U.S. Treasury Yields Plunge This Week as Volatility Returns

After recording one of their biggest weekly rises in years, U.S. Treasury yields declined sharply this week. | Image: Scott Olson/Getty Images/AFP

U.S. government debt yields declined on Friday, extending their weeklong slide as investors continued to assess monetary policy and upcoming trade talks between Washington and Beijing.

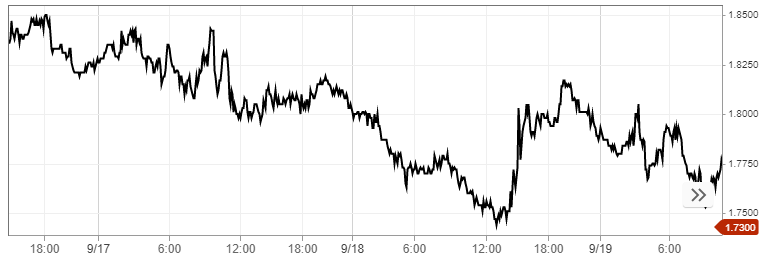

Treasury Yields Fall

The price of U.S. government bonds rose Friday, pushing yields down. The yield on the benchmark 10-year U.S. Treasury reached a session low of 1.73%, having declined as much as 17 basis points from last Friday’s close. It was last seen trading right around its session lows, according to CNBC data.

The yield on the 2-year Treasury note fell 4 basis points to 1.697%. The 30-year note was also down 4 basis points to 2.169%.

The sharp reversal in bond yields has taken place in lockstep with rising volatility on Wall Street. The CBOE Volatility Index, commonly known as the VIX, peaked near 16.00 on Friday, having gained as much as 12.7% during the session. The so-called “investor fear index” usually rises when stocks fall.

U.S.-China Trade Tensions in the Spotlight Again

Those hoping for a swift resolution to the U.S.-China trade war were disappointed to learn that Beijing’s top negotiators will cut their forthcoming trip to the United States short.

As CNBC reported , Chinese officials have changed their travel schedule to head back home earlier than planned, forgoing a trip to Nebraska that was intended to build goodwill with American farmers. The cancellation caused some traders to reassess their optimism for a comprehensive trade agreement to come out of next month’s meetings.

Washington and Beijing have been locked in a bitter trade dispute for going on two years now, as the Trump administration looks to rewrite the rules of the game. President Trump is primarily concerned with Chinese industrial policy, the theft of intellectual property and Beijing’s huge surplus with the United States.