SEC Charges Group Behind Filing System Hack, $4.1 Million in Illegal Trades

Source: Shutterstock

New charges have emerged from a 2015 case of hacking and insider trading, the SEC announced today . In the previous case, Ivan Turchynov and Oleksandr Ieremenko hacked newswire services and provided information to traders before anyone else could get it. The scheme was very profitable. In one incident , a trader using the information made over $2 million by shorting a stock that was to receive bad news the next day, Dendreon Pharmaceuticals.

From Newswires to Government Databases

A total of 32 people went down in the newswire fraud case. The majority traded on the information. But now the SEC is charging that the individuals went further than previously announced. From a press release this morning:

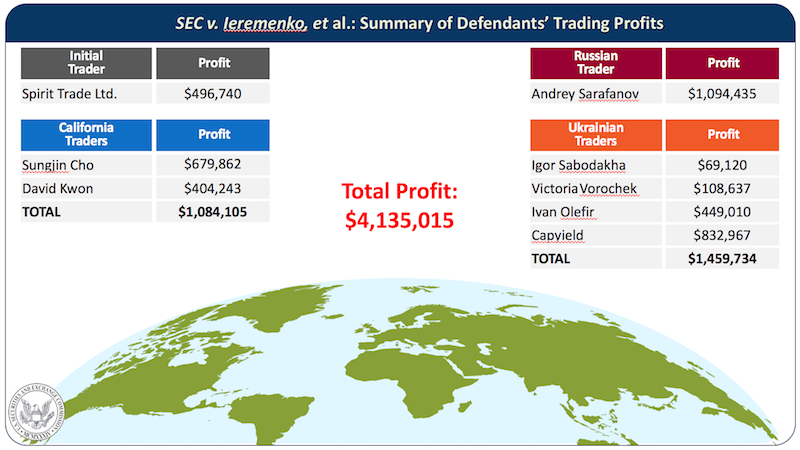

Ukrainian hacker Oleksandr Ieremenko turned his attention to EDGAR and, using deceptive hacking techniques, gained access in 2016. Ieremenko extracted EDGAR files containing nonpublic earnings results. The information was passed to individuals who used it to trade in the narrow window between when the files were extracted from SEC systems and when the companies released the information to the public. In total, the traders traded before at least 157 earnings releases from May to October 2016 and generated at least $4.1 million in illegal profits.

EDGAR stands for “Electronic Data Gathering, Analysis, and Retrieval” system. Most public companies doing business in the US use EDGAR to file information with the SEC. Information that can be very useful to traders, such as bad quarters or other potentially damaging information, as well as positive information. Above all, traders understand that the market responds to company performance. Citigroup’s stock declined by almost $20 over the course of 2018 after posting a huge loss at the end of 2017.

Six Traders Charged

Steven Peikin, co-director of the SEC’s Enforcement Division, said:

The trader defendants charged today are alleged to have taken multiple steps to conceal their fraud, including using an offshore entity and nominee accounts to place trades.

In addition, SEC appears ready to prove that Ieremenko developed a deep understanding of EDGAR. He was able to identify non-public records including unpublished earnings statements. He passed the information along to at least six traders charged alongside him. Two traders charged are US residents: Sungjin Cho and David Kwon, both of Los Angeles.

Additionally, two companies called Spirit Trade and Capyield Systems are also named in the indictment. Importantly, all 9 entities are facing civil penalties and a lifelong ban from trading. Some of them are also facing criminal charges from the U.S. Attorney’s Office for the District of New Jersey. That office has yet to publish a press release on the subject of the charges. Oleksandr Ieremenko’s actions definitely fall under the Computer Fraud and Abuse Act. One of the oldest anti-hacking laws in the United States, at a minimum it criminalizes access to computer systems without authorization.

Featured image from Shutterstock.