What If the Housing Market Recovery Isn’t V-Shaped After All?

Today’s MBA report confirms the warning that low mortgage rates alone won’t keep demand at feverish levels. | Source: AP Photo/Elaine Thompson

- A leading indicator of housing market demand fell for a second straight week.

- The number of homeowners in forbearance has also begun to climb again.

- Is the U.S. housing market recovery starting to fizzle out?

Everything was going so smoothly for the U.S. housing market. Purchase demand had spiked to 11-year highs. Pending sales had recorded their largest monthly increase ever. And the number of homeowners in “mortgage bailout” programs had finally begun to shrink.

In short, nearly every indicator pointed to a V-shaped recovery.

And yet, the outlook for the real estate sector has suddenly begun to grow a bit cloudier. Housing market data analyst Logan Mohtashami warns that the “V” is at risk of slipping into a “W” shape . And the data suggests that he has a reason to be concerned.

Housing Market Demand Gauge Slides Again

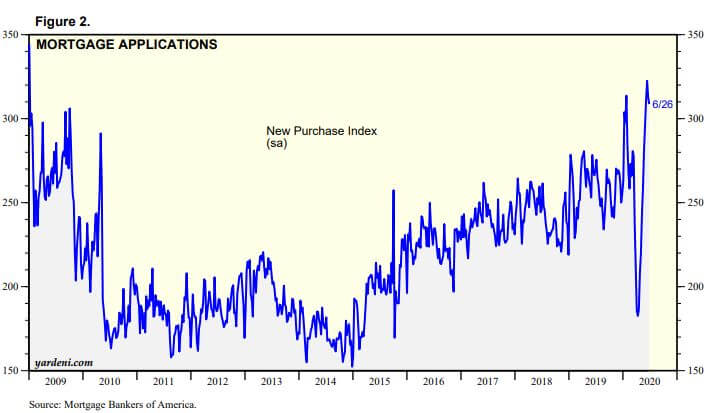

According to the Mortgage Bankers Association (MBA), mortgage applications fell across the board last week. The seasonally-adjusted Purchase Index declined 1%, its second straight pullback.

MBA economist Joel Kan says it’s a potential indication that pent-up demand has begun to wane:

After two months of strong growth, purchase applications declined for the second week in a row. The weakening in activity is potentially a signal that pent-up demand is starting to wane and that low housing supply is limiting prospective buyers’ options.

Granted, the pullback was small, and purchase application volume remains 15% higher than the same period in 2019.

And besides, after surging to an 11-year high in June, it was inevitable that the index’s streak of nine consecutive weekly gains had to end sometime.

Financial Stress Spike Has One Analyst Worried

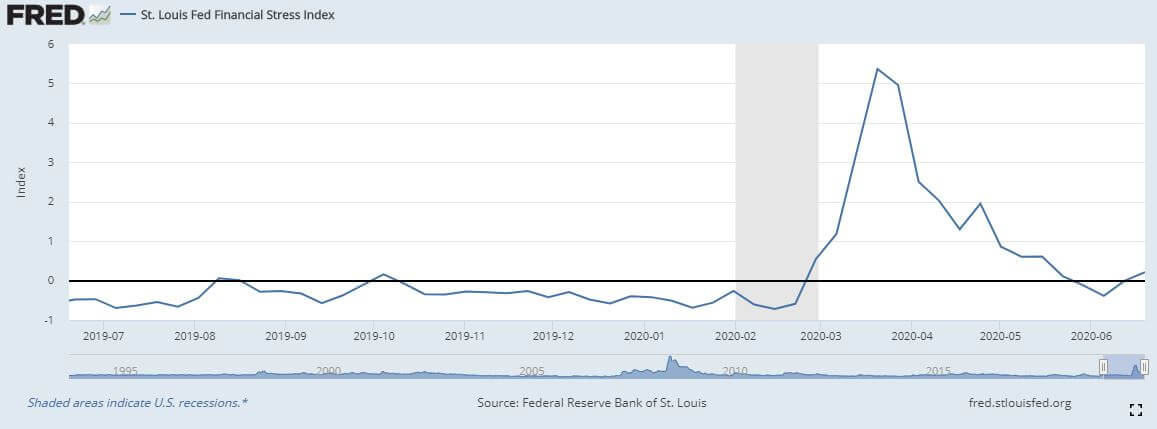

Still, it suggests that the housing market is not impervious to weakness in the broader economy. It’s also concerning that the two-week drop in purchase application volume correlated with a two-week uptick in the St. Louis Financial Stress Index .

Mohtashami warns that if this trend continues, it could put the “V-shaped recovery in housing… in jeopardy”:

If fear of the virus prevents buyers from looking and sellers from putting homes on the market, our V-shaped recovery in housing could be in jeopardy. Our good demographics and low-interest rates mean we should have baked-in demand for housing. But this demand can be quashed by buyer and seller fear.

He explains financial stress tends to spiral quickly once it hits a certain level. And this loss of confidence presents a two-pronged threat to housing market demand.

On the one hand, it dissuades consumers from making life-altering financial decisions like purchasing a home. On the other, it encourages lenders to tighten credit standards, making it more difficult for consumers who do want to buy a home to obtain financing.

Indeed, today’s MBA report confirms the warning that low mortgage rates alone won’t keep demand at feverish levels. Rates dropped to record lows last week – an average of 3.29% for a conventional 30-year fixed rate loan – but application volume still declined.

Home Prices Are Rising as Demand Ticks Lower

That’s not the only bad news.

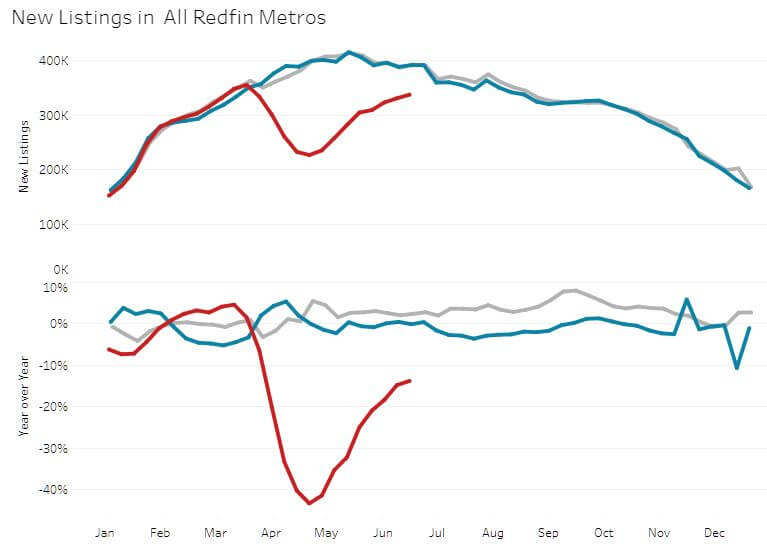

Tight supply is causing price growth to accelerate even faster than before the pandemic. Research from Realtor.com found that inventories are down approximately 30% year-over-year , while prices are growing at 6.2% annually.

That’s a trend Joel Kan highlighted in today’s mortgage application data release:

The average purchase application loan size increased to a record high in our survey – more proof that tight inventory conditions are leading to faster price growth.

With wage growth at risk of falling to “the worst [rate] in recorded history,” a growing number of Americans could find themselves priced out of the housing market.

Bankrate: Housing Market Faces Potential Default Wave in 2021

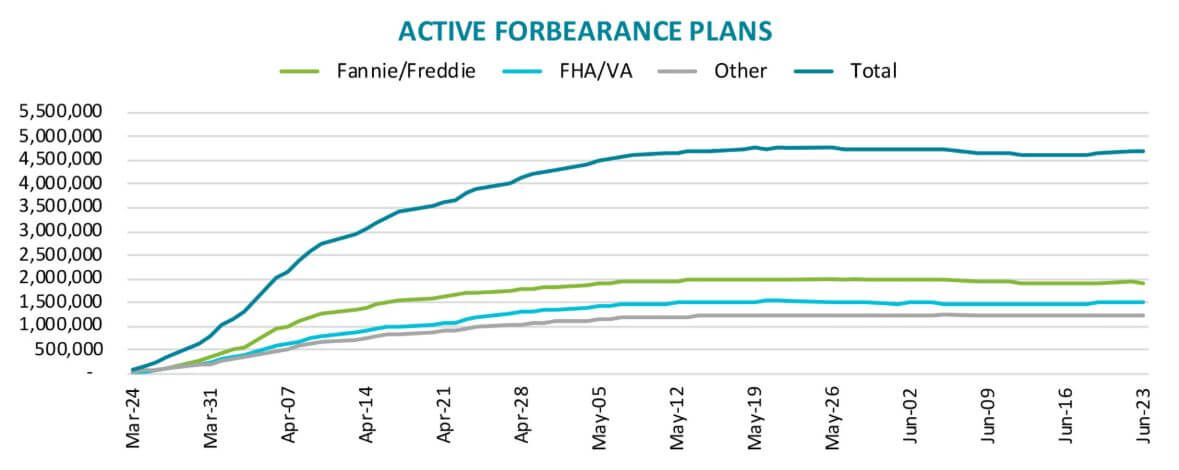

And the hits keep on coming. After appearing to peak in May, the number of active mortgage forbearance plans is on the rise again.

Last week, data firm Black Knight reported that 79,000 more homeowners had entered forbearance , lifting the running total to 4.68 million – or 8.8% of all active mortgages.

Those mortgages collectively represent more than $1 trillion in unpaid principal.

Worse still, many homeowners who nervously entered forbearance plans in March and April continued paying on time anyway. That trend has begun to shift, with the “vast majority” no longer making payments . (And this shift has come before enhanced unemployment benefits expire at the end of July.)

To be sure, that’s not something that’s likely to manifest in the consumer side of the real estate sector within the immediate future. But Bankrate chief financial analyst Greg McBride says it’s worth monitoring closely as the housing market enters 2021.

States experiencing high unemployment will see mortgage delinquencies surge if unemployment remains elevated as forbearance periods expire.

This year may see the worst for unemployment, but 2021 will likely bring the worst for mortgage delinquencies and defaults.

Of course, 2021 is still a long way away. Plenty can happen before then to stave off a genuine delinquency crisis.

But if the euphoria from the housing market’s initial rebound continues to fizzle, more analysts could soon find themselves wrestling with a disconcerting question.

What if the recovery isn’t V-shaped after all?