Global Stocks Slump as Analysts Forecast 30% Gold Rally in 2020

Gold prices are rising amid weak jobs and manufacturing data and that's likely to stick, analysts predict. | Source: allstars/Shutterstock.com

As global stocks continue to slip fueled by the correction of Asian markets, analysts expect the gold price to surge by 30 percent heading into 2020.

The Nikkei 225, a stock market index for the Tokyo stock exchange, plummeted by over two percent on the day alongside South Korea’s Kospi and China’s SSE Composite, which recorded a 1.95 percent and 9.2 percent drop respectively.

The steep pullback of Asian stocks in recent months have led strategists like David Roche, president at Independent Strategy, to anticipate a renewed rally for gold in the short term.

How high could the gold price go?

According to Roche, the outflow of capital from global stocks to safe haven assets and alternative store of value could intensify the upside movement of the gold price in the upcoming months.

Gold, which is hovering at around $1,500, could rise to as high as $2,000 said Roche, especially if a trade deal between the U.S. and China fails to materialize by the year’s end.

He stated :

“What my gut says is that cause of the vilification of fiat currencies by central bankers, which is set to get worse — not better, people will look for an alternative currency. Gold is a good alternative currency because it’s safe, and because it costs nothing to own it compared to paying negative rates on deposits.”

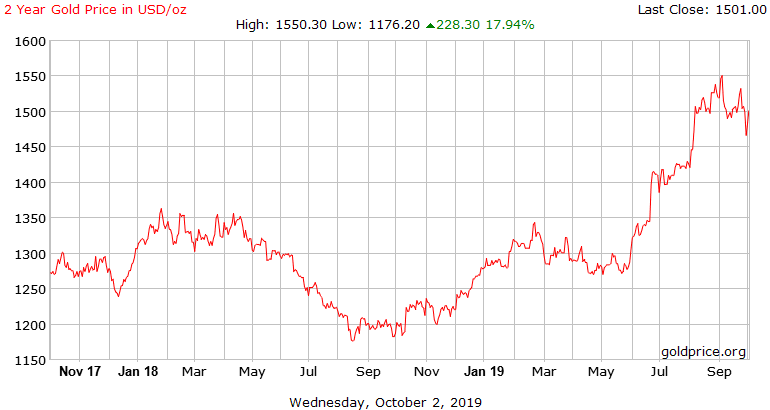

Since September 2018, in just over a year, the gold price has risen from around $1,180 to $1,500, by 27.5 percent against the U.S. dollar.

A further $500 upside movement from the current price range by early 2020 would indicate a near-70 percent rally within a two-year span, bringing it over $1,900 for the first time since 2011.

Bonds rising could catalyze gold rally

Holger Zschaepitz, a market analyst at Welt, reported that the demand for bonds–as seen in the drop in the U.S. 10-year treasury yield–is on the rise, as investors flock to safer alternatives amidst growing uncertainty in the global economy.

“Global stock rout extends to Asia as US tariffs on EU fan growth worries. Nikkei falls 2% after S&P 500 tumbled 1.8%. US tariffs hit already weak sentiment. Bonds rise with US 10 year yields drop to 1.58%. Brent drops to $57.7 on increase in US oil inventories. Gold $1500, Bitcoin $8.3k,” said Zschaepitz.

The decline in the growth of the global economy following the introduction of strong stimuli by central banks that include both the U.S. Federal Reserve and the European Central Bank (ECB) could encourage investors to open discussions on the possibility of a global recession once again, raising the sentiment around gold.

Oliver Bäte, the CEO of Allianz, the largest insurer in Europe, criticized the ECB for its ultra-loose monetary policy, emphasizing that it is not the key towards the recovery of the European economy, which indicates that the fresh interest rate cut by the ECB may not be enough in improving the sentiment around European stocks.

EU-U.S. trade dispute is another variable

Clete Willems, former National Economic Council deputy director, said that the trade dispute between the U.S. and Europe could extend throughout the coming months, placing even more pressure on the global economy with no resolution between the U.S. and China in sight.

He said :

“At the end of the day, what they’d like to do is use these tariffs for leverage to get a negotiated outcome. But I do think that the two sides haven’t worked together particularly well when it comes to trade negotiations lately and it may take some time for them to work through these issues … so you are going to see these tariffs in place for some period of months,”

The clear rise in geopolitical risks in the global economy combined with the uncertainty in the short term future of key American sectors like manufacturing could make gold a more appealing safe option for investors in 2019.