US Housing Market: Economist Says Stellar Data Won’t Stop Recession

Does today's bullish US housing market data eliminate the risk of a recession? Economist David Rosenberg says not so fast. | Source: AP Photo / Matt Rourke

The US housing market continues to mystify investors as they scrutinize economic data in search of a smoking gun that will vindicate – or vanquish – fears that the US economy is on the brink of a recession.

The needle moved in the optimists’ favor on Wednesday, when the Commerce Department reported that housing starts had spiked to a 12-year high in August, indicating that lower mortgage rates had finally begun to respond to the Federal Reserve’s monetary policy easing.

However, one economist warns that traders shouldn’t pre-order those “Dow 30,000 ” hats just yet. The US housing market August’s recovery, he says, is “too little, too late.”

Low Mortgage Rates Send Housing Starts to 12-Year High

According to Commerce Department data, US housing starts surged 12.3% to a seasonally adjusted annual rate of 1.364 million units in August, the metric’s highest level since June 2007. Building permits also jumped to their highest level since 2007, rising 7.7% to a rate of 1.419 million units.

Economists took the data as a positive sign for the US housing market , which had struggled for most of 2019. Including the August bump, housing starts are down 1.8% year-over-year.

“It’s not flashy, but this sign of resilience is welcome news for a housing market that is still struggling to grasp some momentum,” Zillow economist Matthew Speakman told the Wall Street Journal.

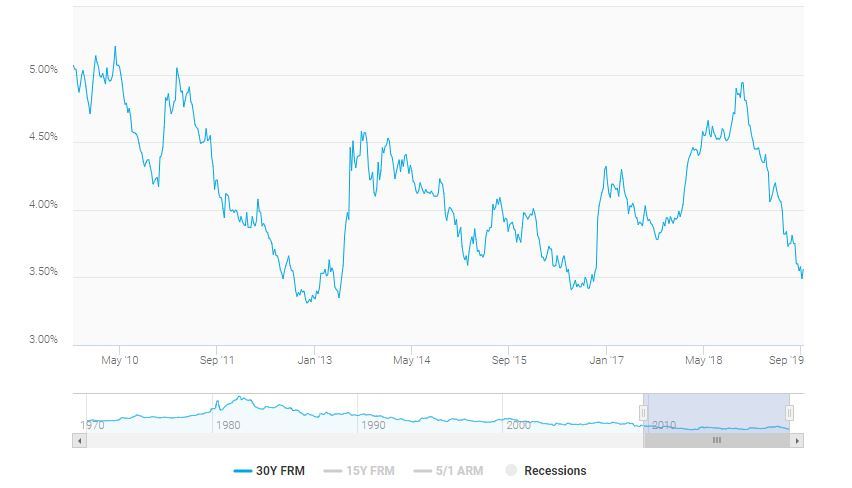

Low mortgage rates failed to provide the boost analysts had expected for much of the year, but that trend appears to be changing. According to Freddie Mac , the average interest rate on a 30-year fixed rate mortgage was 3.56% for the week ended Sept. 12.

That’s the lowest level since late 2016.

If mortgage rates fall much further, they’ll hit a new record low.

Economists say that falling rates are partially responsible for strong homebuilder confidence. On Tuesday, the National Association of Home Builders released its monthly Housing Market Index (HMI) , which indicated that homebuilder sentiment is at its highest level in a year .

Rosenberg: Housing Market Recovery Won’t Prevent Recession

Unfortunately, that stimulus may be too little, too late. That’s according to David Rosenberg, the chief economist at Gluskin Sheff.

Rosenberg says that while today’s housing market data is “good news,” it doesn’t change the uncomfortable truth that residential construction contracted in each of the past six quarters.

According to Rosenberg, the market has never performed so poorly for so long and “escaped an outright recession.”

“It may actually be too little too late re: housing starts data. At no time have we ever escaped an outright recession in the aftermath of such a prolonged decline in the residential sector,” he tweeted . “It is a classic leading indicator.”