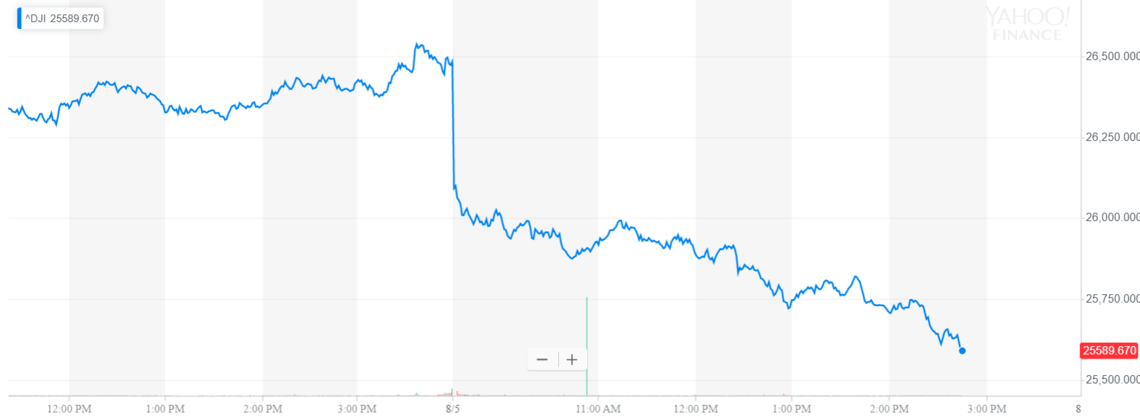

Dow Plunges 890 Points as Market Volatility Spikes to Crisis Levels

The Dow crashed nearly 900 points as stock market volatility broached its most feverish level since the Eurozone debt crisis. | Source: REUTERS / Shannon Stapleton

The Dow and broader U.S. stock market hastened their declines Monday, with intraday volatility reaching its highest level in nearly eight years after the People’s Bank of China effectively weaponized its exchange rate. The flight from risk benefited bitcoin, which is closely mirroring other haven investments over the past week.

Dow Collapses; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes headed for brutal losses, mirroring an extremely volatile pre-market for Dow futures. The blue-chip index sold off 890 points, or 3.4%, to 25,594.22.

The broad S&P 500 Index of large-cap stocks fell 3.3% to 2,834.46, with all 11 sectors reporting losses. Information technology was the worst performer, falling 4.5% as a sector. Five other sectors declined 3% or more.

Plunging tech shares ravaged the Nasdaq Composite Index, which dropped 3.9% to 7,694.47.

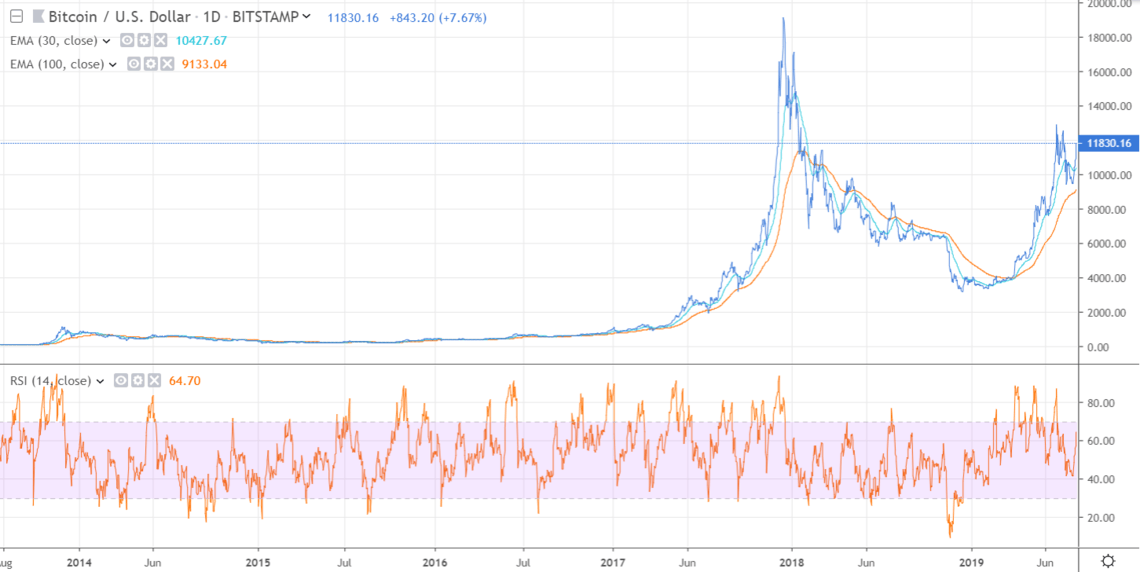

Stock Market Volatility Benefits Bitcoin

Monday’s stock-market selloff was one of the largest in recent memory and produced volatility that rivals some of the biggest meltdowns since the financial crisis.

The CBOE Volatility Index – a measure of implied volatility over the next 30 days – peaked at 36.20 on Monday. That represents an intraday gain of 105.5%. Had that level held, it would have marked the highest close since September 2011 when the Eurozone debt crisis was unfolding.

As of 3:00 p.m. ET, VIX was up 35.89% at 23.93, which is right around the historic average.

The flight from risk benefited traditional haven investments like gold and U.S. government debt. Perhaps unsurprisingly, bitcoin also behaved like “digital gold” as its value surged nearly 9% to $11,959.36 on Bitstamp.

Bitcoin has attracted higher bids ever since the Federal Reserve slashed interest rates last Wednesday for the first time in over a decade.

It continued to outperform the financial markets after President Trump escalated his tariff war against China last week.

Now, its market cap is up $15 billion since the People’s Bank of China decided to let the yuan slide to 11-year lows against the dollar.

Click here for a real-time Dow Jones Industrial Average chart.