Dow Teeters on the Edge as 30-Year Bond Yield Crashes to Record Low

The Dow Jones fought to secure modest gains on Thursday, even as the 30-year Treasury yield crashed to a record low below 2%. | Source: Drew Angerer / Getty Images / AFP

By CCN.com: The Dow and broader U.S. stock market traded mixed on Thursday, as the flight to safety assets triggered another steep fall in Treasury yields, with the 30-year interest rate falling to new record lows.

Dow Secures Modest Gains

Wall Street’s major indexes moderated Thursday afternoon, as the Dow Jones Industrial Average edged up 45.07 points, or 0.18%, to 26,524.49. The blue-chip index was up by as much as 133 points.

The broad S&P 500 Index of large-cap stocks advanced 0.24% to 2,847.44. Gains were mainly concentrated in consumer staples and utilities stocks. On the opposite side of the ledger, energy, industrials, and information technology companies fell sharply.

Sliding technology shares weighed on the Nasdaq Composite Index, which fell 0.1% to 7,767.87.

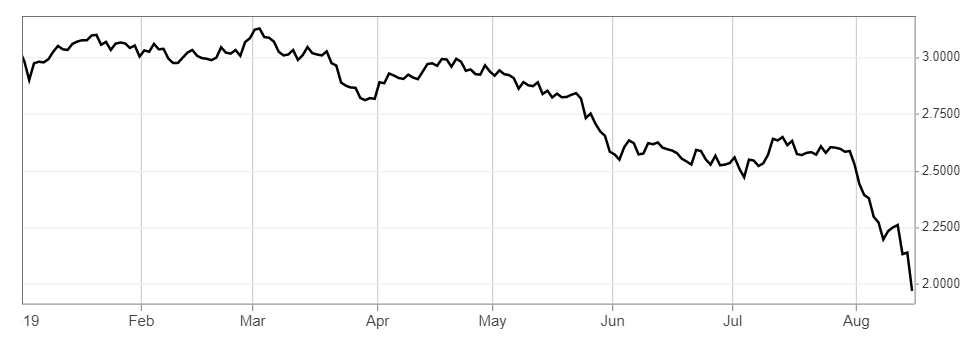

30-Year Treasury Bond Yields Plummet Below 2%

Long-term bond yields plunged to historic lows on Thursday, as investors continued to pile into the perceived safety of U.S. Treasurys. The 30-year U.S. Treasury yield fell to a low of 1.920%, according to CNBC. It was last down 6 basis points to 1.966%.

The benchmark 10-year U.S. Treasury yield broke below 1.5% on Thursday for the first time in three years.

Bond markets flashed a recession warning on Wednesday after interest rates on 10-year and 2-year Treasurys inverted for only the sixth time since 1978. Every recession for the past 50 years has been preceded by a yield curve inversion that occurred an average of 22 months before the economy contracted.

Click here for a real-time Dow Jones Industrial Average chart.