General Motors (GM) Faces Crippling Losses as Autoworkers Strike Enters Day 2

United Auto Workers Union strike enters day two. | Image: Jake May/The Flint Journal via AP

Detroit automaker General Motors Co (GM) could lose up to $50 million per day in earnings after the United Auto Workers (UAW) union orchestrated its first walk out against the company in 12 years.

Largest Strike in 12 Years

As many as 50,000 workers are participating in the GM strike that began late Sunday and continued for a second day on Tuesday. The auto union is demanding higher wages, lump sum payments and a more lucrative profit-sharing plan. It’s the largest walkout any U.S. labor group has staged in 12 years.

Although GM is no stranger to labor disruptions, the last autoworkers’ strike against the company was resolved after just three days. The strike of 1998 was far more devastating, lasting 54 days.

GM has already offered to upgrade U.S. factories to the tune of $7 billion and increase payrolls by 5,400 positions. In the meantime, the company has a 59-day supply of automobiles and an even larger inventory of SUVs and trucks.

Impact on GM Stock

Shares of GM tumbled as much as 3.6% on Monday, and eventually closed at $37.21, the lowest in two weeks. The stock bounced back on Tuesday, regaining most of its prior losses.

Analysts warn that a prolonged labor disruption could have serious consequences on the automaker’s profit margins. Dan Levy, an analyst for Credit Suisse, pegged GM’s daily losses at $50 million.

“The longer it lasts, the more it will be felt in GM’s earnings profile,” Levy wrote in a note to clients, as reported by Business Insider. “The strike potentially could dampen the earnings, and at the very least is an optical negative and a reminder of the challenges of investing in automakers at this point in the cycle.”

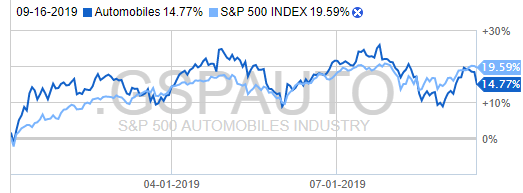

GM’s yearly gain of around 12% puts it well below the S&P 500. It also undershoots the automotive component of the S&P 500’s consumer discretionary sector, which has returned almost 15% year-to-date.

Impact on the Economy

U.S. auto manufacturing doesn’t have the same clout as it did decades ago when the nation’s factories were humming, but the impact of a prolonged labor disruption could be severe. JPMorgan economist Daniel Silver believes “the magnitude of the strike’s impact should increase the longer it lasts.”

In a note to clients, Silver said auto manufacturing accounts for only 0.8% of GDP, but GM represents nearly 20% of recent U.S. vehicle production. If the 50,000-worker union strikes for months on end, it will impact jobs numbers and perceptions about the economy’s health.

The U.S. jobs machine has shown signs of slowing in recent months, with most broad measures of economic growth also cooling. If the GM disruption continues, it could impact the October hiring numbers. The September data are unlikely to be affected because the reference week for the labor report ended on Saturday.