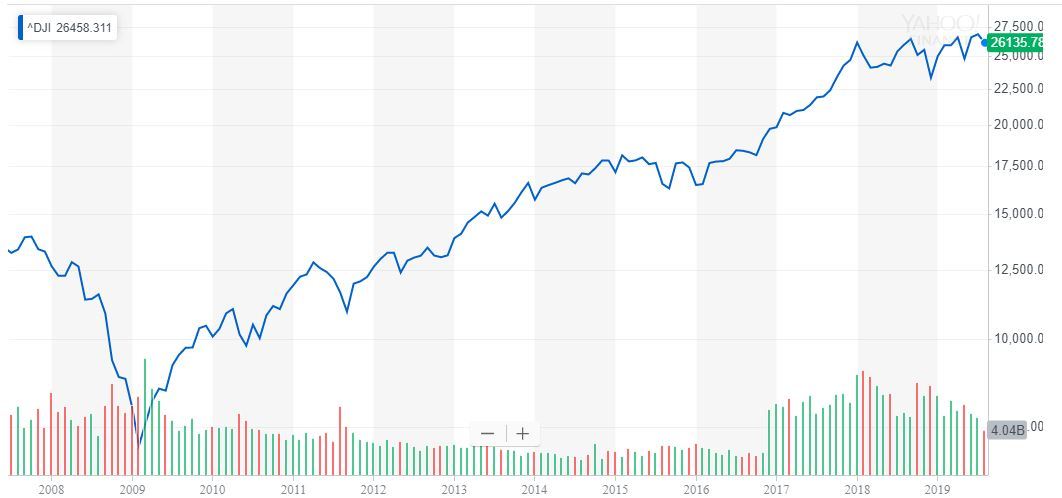

By CCN.com: Investment management firm First Trust put out an important note on Monday regarding a potential recession. Entitled “This Is Not 2008,” the note from First Trust’s chief and senior economists make important points about the inverted yield curve we’ve been hearing a lot about.

History Doesn’t Always Repeat Itself

First Trust points out that, while inverted yield curves have historically proceeded recessions, it is a single data point that should not be viewed in a vacuum.

An inverted yield curve occurs when interest rates on short-term bonds exceed the interest rates on longer-term bonds. That’s an unusual situation because the longer a bond’s maturity, the longer period of time that changes in the economy can occur, and investors are compensated for that higher risk with higher interest rates.

First Trust accurately points out that the economy was already experiencing some dire situations at the times that the yield curve inverted in the past.

The Housing Crisis Caused The Recession

For example, in 2008, the economy was running headlong towards a disaster thanks to the housing bubble. It was this bubble that was arguably the reason for the recession, not necessarily an inverted yield curve. We see an inverted yield curve merely as a pattern of behavior which may foretell a recession.

To expand on this, one needs to understand why the yield curve is inverting as it has been.

That’s because a number of countries around the world have instituted negative interest rates. That means that while people keep their money in the bank, instead of the bank paying them interest on that money, the depositors are paying money to the bank!

If that sounds crazy, that’s because it is. The intent behind this policy is for people not to keep money in the bank, but to invest it, somewhere, anywhere.

So where do people invest their money, if they can’t even put it in a safe place like a bank in their own country?

Foreigners Invest In US Bonds, Driving Rates Lower

They buy U.S. Treasury bonds. With all that money flowing into the United States bond market, because interest rates are negatively correlated with price, interest rates fall.

So all those depositors invest in short-term bonds, hoping that in the short term, their countries banking policies will change, and they can move their money back into the security of their own nations banks.

Thus we have a perfect example of not looking at something in a vacuum.

Ed Butowsky, Managing Partner of Chapwood Capital Investment Management, tells CCN.com:

“Let’s also remember that a recession is defined as two consecutive quarters of negative GDP growth. So far we haven’t even had one. The last quarter came in at a weak 1.9%, but the average during the Trump administration has been 2.7%. So let’s not get ahead of ourselves talking about recessions. An inverted yield curve is a signal only, and just one of many.”