The Dow Is Breaking Free from Boeing Stock’s Ugly Stranglehold

Boeing began the year as the Dow's most important component. It may end the year as an afterthought. | Source: AP Photo / Elaine Thompson

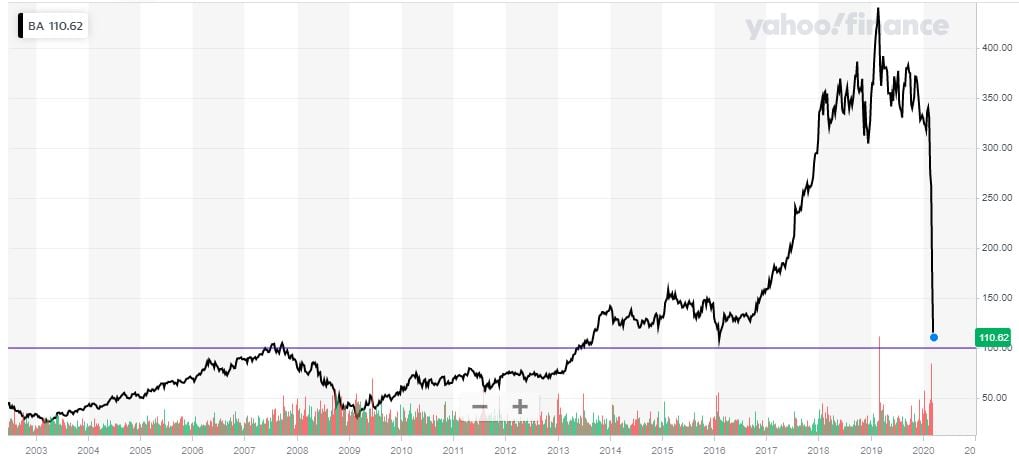

- Boeing stock’s ugly 2020 crash has caused the Dow Jones Industrial Average (DJIA) to underperform its peers.

- But the aerospace stock’s stranglehold on the DJIA is fading.

- Boeing’s weighting has plummeted to 9th in the 30-member index, and its free-fall shows no signs of letting up.

Boeing bulls may cast the Dow Jones stock as a “value investor’s dream,” but for shareholders, the past year has been nothing short of a nightmare.

Down roughly 66% since the start of January, the U.S. aerospace giant’s stock price is on the brink of crashing below $100 for the first time since 2013.

Boeing Stock Relinquishes Its Dow Jones Crown

Boeing was long the most heavily weighted component in the Dow Jones Industrial Average (DJIA) , and its grisly performance is the primary reason the Dow has trailed the S&P 500 and Nasdaq by a considerable margin in 2020.

Nothing about this should encourage Dow Jones bulls. But if there is a silver lining, it’s that the Dow is a price-weighted index . And as its shares crumble, the century-old manufacturer is quickly relinquishing its stranglehold on the DJIA.

By the time Monday’s closing bell finally brought an end to the Dow’s 3,000-point bloodbath, Boeing’s DJIA weighting had plummeted to 9th in the index.

It’s hard to remember a time when Boeing wasn’t the most important component in the Dow. Not even the never-ending 737 Max scandal was enough to knock BA off its pedestal. At least not permanently. (Apple edged to the top of the Dow 30 a few times but never for long.)

But the coronavirus crisis has obliterated Boeing’s order-book, and the aerospace company’s debt-financed house of cards has finally come crashing down.

So forget Apple. These days Boeing is languishing behind surprising names like McDonald’s and 3M. And it looks like the company is about to get ejected from the index’s top ten.

Will the Stock End 2020 as an Afterthought?

The Dow Jones may have embarked on a massive recovery on Tuesday, but Boeing stock crashed more than 10%.

If current prices hold, Boeing will end the session as the index’s 12th-most heavily weighted component, dropping behind Johnson & Johnson, Procter & Gamble, and Walmart.

Another 20% and BA could find itself in the bottom half of the 30-member index.

No one knows what havoc the coronavirus pandemic will ultimately wreak on the airline industry and its suppliers. But Boeing’s outlook has never been bleaker.

It began the year as the Dow’s most important component. It may end the year as an afterthought.