Bitmain is Hodling Nearly $600 Million in Bitcoin Cash

TSMC, which supplies chips to bitcoin mining giant Bitmain, said crypto-related demand plunged in 2018. | Source: Shutterstock

When Bitmain announced last year that it was throwing its weight behind bitcoin cash ahead of the latter’s decision to pursue a divorce from the main BTC network due to irreconcilable differences over blockchain scaling, the cryptocurrency mining giant put its money where CEO Jihan Wu’s mouth was.

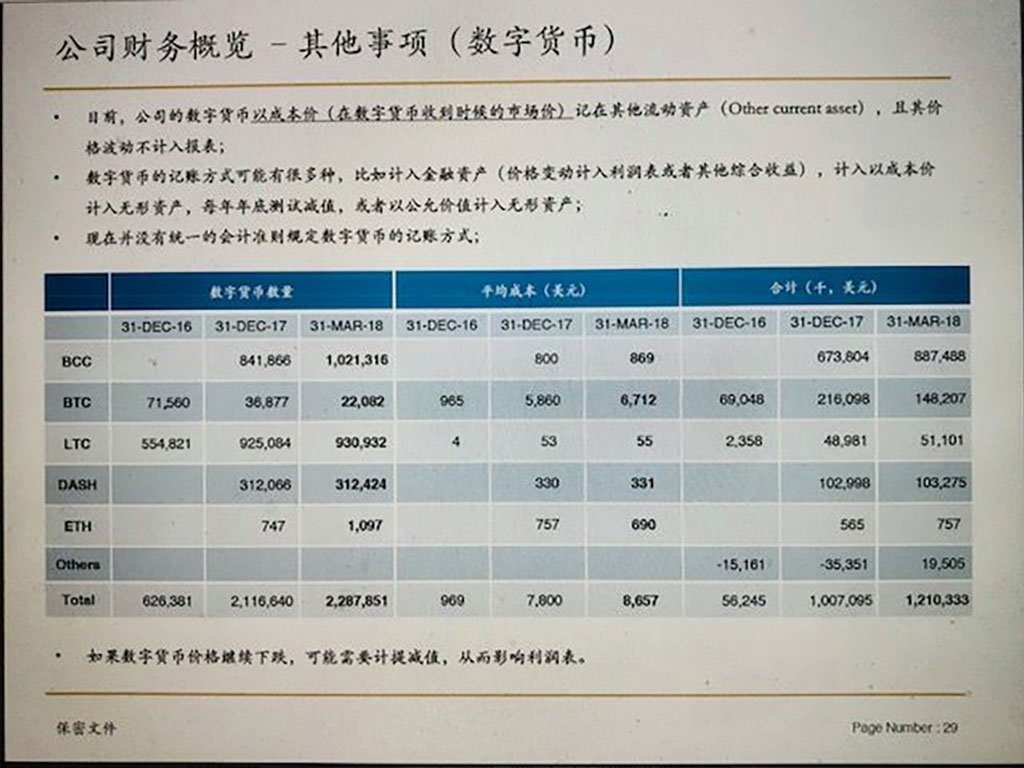

Leaked documents from Bitmain’s pre-IPO investor deck show that, as of March 31, the China-based firm was holding more than 1 million bitcoin cash (BCH) on its balance sheet, worth nearly $600 million at the present exchange rate — but down nearly $300 million from when the data in the investor deck was published.

Perhaps more significantly, that stake represents more than 5 percent of the 17.3 million BCH currently in circulation and 12.5 percent of the 8.4 million BCH that have been moved since the Aug. 2017 hard fork.

Estimates vary on how much bitcoin cash Bitmain is holding now, nearly five months after the latest data published in the investor deck. However, data from the bitcoin cash “rich list” indicates that the figure is between 664,000 and 1.33 million.

Notably, Bitmain appears to be methodically liquidating its BTC holdings, even as it deepens its stake in bitcoin cash. Bitmain had about 22,000 bitcoins at the end of March, down from more than 71,500 in Dec. 2016. This does not necessarily mean that Bitmain is trading BTC directly for BCH, but it does suggest that it is selling bitcoin to cover the expenses associated with its acquisition of BCH through other means, such as mining and ASIC sales.

Either way, this data suggests that at least until recently and possibly including the present, Bitmain has been supporting bitcoin cash by eating the cost of its BCH-related operations and hodling the coin even amidst a steep market downturn.

Even so, the bitcoin cash price has experienced a sharp decline throughout 2018, not only against the dollar but also against BTC. Since Jan. 1, BCH/BTC has dropped by approximately 50 percent, to 0.09 from 0.18. Given the low level of liquidity in the cryptocurrency market, it’s unlikely that Bitmain could liquidate its BCH holdings, even if it wanted to.

That’s particularly significant since, as CCN.com reported, Bitmain is gearing up to go public, potentially raising $18 billion in what could be one of the largest IPOs ever. If the firm raises that full amount, it could achieve a market cap of $50 billion or more.

Bitmain reportedly expects to rake in more than $10 billion in revenue during 2018, up from $2.5 billion last year. However, if the current bear market does not turn a corner before the company files to go public, its BCH stake could begin to weigh heavily on its profit figures and possibly turn off some investors.

Featured Image from Shutterstock