Treasury Yields Pull Back from Highs as U.S.-Sino Relations Show Signs of Imploding

The market for government bonds is gripped by U.S.-China trade tensions. | Image: Johannes EISELE / AFP

U.S. government debt yields edged up slightly on Friday but were well off daily highs amid reports that the Trump administration is looking for ways to limit investment flows into Chinese equity markets.

Treasury Yields Pull Back from Highs

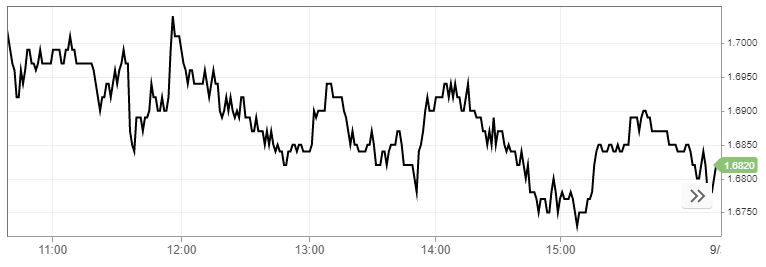

Government bond prices were mostly lower Friday, pushing yields slightly higher. The benchmark 10-year Treasury note saw its yield reach a high of 1.73%, according to CNBC data. By late afternoon, it had reversed course and was down 1 basis point at 1.684%.

The yield on the 2-year Treasury note peaked at 1.68%. It was last down nearly 2 basis points at 1.636%.

The yield on the 30-year Treasury note was little changed at 2.126%.

Trump Takes Aim at Investor Flows into China

Bloomberg reported Friday that the White House is exploring curbing U.S. portfolios flows into Chinese equity markets and limiting mainland businesses from being listed on Wall Street. Such moves would mark a major escalation in the ongoing trade war and affect billions of dollars in investor flows. As CCN.com reported earlier, U.S.-listed Chinese companies like Alibaba Group and Baidu could be among the hardest hit by such measures.

It could be that Trump administration is looking for leverage in its upcoming negotiations with China scheduled for Oct. 10-11 in Washington. But if recent history is any indication, the current administration isn’t afraid to use divisive tactics to strong arm China into a new agreement. Such measures appeared to be working earlier this year when Beijing was on the ropes and looking to make a deal. A prolonged stalemate beginning in May suggested otherwise.

Despite optimism that both sides are edging closer to an agreement, several major areas remain unresolved, including Chinese industrial policy, intellectual property and Beijing’s massive trade surplus with Washington.