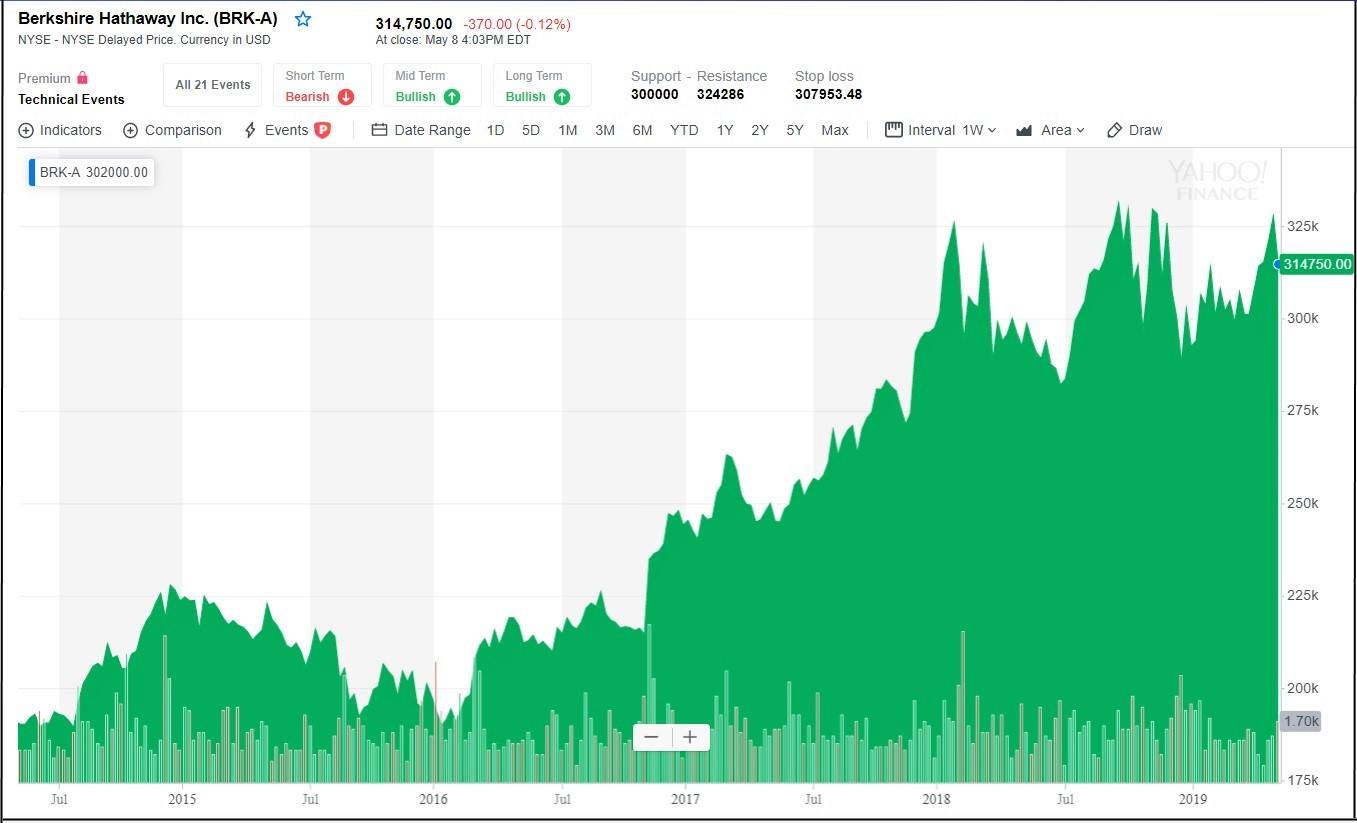

Buffett’s Berkshire Scammed Out of Staggering $340 Million by Solar Ponzi Fraud

Warren Buffett, CEO of Berkshire Hathaway,is celebrated as the world's greatest investor. | Source: Johannes EISELE / AFP

By CCN.com: Berkshire Hathaway, the multinational corporation led by billionaire Warren Buffett, recorded a $377 million first-quarter charge for investment losses related to a solar Ponzi scheme.

Berkshire invested $340 million in Ponzi scheme

Berkshire made the disturbing revelations in a regulatory filing during its annual shareholders meeting last weekend. In the filing, the company admitted that it was the victim of a massive Ponzi scheme.

“In December 2018 and during the first quarter of 2019, we learned of allegations by federal authorities of fraudulent income conduct by the sponsor of these funds.”

“We now believe that it is more likely than not that the income tax benefits that we recognized are not valid. Law-enforcement officials searched a business tied to the case in December and alleged a “Ponzi-type investment fraud scheme.”

Sham fund promised tax benefits for investors

In total, Berkshire Hathaway invested $340 million in tax-equity investment funds tied to a California company called DC Solar.

The sham mobile solar generator company had bragged that it could offer “very favorable tax consequences” for its investors. That was all a lie, according to federal authorities.

In February 2019, DC Solar filed for bankruptcy after the FBI raided the company’s offices and the home of its co-owners, Jeff and Paulette Carpoff.

The $340 million investment loss Berkshire incurred in the swindle is tiny compared to its massive $190 billion stock portfolio. However, the incident underscores that even savvy financial wizards like Warren Buffett can be hoodwinked.

Berkshire is heavily invested in bank stocks

As CCN.com reported, these are Berkshire Hathaway’s 15 largest stock holdings, according to its 13-F filing from February 2019.

Does Buffett hate bitcoin because he’s invested in legacy banks?

As you can see, more than half of Berkshire’s top 15 holdings is in large banks, such as:

- Bank of America.

- Wells Fargo.

- American Express.

- US Bancorp.

- JPMorgan.

- Bank of New York.

- Goldman Sachs.

Accordingly, it’s no surprise that Warren Buffett and his longtime lieutenant Charlie Munger despise bitcoin and have repeatedly trashed it.

These comments are indicative of the way many established financial institutions view cryptocurrencies: as an existential threat to traditional banks.

At Berkshire’s 2019 shareholders meeting last weekend, Buffett and Munger doubled-down on their anti-bitcoin crusade.

As CCN.com reported, Munger called bitcoin fans traitors who worship at the altar of history’s greatest traitor: Judas Iscariot. For reference, Judas was the apostle who betrayed Jesus Christ for 30 pieces of silver.

Buffett also reiterated his bitcoin hatred by saying buying it is “mathematically dumb.”

Warren Buffett disses Elon Musk

Buffett may be 88 years old, but he’s still super-sharp and incredibly competitive. Don’t let his mild-mannered appearance fool you. He’s a shark.

Want proof? Last weekend, Buffett slammed Elon Musk‘s ambition to launch a Tesla insurance product. Buffett said he’d bet against it because the insurance industry is too tough to break into.

“It’s not an easy business. I’d bet against any company in the auto business [getting into insurance.]”

Keep in mind that one-third of Berkshire’s business is in insurance, including Geico. So it’s no surprise that Buffett threw shade at a potential competitor.