Warren Buffett Is Making a Mistake Buying Dominion Energy’s Natural Gas Assets

Warren Buffett is doubling down on natural gas at a time when more segments of the economy are shifting to renewable energy. | Image: Zach Gibson/Getty Images/AFP

- Berkshire Hathaway’s $10 billion deal in natural gas assets barely scratches the surface of its cash reserves.

- Warren Buffett’s investing giant now remains with nearly $130 billion in cash.

- The purchase of Dominion Energy’s assets will more than double Berkshire’s footprint in natural gas transmission and storage.

Berkshire Hathaway’s (NYSE:BRK.A) first significant purchase since March has thrown the investing conglomerate deeper into the energy business. The Warren Buffett-led firm will acquire Dominion Energy’s (NYSE:D) natural gas transmission and storage assets for $9.7 billion. The sum is a fraction of Berkshire’s nearly $130 billion in cash on hand.

The deal will now see Berkshire transmitting 18% of all the natural gas in the U.S. Previously, the figure was 8%.

The Dominion Energy deal will assuage some Berkshire investors’ concerns over its huge cash pile. In an age where more and more investments in the energy sector are going into renewables, Buffett is blundering.

Here are three reasons why.

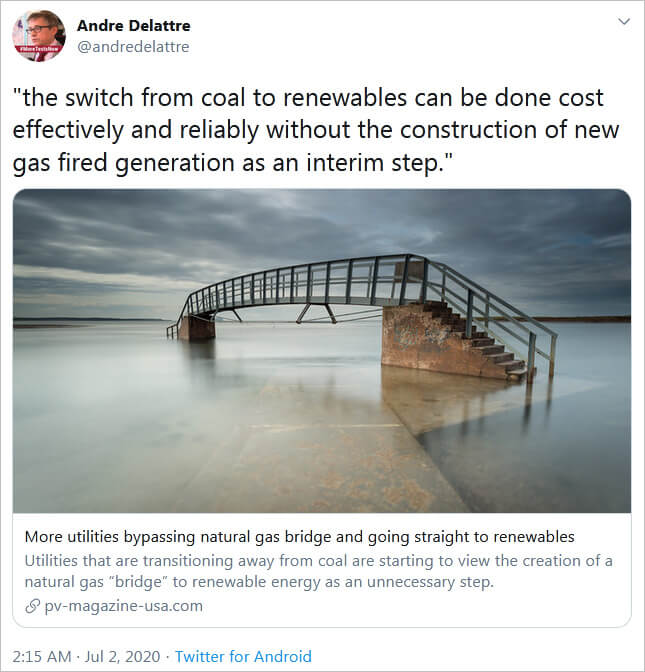

1. Natural gas no longer a “bridge fuel”

Natural gas was once considered the bridge fuel to renewable energy. This raised the prospect of demand growing heavily. That’s changing as utilities transition from coal-generated power straight to energy produced by renewables.

Utilities in Florida, Colorado, and Arizona are closing coal plants and building renewable energy generation facilities without first building natural-gas facilities. The New Mexico Public Regulation Commission has recommended bypassing gas and going straight to renewables.

This has come about with the improved performance of renewables, as well as falling prices for wind and solar energy equipment. Declining battery storage costs have helped too.

These developments will reduce natural gas use, which could impact Berkshire’s Dominion acquisition.

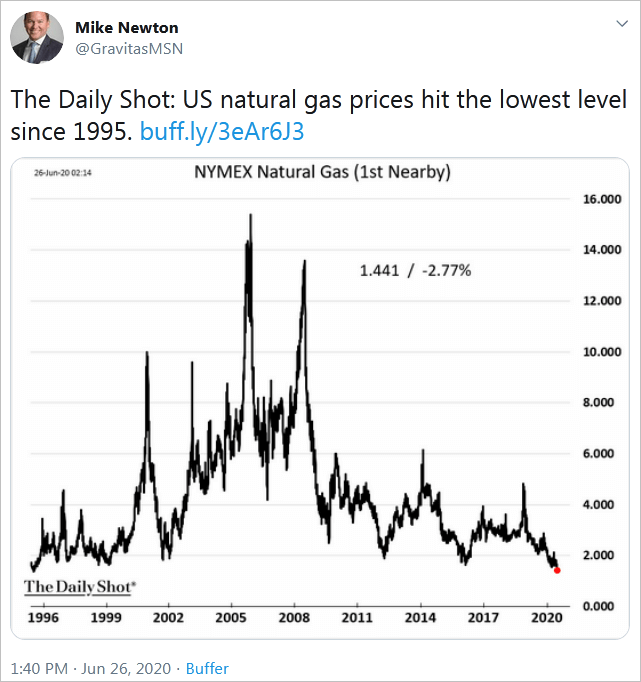

2. Warren Buffett buys natural gas assets while the commodity’s price falls

Last month, the price of U.S. natural gas hit the lowest level since 1995 .

At a time when global consumption of natural gas is expected to fall by record levels, prices are set to decline further. According to the International Energy Agency, global natural gas demand will decline by 4% this year . The previous record fall was in 2009 when demand declined by 2%.

The demand destruction will place pressure on producers to cut costs. This will impact the margins that providers of transportation and storage facilities such as Berkshire Hathaway enjoy.

3. Scrutiny toward Berkshire’s nonchalant attitude towards climate change

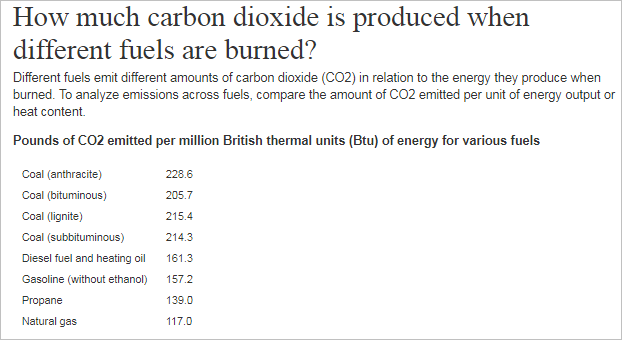

Natural gas is the cleanest of fossil fuels, but it is still responsible for global warming emissions. When combusted in an efficient plant, natural gas emits between 50% and 60% less carbon dioxide compared to coal or oil.

But natural gas production and its transportation via pipelines result in methane leakages. Methane is 34 times stronger than carbon dioxide in trapping heat.

Warren Buffett told Berkshire Hathaway shareholders four years ago that climate change shouldn’t be on their “list of worries.”

Buffett’s sidekick Charlie Munger has been less subtle. In 2015, he expressed skepticism over climate change warnings , saying,

I think there’s a lot of guesswork in that field.

The purchase of Dominion Energy’s natural gas assets is likely to heighten the criticism of Berkshire Hathaway’s climate change stance.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.