Manufacturing Recession Puts U.S. Economy on Track for Worst Quarter Under President Trump

Q4 is shaping up to the worst quarter for the U.S. economy under President Trump. | Image: Robyn Beck / AFP

- U.S. industrial production plunged in October at the fastest rate in a year-and-a-half.

- GM strike exacerbated the decline following a six-week work stoppage.

- The manufacturing sector remains in a recession that could spill over to the rest of the economy.

U.S. industrial production plunged in October at the fastest rate in a year-and-a-half, further underscoring the nation’s manufacturing downturn at a precarious time in its ongoing trade negotiations with China.

The decline was much worse than expected due to a six-week work stoppage at General Motors that likely cost the auto manufacturer $3 billion . But even if we control for the GM strike, America’s productive economy has been in a downward spiral for decades.

U.S. Industrial Production Plummets

In its monthly report on industrial production, the Federal Reserve announced Friday that output at American factories fell 0.8% in October against expectations of a 0.4% drop. It was the worst monthly decline since May 2018 . On an annualized basis, industrial production was down 1.1%.

Industrial production is the widest measure of factory output, capturing trends at manufacturing companies, mines and utility providers.

Fed data showed a 0.6% drop in manufacturing output from September and a 1.5% decline over year-ago levels. Much of that decline was attributed to a slumping automotive industry after workers at General Motors walked off the job. Output of motor vehicles and parts fell 7.1%.

Overall, manufacturing production has declined in three of the last four months.

Meanwhile, mining output declined 0.7% in October but was up 2.7% annually. Utilities fell 2.6% from September and 4.1% annually, official data showed.

Trade War Knocks Manufacturers Off Course

Although manufacturing’s share of GDP and employment has declined throughout the decades, it still represents a critical component of the U.S. economy. Latest PMI data from the Institute for Supply Management (ISM) suggest U.S. manufacturers are feeling the pinch of the ongoing trade war with China more severely than their Chinese counterparts.

In an interview with the Financial Times , Michael Metcalfe of State Street Global Markets said:

U.S. manufacturing sentiment has collapsed in the past nine months, spectacularly so in the last quarter. Meanwhile, their Chinese counterparts, at least by the official measure, are no less cautious than they were at the beginning of the year.

The Caixin manufacturing PMI of small- and mid-sized companies recently surged back into positive territory, reaching its highest level in two years.

U.S. Economy Under Threat

A slowdown in manufacturing is already spilling over into other segments of the economy. ISM’s non-manufacturing PMI – a gauge of service activity – fell to three-year lows in September. The indicator has since recovered, but it remains in a precarious position as business spending and GDP growth continue to soften.

The Atlanta Fed’s GDP tracker is forecasting the worst quarter for the U.S. economy since Donald Trump was elected president. At last check, the regional Fed Bank was calling for annual growth of just 1% in the present quarter, down from an already disappointing 1.9% growth clip between July and September.

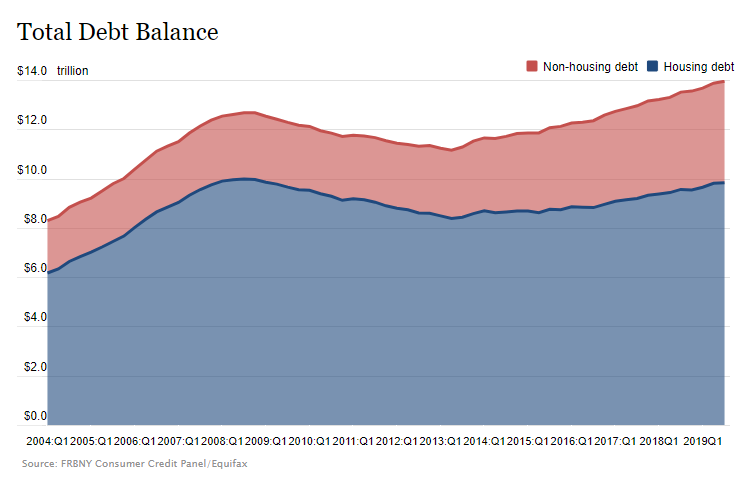

Although services are largely underpinned by consumer spending, a record surge in household spending threatens to knock the sector off course. By the end of the third quarter, debt-laden Americans owed a staggering $13.95 trillion, according to the New York Federal Reserve Bank. That puts household debt $1.3 trillion higher than the 2008 peak.

The fact that services account for the vast majority of the American workforce is also a concern. The explosion in service employment partially explains why average earnings fail to keep up with inflation. Hiring in the sector remains strong, but wages are weak. While this has improved under President Trump, with average annual earnings eclipsing 3%, the U.S. economy today is largely made up of low paying services jobs. Combined with the aforementioned rise in consumer borrowing, this could be a recipe for disaster.