Housing Market Completes Comeback With Pending Home Sales – or Has It?

Pending home sales surged in July, but affordability challenges are growing each month as inventory plummets. | Image: AP Photo/Gene J. Puskar, File

- Demand for homes is high, as shown by strong growth in pending home sales.

- Low inventory could hinder further sales growth.

- It has never been more expensive to buy a home in the US.

The U.S. housing market shows no sign of slowing this summer. Buyers continue to show strong demand as mortgage rates are at record lows and Americans express a desire to move to the suburbs. Potential buyers missed most of the spring buying season due to the lockdown measures induced by the pandemic.

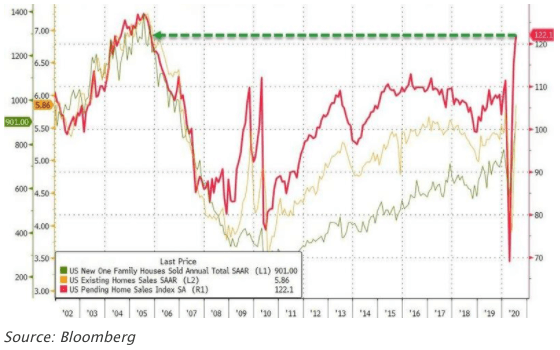

Pending Home Sales Rise 5.9% in July

According to the National Association of Realtors , pending home sales, which measure contracts signed to buy existing homes, rose 5.9% in July. Watch the video below.

Sales grew 15.5% year over year, the biggest annual jump since October 2012.

Pending home sales increased in all parts of the country, led by a 25.2% gain in the Northeast.

Lawrence Yun, NAR’s chief economist, said:

We are witnessing a true V-shaped sales recovery as homebuyers continue their strong return to the housing market. Home sellers are seeing their homes go under contract in record time, with nine new contracts for every 10 new listings.

According to Yun, there is no indication that contract activity will decrease in the immediate future, especially in the suburbs. He expects existing-home sales to rise to 5.8 million in the second half of the year. This expected rebound would bring the annual level of existing-home sales to 5.4 million, a gain of 1.1% from 2019.

Yun predicts that existing home sales will reach 5.86 million in 2021, supported by a rebounding economy and low-interest-rate environment, with an average 30-year mortgage rate of 3.2%.

The Housing Market Has Headwinds

The housing market has a significant headwind that will keep sales volumes from reaching record highs: a shortage of homes available for sale.

Coldwell Banker Real Estate CEO says that low home inventory is concerning. Watch the video below.

Inventory at the end of July was down 21% annually, the lowest supply ever recorded by the NAR since it started tracking this metric in 1982. Buyers cannot buy what’s not for sale.

Anecdotally, Realtors® are telling me there is no shortage of clients or home seekers, but that scarce inventory remains a problem. If 20% more homes were on the market, we would have 20% more sales, because demand is that high.

Unless more people put their homes on the market, the country’s home inventory will limit the growth in sales volumes for the foreseeable future.

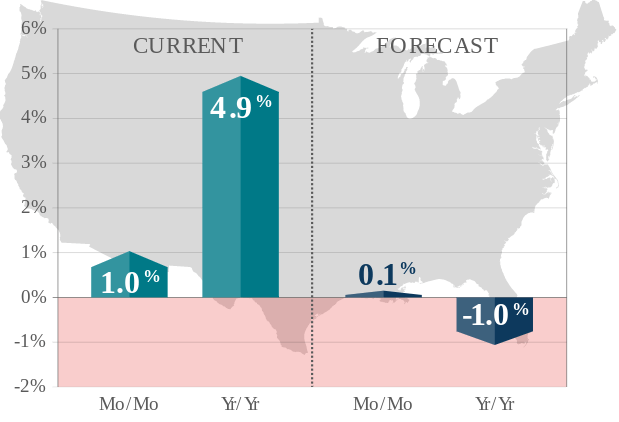

Home prices continue to rise due to stiff competition in the market. In July, the median home price hit a record high of $304,100 , as measured by closed sales.

Homebuying demand could slow down if prices continue to increase. With tightening lending criteria, it’s getting harder to get a mortgage. As unemployment will remain high for a long time, fewer people will be able to afford a home.

CoreLogic expects nationwide home prices to decrease by 1% on a year-over-year basis from June 2020 to June 2021. 2021 would be the first year home prices are expected to decline in more than nine years.

Millennials would welcome a drop in home prices as it would allow them to enter the housing market.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.