Collapsing Trade Talks and Trump Impeachment Vote Create Perfect Storm for S&P 500

Faced with China trade hurdles and impeachment threats, Donald Trump may crash the stock market to secure his re-election bid. | Image: REUTERS/Leah Millis/File Photo

- Any significant trade resolution between China and the U.S. appears unlikely.

- The impeachment proceedings will give Trump powerful leverage that can get him re-elected in 2020.

- The stock market is very likely to go through a massive selloff but Trump may come out victorious.

There are two catastrophes coming for the stock market and the economy. The first one will dissipate all bullish momentum that drove the S&P 500 to fresh highs of 3,050. The second one will likely force President Donald Trump to ignite a massive selloff.

We’re talking about the caving in of the trade talks between China and the United States. In addition, the House decided to approve impeachment proceedings. While it may seem that Trump is losing ground, the POTUS unleashed one of the most powerful weapons in his arsenal: misdirection.

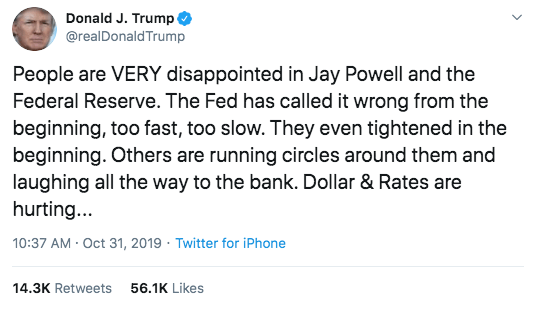

The U.S. president is trying to steer the attention of the public away from his recent misfortunes by blaming Federal Reserve Chairman Jerome Powell. This comes after the Fed cut rates for the third time this year.

Trump can pin it on Powell as much as he wants but the fact remains that his re-election is at stake. With China’s non-commitment on trade and the House passing the impeachment procedure, a perfect storm is brewing for the S&P 500.

There Is No ‘Phase One’ Deal – Bad News for the S&P 500

On Oct. 12, Trump took to Twitter to brag about the “greatest and biggest deal ever made.” However, China countered with an announcement that they wanted to extend talks to the end of October. At the end of October, the Asian giant said that they’re not ready to buy large amounts of agricultural goods from the United States. In a CNBC report, an official from a Chinese-owned company said,

China does not want to buy a lot of products that people here don’t need or to buy something at a time when it is not in demand.

Caught between the seemingly never-ending trade war are investors. Over the last few months, the stock market has been at the mercy of trade war developments. For instance, the S&P 500 cracked the 3,000 level Oct. 21st after a high ranking Chinese official said that both countries are making “substantial progress.”

On Thursday morning, the S&P 500 index plunged as Beijing revealed that signing any significant deal with Trump looks uncertain at this point.

The Chinese response did not come as a surprise. In October, CCN.com reported that there will be no significant deal between the two countries. China has taken on too much debt and it can’t afford to buy billions of dollars worth of U.S. agricultural products. With no resolution in sight, we expect the S&P 500 to lose its bullish steam.

Impeachment Proceedings to Energize Trump’s Re-Election Campaign

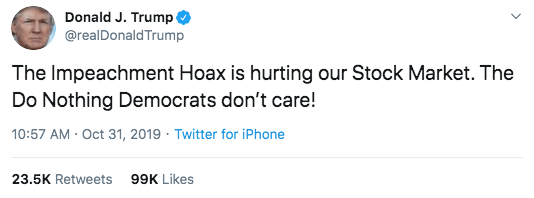

To make matters worse, the House voted on Thursday to approve the impeachment inquiry. A month ago, Will Meade, former Goldman Sachs analyst, predicted that Trump will drag the stock market to the ground if the House approves impeachment proceedings.

The analyst’s tweet is relevant now more than ever. On Thursday, Trump was quick to point the finger to the Democrats for Thursday’s drop.

We’re witnessing Trump’s brand of genius at play. His strategy appears to let the stock market crash and blame everything on the Democrats due the impeachment inquiry. This gives him something to leverage for his 2020 re-election. More importantly, the impeachment will distract the American people from Trump’s inability to make any significant deal with China.

A perfect storm is brewing and the stock market will likely dump big time. However, it may be possible that Trump will come out unscathed.

Disclaimer: The above should not be considered trading advice from CCN.com.