This Is the Real Risk of U.S. Recession, Not the Epic Stock Market Plunge

Small businesses have a lot of tough decisions to make. | Source: REUTERS/Amanda Perobelli

- The struggle of 30.2 million small businesses in the U.S. increases the probability of a recession in the U.S.

- With a cash buffer of 27 days on average, millions of businesses are at risk of temporarily closing down.

- The stock market is showing no signs of recovery despite aggressive fiscal policies.

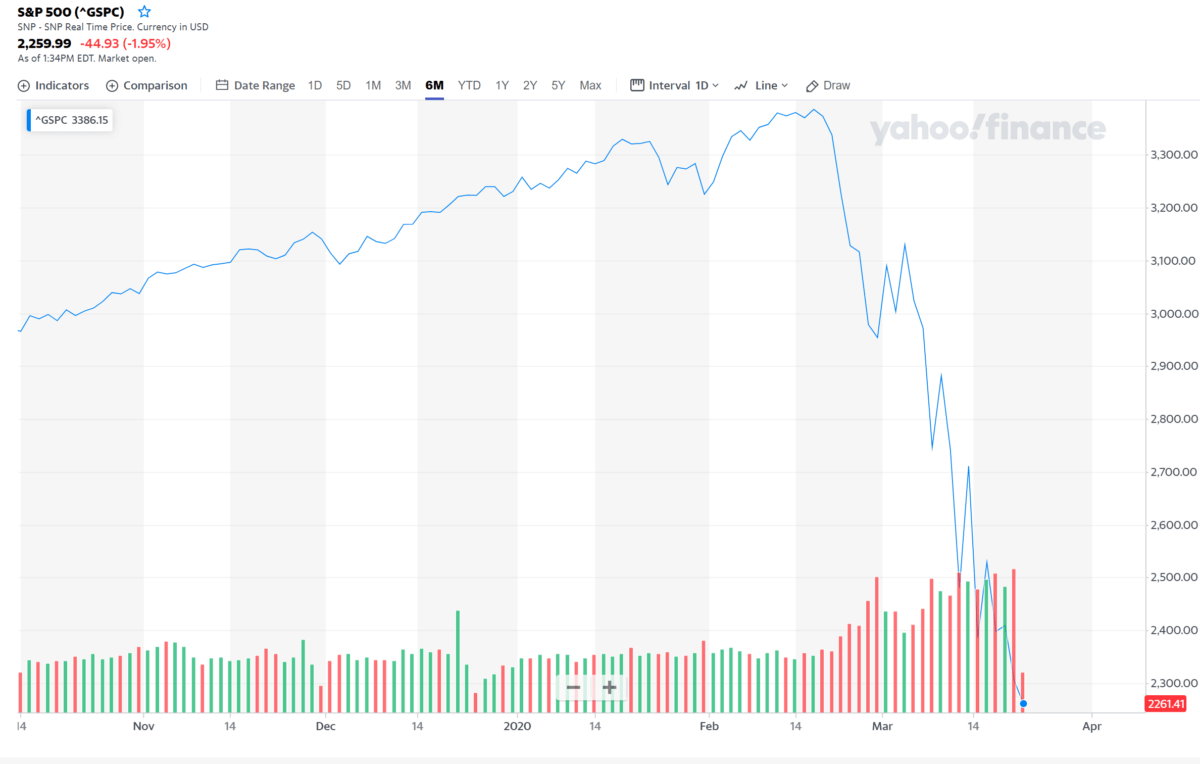

The U.S. stock market has been struggling to show signs of recovery following a 35% dip since February 20. But, it’s not the steep correction of stocks that are placing the U.S. economy at risk of a recession.

The global coronavirus pandemic has hit small businesses the hardest; many firms are expected to lay off millions of employees. Federal Reserve Bank of St. Louis President James Bullard sees the nation’s unemployment rate rising to as high as 30%.

The biggest problem of small businesses in the short-term is their average cash buffer of 27 days . With high rentals, maintenance costs, and employee salaries, a large chunk of America’s 30.2 million businesses are at risk of closing down, at least temporarily.

Small Businesses Are the Backbone of the Struggling U.S. Economy

Small businesses are described as the backbone of the U.S. economy for a reason. They employ 58.9 million people which is 18% of the entire U.S. population.

The narrative around a full-blown recession by 2020 has primarily been based on the stock market plunge. Large companies like Boeing (NYSE:BA) have seen their stocks free fall since March 12. They’ve failed to recover despite aggressive fiscal policies.

But, as Bank of America (NYSE:BAC) said in a recent note, the real risk of recession in the U.S. stems from the abrupt surge in the nation’s unemployment rate.

3.5 million individuals are projected to lose their jobs by the end of the second quarter of 2020, doubling the rate of unemployment in a month.

Bank of America and other major banks foresee the economy returning to its norm by the third quarter of 2020. That still largely depends on whether the coronavirus outbreak can be contained by that time.

With lockdowns in place in the state of California and New York, many small businesses in the U.S. will soon hit their cash buffer limit of 27 days.

If the U.S. implements large-scale lockdowns and quarantine, the path to recovery for small businesses remains bleak in the short-term.

The Underperformance of the Stock Market Isn’t Helping

The coronavirus pandemic continues to rattle the stock market, regardless of the stimuli set forth by the Federal Reserve and the U.S. government.

It indicates that the appetite for high-risk assets, including single stocks, is unlikely to increase until the virus outbreak is contained.

The instability in the global financial market places additional pressure on small businesses that are unsure how to cope with the pandemic. Hopefully, things start to ease up, but it’s not looking that way for now.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.