$225 Billion Abu Dhabi State Fund Dumps 35 Million AMD Shares for Cash – Has the Chipmaker Hit a Market Top?

Abu Dhabi's wealth fund has monetized its majority of its holdings in US chipmaker AMD. | Source: Shutterstock.

Sovereign wealth fund Mubadala Investment Co has announced the sale of nearly 35 million shares in semiconductor firm Advanced Micro Devices (AMD).

According to Reuters , the state fund of Abu Dhabi disposed of 34.9 million common equity shares in AMD. Mubadala also intends to convert 75 million warrants in the chipmaker into common equity shares. After the conversion Mubadala will have an ownership stake of around 6.9%. The chipmaker will benefit from the conversion to the tune of $448.5 million.

Per a spokesperson, Mubadala’s decision to sell part of its stake in AMD was driven by its investment strategy. This strategy, the spokesperson pointed out, is ‘to monetize mature holdings to deliver attractive commercial returns’.

Mubadala has been Holding AMD Shares for Over a Decade

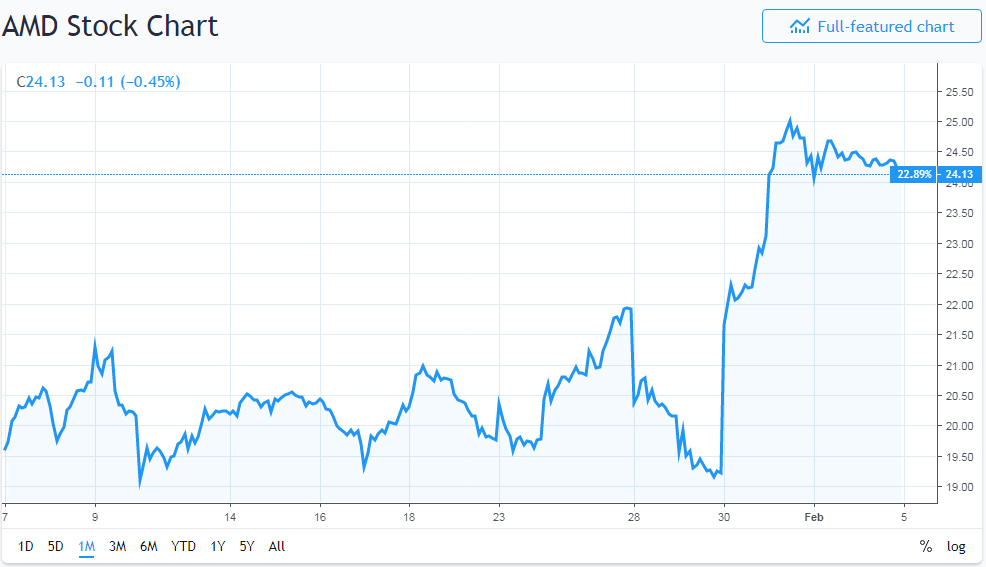

The sovereign wealth fund’s initial investment in AMD was made in 2007. At the time the stock was hovering below $20. While Mubadala did not reveal the sale price it could have netted more than $840 million. This is based on the closing price of $24.13 recorded on Monday.

The sale of the shares comes about a week since AMD announced its Q4 and full year results. Revenue for the chipmaker grew by 23% year-over-year to reach a figure of $6.48 billion. Operating income also increased year-over-year to $451 million from $127 million. While in 2017 AMD recorded earnings per share of negative $0.03, the EPS improved in 2018 to $0.32.

The president and CEO of Advanced Micro Devices, Dr. Lisa Su, attributed the impressive results to the company’s ‘high-performance’ products:

In 2018 we delivered our second straight year of significant revenue growth, market share gains, expanded gross margin and improved profitability based on our high-performance products. Importantly, we more than doubled our EPYC processor shipments sequentially and delivered record GPU datacenter revenue in the quarter.

AMD Shares Rally After Impressive Results

Shares of AMD rallied from around $19 to above $22 after the results were announced. While Mubadala’s sale of AMD shares could have been long planned it is interesting that it came after the rally. It could also suggest that Mubadala doesn’t think the share has much room for growth in the near-term. To be fair, AMD is also not particularly optimistic about the short-term, either.

While releasing its most recent results AMD indicated that it expects revenues to fall in 2019’s first quarter. This is because of the seasonal nature of demand for the company’s products. Additionally, Advanced Micro Devices is expecting demand for graphics chips to be soft. Notably, the cryptocurrency bear market continues to impact the chipmaker’s revenues:

The year-over-year decrease is expected to be primarily driven by lower graphics sales due to excess channel inventory, the absence of blockchain-related GPU revenue and lower memory sales.

Crypto Winter has Softened Demand for AMD’s Chips

This, however, was not entirely unexpected as AMD had projected this last year. In July during an earnings call, AMD reported a quarterly decline which it attributed to softness in the ‘blockchain market’.

Just a quarter prior, the opposite was the case with the chipmaker attributing 10% of its revenues to the blockchain and cryptocurrency sector.