Treasury Yields Rebound from Two-Week Lows Despite Manufacturing’s Deep Recession

The U.S. manufacturing slowdown continued at the start of the fourth quarter, according to ISM's PMI gauge. | Image: shutterstock.com

- U.S. government debt yields recovered on Friday as bond prices fell.

- The benchmark yield nosedived below 1.70% on Thursday, reaching its lowest levels since Oct. 15.

- The U.S. manufacturing sector is in a deep recession, according to at least one indicator.

U.S. government debt yields rose Friday, as bond prices fell after stronger than expected jobs data offset another dismal manufacturing report from the Institute for Supply Management (ISM).

Treasury Yields Recover

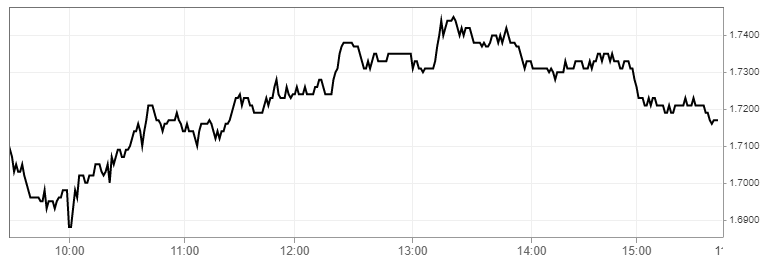

The yield on the benchmark 10-year Treasury note peaked at 1.75%, according to CNBC data, before paring gains later in the afternoon. It was last spotted at 1.719% for a gain of almost 3 basis points.

Treasurys with shorter maturities also rallied in the final session of the week. The yield on the 2-year Treasury note reached a session high of 1.58%; it was last spotted at 1.556% for a gain of 3 basis points.

The yield curve plunged more than 10 basis points on Thursday over concerns that the United States and China were heading towards a stalemate on trade. A dismal outlook on nonfarm payrolls that didn’t pan out also weighed on investor sentiment prior to Friday’s session.

U.S. Manufacturing Extends Slide

Output at U.S. factories fell in October for a third straight month, as the prospect of a ‘phase one’ trade agreement with China failed to impress purchasing managers.

ISM’s manufacturing purchasing managers’ index (PMI) improved to 48.3 in October from 47.8 the month before. Despite the modest uptick, a PMI reading below 50 denotes contraction in economic activity.

Timothy Fiore, the Chair of ISM’s manufacturing business survey committee, issued the following statement :

“Global trade remains the most significant cross-industry issue. Food, Beverage & Tobacco Products remains the strongest industry sector and Transportation Equipment the weakest sector. Overall, sentiment this month remains cautious regarding near-term growth.”

The outlook on manufacturing painted by IHS Markit is more optimistic than the ISM report. On Friday, Markit said U.S. manufacturing PMI fell to 51.3 in October from 51.5 in September – still higher than the 50 level that separates expansion from contraction. In general, U.S. investors place more emphasis on the ISM report.

Chinese Manufacturing Output Improves

China’s manufacturing industry recovered much more profoundly in October, as a key gauge of mid-sized producers posted its highest reading for two-and-a-half years.

Caixin’s China general manufacturing PMI improved to 51.7 in October compared with 51.4 the month before. It was the highest reading since February 2017 and much better than the consensus forecast.

Producers reported their first increase in new export orders in five months after Washington exempted roughly 400 types of Chinese products from tariffs.