Is This the End of the Stock Market Rally?

A forward-looking volatility indicator surged on Thursday, setting the stage for a depressed stock market. | Image: Spencer Platt/Getty Images/AFP

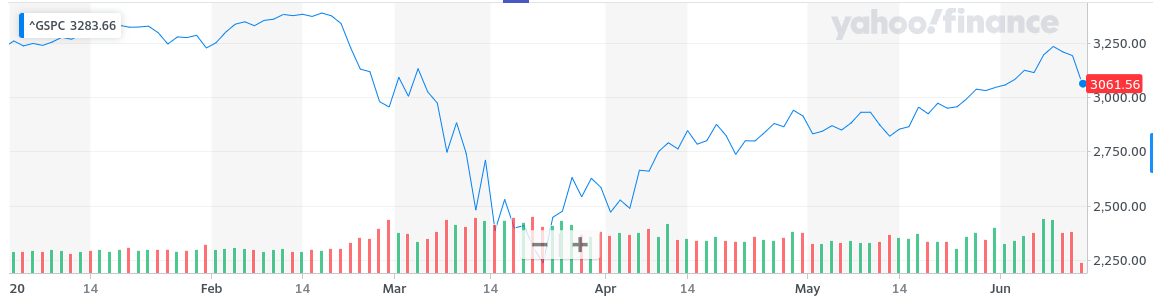

- The U.S. stock market plunged sharply on Thursday on concerns about the economy and rising virus cases.

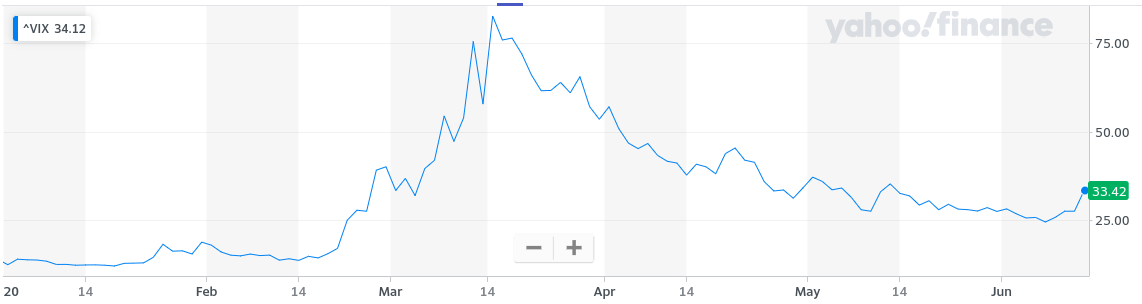

- The VIX spiked as investors’ fear is mounting.

- The rally might end when investors realize the pandemic is causing lasting damages to the economy.

The stock market plunged on Thursday amid concerns about the Federal Reserve’s grim outlook on the economy and an uptick in U.S. virus cases.

The S&P 500 fell by more than 4% on its way to its worst daily decline since early May.

A Dangerous Indicator Just Flashed A Warning Sign

The movements of the Cboe VIX Index reflected the sharp drop in the stock market. The market “fear gauge” spiked more than 20% Thursday morning and broke 30 for the first time in a month. The VIX is now well above the historical mean (20-25).

The VIX is a measure of the stock market’s expected volatility based on S&P 500 index options.

When the stock market goes down, investors want to purchase insurance. They drive up the prices of put options which, in turn, increases the VIX.

The VIX is going up because investors’ fear is rising.

Americans fear a second virus wave in some states as reopening efforts continue. Texas, Florida, Arizona, and California have all reported sharp upticks in the number of cases or hospitalizations.

The increasing number of cases has pushed the American total above 2 million. A second wave could trigger a new round of stay-at-home restrictions or layoffs.

Investors also mulled cautious commentary from Fed President Jerome Powell on Wednesday. He said the pandemic could result in permanent economic damage and a long spell of high unemployment.

Powell warned that, despite the better-than-expected May employment report, the labor market recovery is a long road. At the end of 2022, the unemployment rate should still be 5.5% , much higher than at the start of this year. The Fed predicts a 6.5% drop in GDP in 2020.

Still, the Fed has indicated its willingness to continue its economic stimulus efforts, saying it will leave rates near zero for a long time and maintain its multi-billion-dollar bond purchases.

The Stock Market Rally Might End Soon

Are we seeing an end to the stock market rally? It’s too soon to tell. A day or two of weakness doesn’t mean we are back in a bear market. This could be just a short-term pullback.

But what we do know is that investors are getting more bearish. So, the risk that the stock market rally is about to end is increasing.

Savita Subramanian, Bank of America Merrill Lynch’s head of U.S. equity and quantitative strategy, is looking for constant improvement in the employment situation, rather than just an immediate rebound in weak figures.

The boss of a multi-billion-dollar wealth manager warned in an interview with CNBC that the stock market could drop 10% at the end of the summer when the pandemic’s lasting damage is revealed.

Peter Boockvar of Bleakley Advisory Group said we wouldn’t know how many businesses can reopen, how many employees will get their jobs back, and how much households and businesses spend until August or September. That’s when the gut check will take place.

Boockvar recognized that the Federal Reserve’s unprecedented stimulus policies are a significant driver of the stock market rally. But he added that a premature assumption that the pandemic has turned a corner also caused the rally.

The Fed’s stimulus might not be enough to keep fueling the rally if data come off worse than expected.

When investors realize the pain isn’t over, we could see a significant stock market sell-off. The bubble could pop sooner or later.