10 Best Performing S&P 500 Stocks Since 2000. You’ll Never Guess No. 1

All of these top 10 S&P 500 stocks returned over 4,000% since the end of 2000. The No. 1 stock on the list surged by 72,837%. | Credit: AP

It would appear that the tech industry took over ever since the turn of the millennium. Companies like Apple, Google, and Amazon became household names. Many got rich investing in these tech giants. However, if you combine the gains of these three stocks from the end of 2000 up to today, the sum won’t even amount to half of the returns generously provided by the best performer on our list.

Here are the top 10 best performing S&P 500 stocks since the turn of 2000.

10. Activision Blizzard Inc. (ATVI) Stock

Activision leads all stocks in the gaming industry. The California-based video game publisher is popular for names such as Starcraft and World of Warcraft. By the end of 2000, it was trading at $1.26 per share. Today, the stock has skyrocketed to $54.76 per share for an explosion of 4,246 percent.

9. HollyFrontier Corporation (HFC)

The petroleum refiner and distributor takes the ninth spot on our list. At the close of 2000, HollyFrontier traded at $1.17 per share. Those who bought stock in the company are now enjoying gains of 4,398 percent as the equity is trading at $52.63 today.

8. IDEXX Laboratories Inc. (IDXX) Stock

The Maine-based developer and distributor of animal diagnostic tests, software, and water microbiology tests sits at No. 8. By the end of 2000, IDXX shares were trading at $5.50. Fast forward to today, investors have to shell out $274.17 to become a shareholder. That’s a massive growth of 4,884 percent.

7. Ansys Inc. (ANSS) Stock

At No. 7 is the engineering simulation and 3D software developer and marketer, Ansys Incorporated . Shares of the Pennsylvania-based design firm traded at $2.81 at the end of 2000. Today, investors have to pay $216.57 per share. That’s an impressive rate of return of 7,607 percent.

6. Intuitive Surgical Inc. (ISRG) Stock

Concluding the first half of our list is Intuitive Surgical . Back in 2000, shares of the company that develops robot-assisted technology for surgery were bought and sold at $5.67. Nineteen years later, ISRG is trading at $531.16 to record mind-boggling gains of 9,267 percent.

5. Amazon (AMZN) Stock

It would be surprising if Amazon did not make the cut. Way back in 2000, investors had to pay $15.56 for a share of the e-commerce firm. Nowadays, AMZN is trading at $1,792.01 to register a massive growth of over 11,416 percent.

4. Tractor Supply Company (TSCO)

Landing at No. 4 on our list is the largest rural lifestyle retail chain of stores in America. Almost two decades ago, investors bought TSCO shares at dirt-cheap prices of $0.53. That’s why it came as a surprise to many that the stock is now trading at $90.39. If you bought and held since the end of 2000, you would be up by over 16,954 percent.

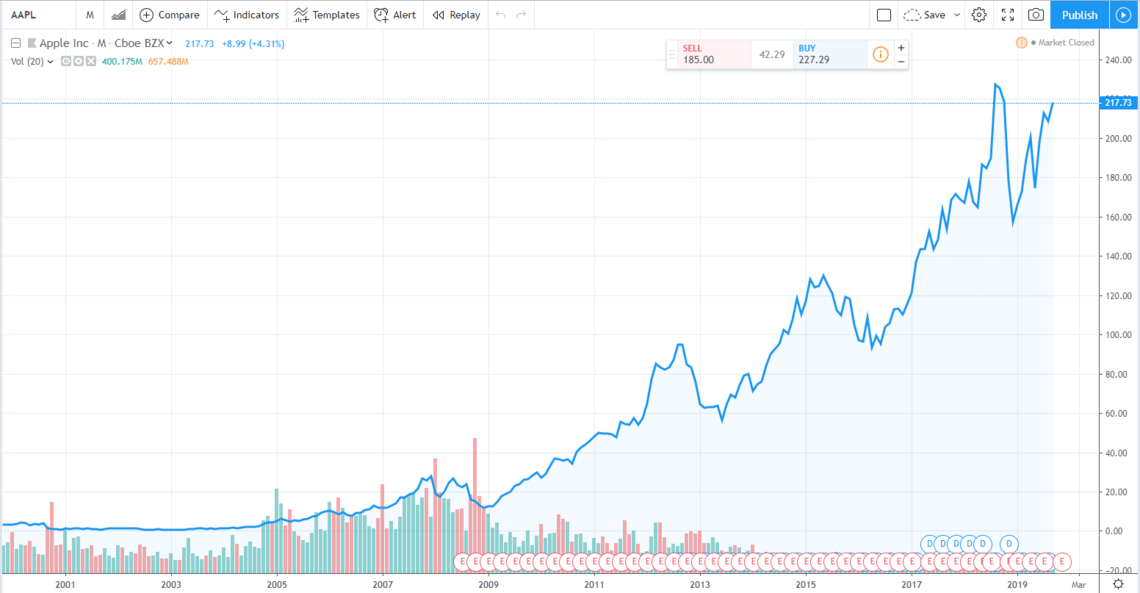

3. Apple Inc. (AAPL) Stock

The new millennium gave Apple a new lease on life. At the turn of the century, Apple stock traded at $1.06 per share. If you were a big fan of the company and you bought and held since the end of 2000, your portfolio would be in the green by over 20,465 percent as AAPL is priced at $217.99 per share now.

2. Netflix (NFLX) Stock

It may come as a surprise to many that Netflix has edged out Apple in terms of gains. The most dominant on-demand video streaming company closed 2002 (IPO year) at $0.79. Today, shares of the company are trading at $270.75 to register returns of over 34,172 percent.

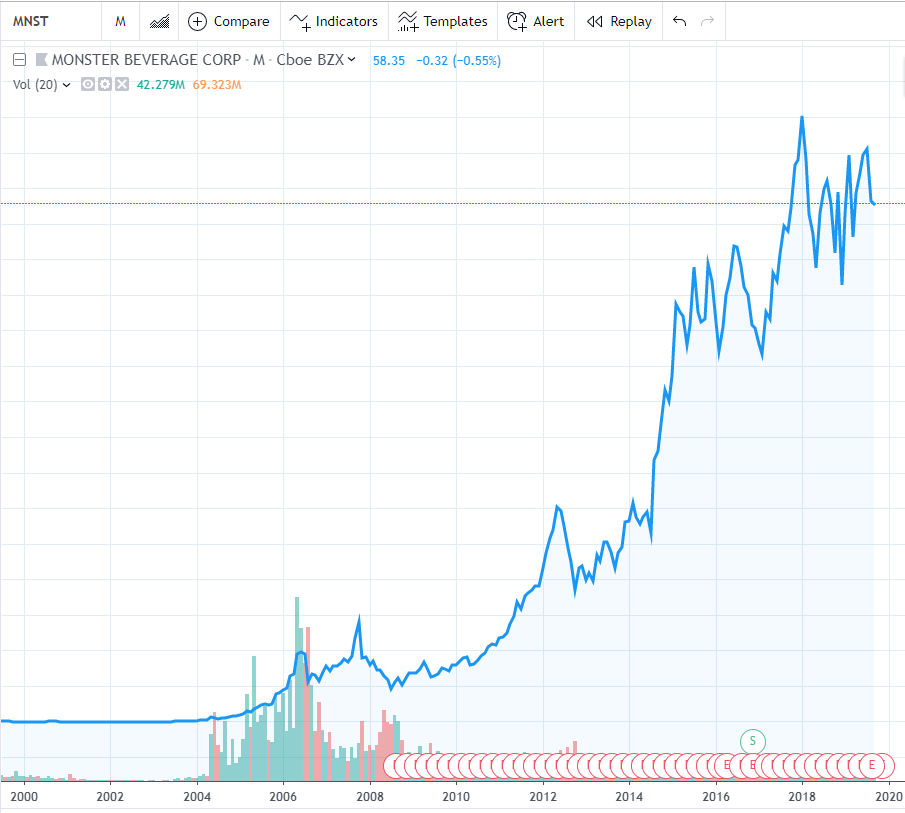

1. Monster Beverage Corporation (MNST)

Surprise, surprise! The S&P 500 stock that provided the highest return is Monster Beverage . The manufacturer of energy drinks grew by a ridiculous 72,837 percent since 2000.

Back then, shares of the company traded at $0.08. If you invested $1,500 in the company in 2000, your equity would be valued at over $1.094 million as the stock is trading at $58.35 per share now.