Citigroup Stock Recovers 5% on Positive Earnings Announcement

Citigroup kicks off earnings season with stronger than expected results. | Source: Shutterstock.

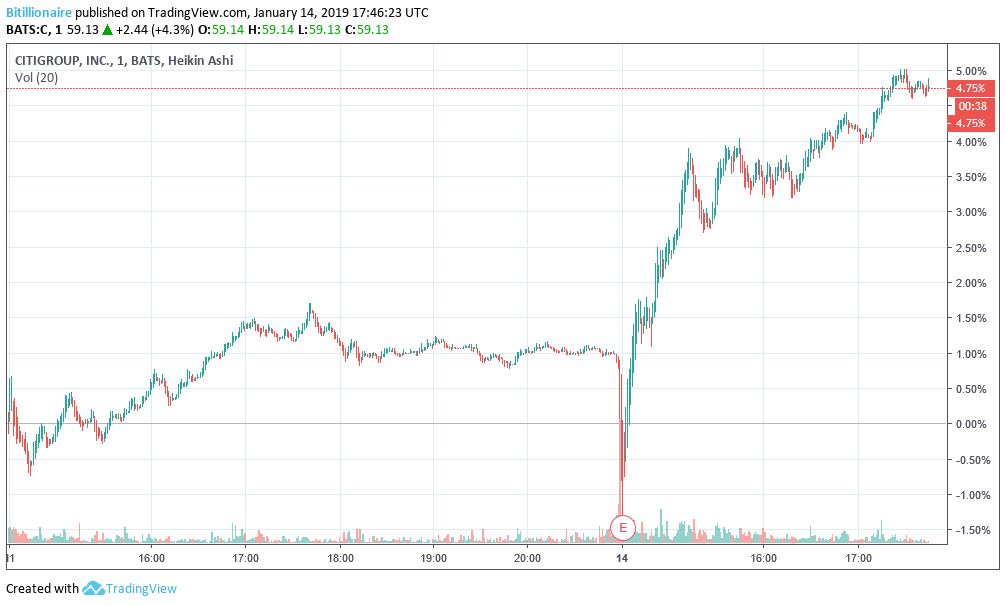

Barron’s reported early Monday morning that Citigroup stock had “slumped” after a positive earnings report that also showed a substantial revenue miss, but by the time of writing the trend was reversing on the NYSE. Citigroup (NYSE:C) is the fourth largest US bank with nearly $2 trillion in assets .

Citigroup posted earnings of $4.3 billion for the fourth quarter of 2018 today . They note in their report that tax reform positively enhanced the overall earnings by 3 cents per share. Without tax reform, earnings per share would still be $1.61. The total positive impact of tax reform was about $100 million.

Barron’s wrote :

Citigroup (C) is down 0.7% to $56.30 after reporting fourth-quarter earnings. The bank earned $1.64 a share on revenue of $17.1 billion. Analysts were looking for EPS of $1.55 on revenue of $17.57 billion.

Turnaround for Citigroup

Citigroup posted losses of over $18 billion in Q4 2017. In the same period in 2018, however, they’ve turned things around and posted a revenue of over $17 billion. They had around $11 billion in expenses to deal with, the biggest portion of which was reduced by nearly $1 billion from the same quarter the previous year.

Citi bought back a total of 212 million common shares over the course of 2018.

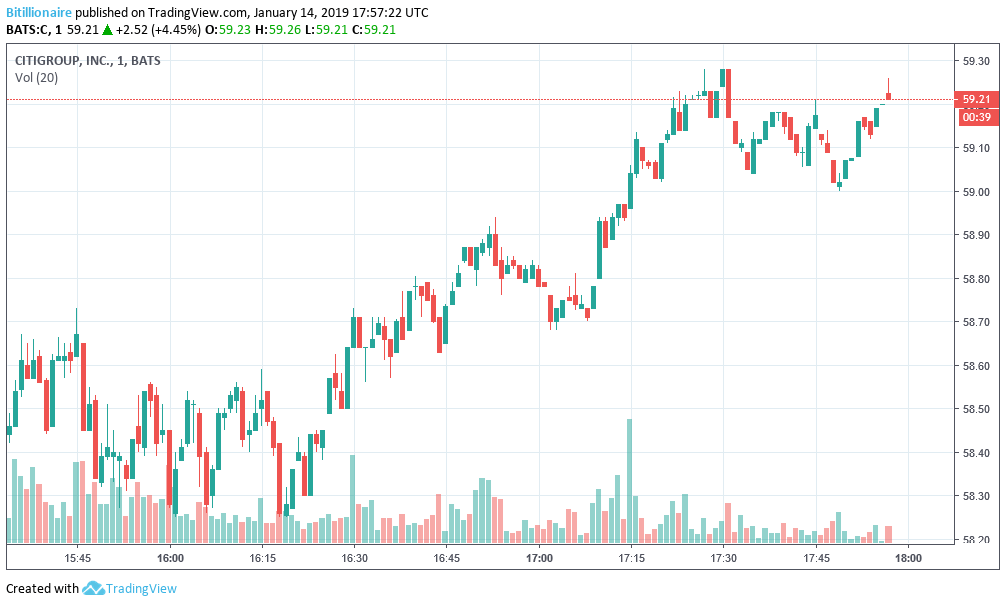

While Barron’s initially called a bad day for Citigroup, C stock was trending upwards at time of writing.

Citigroup was trading around $59 at time of writing, up from a 5-day low of $54.

Tax Reform and Strategies Playing Big Role in Citigroup Returns

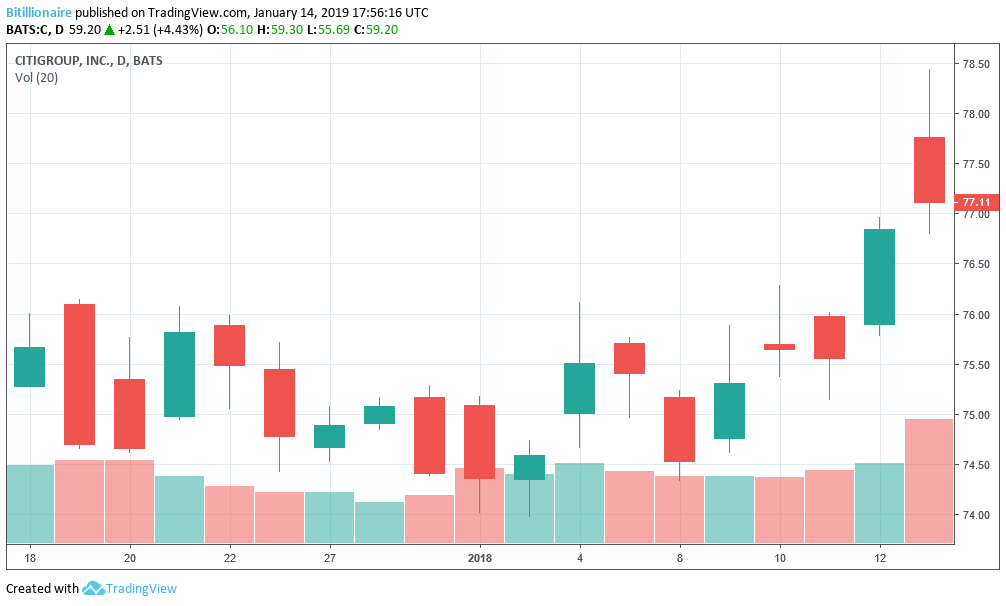

It is still down from its price of over $77 before the Q4 2017 losses were posted. These losses were in part due to a non-cash charge off in the amount of $22 billion.

The incident was not reported until the following month, near the end of February. Citigroup explains the charge as such:

[A]s a consequence of the passage of tax reform legislation in the U.S. in the fourth quarter of 2017, we took a one-time, noncash charge of $22.6 billion, resulting in a net loss on a reporting basis for the year of $6.8 billion. Having put that onetime charge behind us, however, we can now focus on the positive impacts of tax reform for us and our clients.

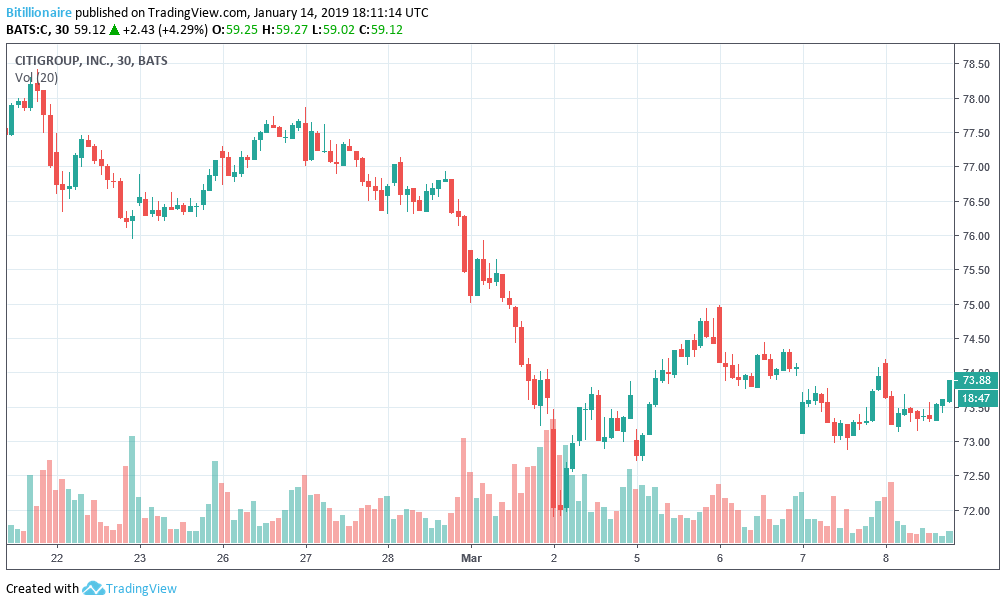

It was noted in their annual 10-K filing with the SEC. Immediately after the news went live, Citibank began to dip. On February 21, it stood around $78, but by March 1 it had dropped to $71.

Citi Rebounding?

Over the rest of the year, Citi bulls fought hard to keep the price above $70, but when it fell in November, it fell hard. Analysts expected the company to post profits, but the returns don’t seem to impress investors.

Citi and its investors seem most comfortable in the $70 range. They post a book value of shares at over $75 with an actual value of over $60, neither of which is the reality at time of writing. Pressure seems to be pushing the fourth largest bank upwards, however. Minor strategy adjustments plus further decreases in costs could propel first quarter confidence back to $75 or higher.

Featured image from Shutterstock. Charts from TradingView.com .