Dow Recoils After China Tosses a Match on Gasoline-Soaked Trade War

The Dow Jones Industrial Average recoiled after Beijing poured gasoline on the US-China trade war - and then lit a match. | Source: Spencer Platt / Getty Images / AFP

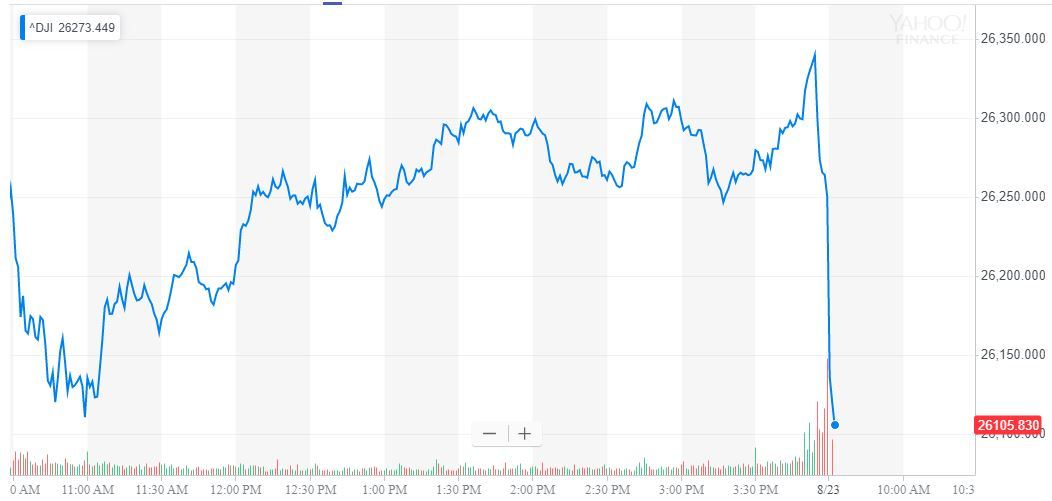

By CCN.com: China’s government poured gasoline on the trade war negotiations yesterday when it threatened retaliation against President Trump’s scheduled September tariffs. On Friday, Beijing lit a match, leaving the Dow Jones and broader stock market reeling.

Dow Tumbles as China Backs Up Threats With Action

All of Wall Street’s major indices endured major setbacks at the opening bell. The Dow Jones Industrial Average fell 133.77 points or 0.51% to 26,118.47.

The S&P 500 slid 13.13 points or 0.45% to 2,909.89. Nine of 11 primary sectors dipped into the red, led by energy’s 1.45% pullback.

The Nasdaq suffered the worst decline, falling 45.03 points or 0.56% to 7,946.56.

China Smacks US With New Tariffs, Wants Trump to ‘Feel the Pain’

Stock futures recoiled in pre-market trading after China dropped a bomb on already-tense trade negotiations, setting the Dow up for a brutal end to an otherwise-excellent week.

Beijing revealed that it would impose new tariffs on $75 billion worth of US imports. The duties, which range from 5% to 10%, target US goods like soybeans, auto parts, and oil.

Tellingly, the first batch of new tariffs will take effect on September 1, the same date the Trump administration plans to impose a new round of tariffs on Chinese goods.

“In response to the measures by the US, China was forced to take countermeasures,” the Chinese State Council said in the announcement, according to a CNBC translation .

The Council also revealed that it would reinstitute a 25% tariff on US automobile imports beginning on December 15. Beijing had suspended that tariff on January 1 after Presidents Trump and Xi Jinping agreed to a trade war truce.

Hu Xijin, editor-in-chief of the state-run Global Times, had earlier warned that China was on the verge of launching new tariffs at key US industries.

“China has ammunition to fight back, Hu said before the announcement. “The US side will feel the pain.”

China’s Ministry of Commerce had also made clear that it would strike back against Trump’s September tariffs. “China will be forced to adopt retaliatory actions,” ministry spokesperson Gao Feng had said on Thursday.

Yuan Plunges to 11-Year Low

Beijing’s decision to engage in a tit-for-tat with the White House could be a gambit to determine whether the Trump administration will flinch – again – and scrap its scheduled tariffs.

However, the prevailing mood seems to be that China has abandoned hopes for a trade deal, at least while Trump sits in the Oval Office.

Confirming this bearish outlook, the yuan slid to an 11-year low against the US dollar.

“Perhaps the PBOC is sending a message to the US trade hawks that it will let the yuan gradually weaken as a policy weapon to neutralize the effect of increased tariffs,” Stephen Innes, co-founder of Valour Markets, told the South China Morning Post .

All eyes now turn to Federal Reserve Chair Jerome Powell, who will speak this morning at the Kansas City Fed’s annual economic symposium in Jackson Hole, Wyoming.

Powell’s remarks are scheduled to begin at 10 am ET.

Click here for a real-time Dow Jones Industrial Average chart.