No Evidence That Apple Has Topped Out Says Financial Analyst

Despite concerns over slowing China sales, Apple maintains a formidable position in technology industry. | Image: NICOLAS ASFOURI / AFP

From a long-term perspective, Apple (AAPL) is enjoying one of the longest bull runs in the history of the S&P 500. The stock has been bullish on the monthly time frame ever since 2003 when shares were trading around $1.00.

Since then, the equity has skyrocketed by over 21,700% as it is currently trading around $218. The impressive run is causing some investors to feel jittery. Some believe that the stock has topped out.

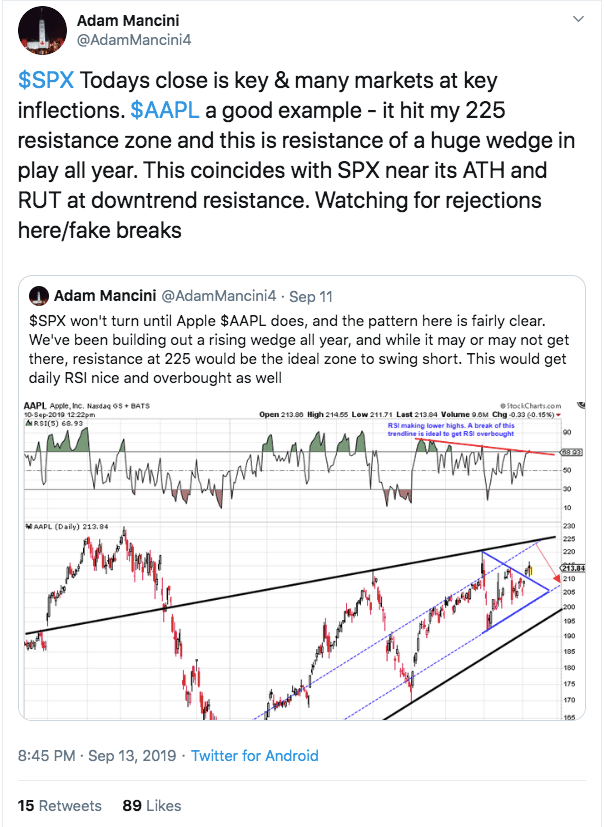

Although the below tweet is ten days old, it’s still relevant:

With bearish technicals and weakening iPhone sales, it appears that the tech giant is on its way down. However, we talked to a couple of experts, and they believe that Apple has a lot of gas left in its tank.

iPhone Sales in China Slowing down as Apple Loses Ground to Major Competitors

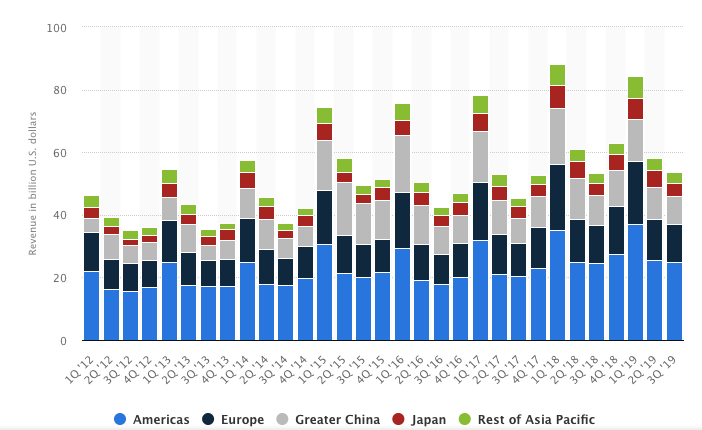

China is a key market for the iPhone maker. According to Statista , the country is the third largest market by region for the tech company behind the Americas and Europe.

Unfortunately, Apple is seeing its market share in the smartphone department gradually shrinking as it loses ground to major competitors. A Canalys report revealed that the market share of the Cupertino-based company contracted by 14% in the second quarter of 2019 as Huawei dominated smartphone sales in the country.

In addition, CCN.com reported Sunday that the release of iPhone 11 was “met with a lukewarm response in China.” The less than stellar reception comes after Apple significantly reduced the price of its flagship product to $699.

Despite these developments, some experts are still upbeat about the stock’s long-term prospects. They believe that Apple’s Services segment, Wearables, as well as brand loyalty will keep shares humming in the next few years.

Financial Experts: Apple Still Looks Attractive

We spoke to Romeo Alvarez, a research analyst and a director at investment firm William O’Neil + Co . He said:

From a technical view, we do not have any concrete evidence that leads us to believe that Apple shares have topped. Although we recognize the shares may hit resistance near YTD highs at $221.37, AAPL has been in an uptrend since the start of the year and is likely to continue in that direction.

The research analyst added:

In fact, momentum has picked up over the last six week despite choppy general market conditions and uncertainty over trade with China due to investor excitement over the prospects of Apple’s high-margin Services segment (iTunes, Apple TV+, iCloud, Arcade, etc.) and its Wearables business, which is growing at a 47% year-over-year rate, offsetting slowing growth in iPhone sales.

Mr. Alvarez appears to be betting on Apple’s Wearables and Services segments to counteract declining iPhone sales.

Another Finance Expert’s Opinion

In addition, we spoke to Dr. Robert Johnson, Professor of Finance at Heider College of Business at Creighton University. The finance expert supports the view of Mr. Alvarez as he said,

Apple is still very attractively priced, as it sells at around 17 times forward earnings; approximately the broader market multiple. And for that multiple an investor gets a premium company that possesses several economic moats.

Dr. Johnson cites brand name, switching costs, network effect, and efficient scale as its economic moats. Also, he is banking on the loyalty of Apple’s customers. The professor thinks that most buyers of Apple products are “incredibly loyal and routinely trade in their iPhones when an upgraded model is made available.”

Also, Dr. Johnson stressed an important note that many experts tend to ignore,

Finally, Apple has over $20 in cash per share and has the financial flexibility to pursue attractive acquisitions.

In addition to the growth of its Services and Wearables segment, Apple can still expand its portfolio through acquisitions of high growth companies.

iPhone sales might be losing out on its competitors but Apple appears to be carving out shares in other markets. Tim Cook may not be an innovator like Steve Jobs but he seems to be doing right by his investors.