Dow Staggers While World Economy Spirals Toward Brutal Recession

The Dow Jones staggered toward one of its worst losses of 2019 as the world economy potentially spiraled toward a brutal recession. | Source: Source: REUTERS / Brendan McDermid

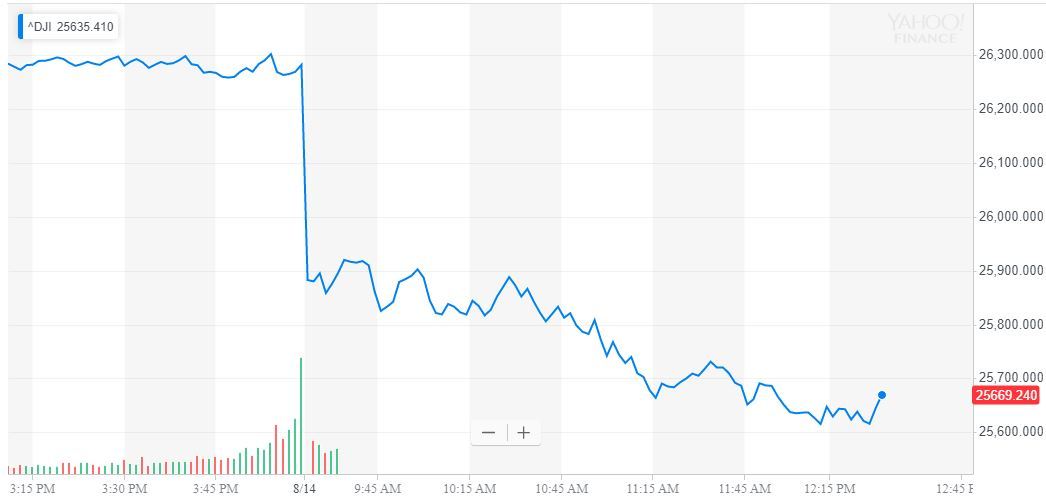

By CCN.com: The Dow Jones took a hammering on thin liquidity on Wednesday as a blizzard of terrible news iced bulls and thrust the index into a 600 point tailspin.

The bears were out in force as the mighty German economic machine contracted, Chinese data missed estimates, Hong Kong wallowed in chaos, and bond yield curves inverted in the US and UK.

Dow Dives More than 2%

As of 1:49 pm ET, the Dow Jones Industrial Average had lost a staggering 606 points or 2.31%. The index last traded at 25,673.

The S&P 500 and Nasdaq also crashed more than 2.3% after US Treasury bonds suffered their first main yield curve inversion since the financial crisis.

The fact that a US 2-year note yielded more than a 10-year is a significant worry for Dow bulls given that this has heralded every major recession in the United States since 1956.

The fear looks even more justified in the broader context of a world ravaged by slowing economies and simmering trade war tensions.

The Stock Market’s Bearish Stars Are Aligning Into a Devastating Constellation

The bearish stars are certainly aligning.

Germany, the cornerstone of the Eurozone economy is in serious trouble . These GDP woes would only heighten if Trump wins in 2020 and moves the fight away from China and onto European car exports.

Elsewhere, Chinese data was miserable , suggesting that even more easing might be necessary for the already dangerously leveraged economy. Hong Kong is a significant financial hub, so the dramatic drop off in its economic performance amid the protests is concerning as well.

Chief Economist James Knightley at IMG offers some prosaic thoughts on the outlook for US equities. The Dutch investment bank maintains its view that President Trump will come to the Dow Jones’ aid in its darkest hour.

“We continue to make the case for an eventual more stable truce on trade with China as President Trump looks to focus on re-election next year. He will recognise that a strong economy with rising asset prices is critical for his campaign so securing some form of a deal will help lift a huge dark cloud hanging over the global economy”

Dow Jones Stocks: Defensive Play Coca-Cola Shines, Financials Struggle

The major Dow stocks faced heavy selling on Wednesday – as expected.

Naturally, Goldman Sachs and JP Morgan Chase were two of the worst-hit amid the collapse in yields. JPM and GS shares fell 4% and 3.6%, respectively.

Oil companies Chevron and Exxon Mobil were both down around 3% as a surprising rise in US crude inventories stunned the market, sending the price of oil lower.

Heading toward the close, only Coca-Cola was trading in the green, clinging to a gain of just 0.03%.

Click here for a real-time Dow Jones Industrial Average chart.