U.S. Futures Jump but Bill Gates Has a ‘Super Urgent’ Pandemic Warning

Billionaire philanthropist Bill Gates stressed self-isolated America is an economical disaster - that's entirely necessary. | Source: JEFF PACHOUD / AFP

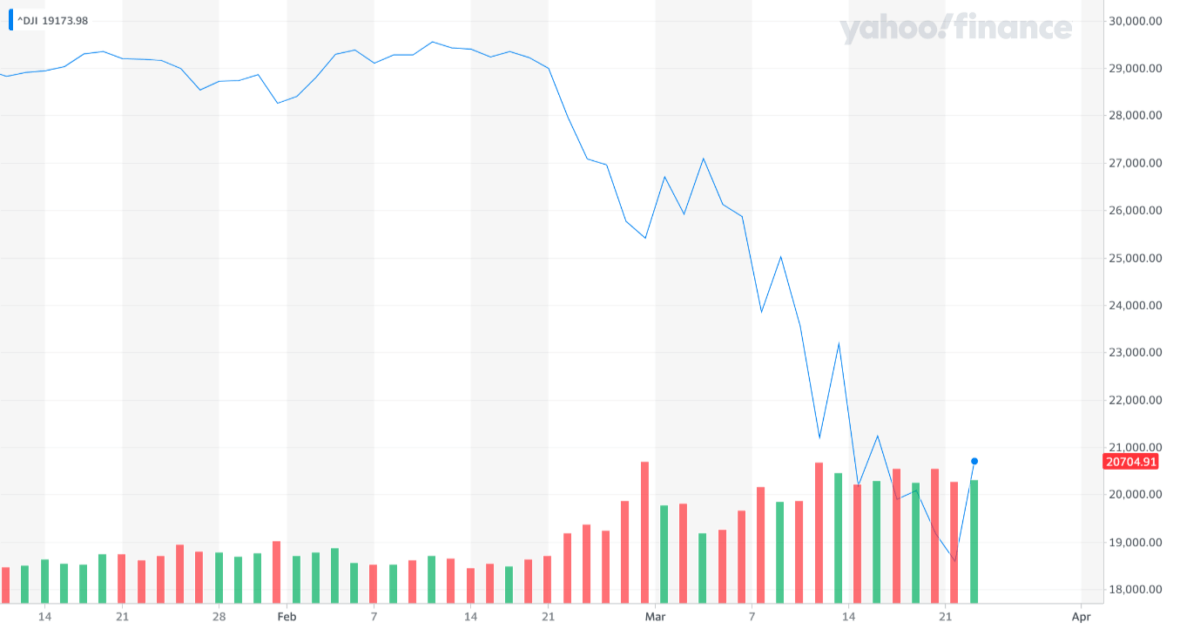

- The U.S. stock market is set for a 1.12% gain after a highly anticipated stimulus deal was agreed upon.

- The Dow Jones is up 265 points in pre-market trading, after a 2,100-point gain on Tuesday.

- But, Bill Gates warns there is not enough testing in the U.S., and rising coronavirus cases leave the stock market vulnerable to a correction.

The U.S. stock market futures is up 1.12% after Senate Democrats and Republicans reached on a highly anticipated coronavirus stimulus package. But, the markets are not showing a a response investors anticipated, as COVID-19 cases continue to surge in the U.S.

Larry Kudlow, Director of the United States National Economic Council, said the package is to reach $6 trillion and will be “the single largest main street assistance program” in the history of the U.S.

The Dow futures suggest a 230-point gain at the open, after surging by more than 11% on Tuesday upon the finalization of the deal.

The U.S. stock market cautious because coronavirus cases are rising

As of March 24, the Centers for Disease Control (CDC) officially confirmed 44,183 coronavirus cases in the U.S. And According to Worldometer, the U.S. has already surpassed 54,000 cases , adding 11,000 cases in a short period.

Despite the clear benefits of the coronavirus stimulus package on the economy and the stock market, investors are unlikely to portray growing appetite for high-risk assets until the coronavirus curve in the U.S. begins to flatten.

Billionaire Bill Gates has said that the U.S. missed its opportunity to prevent a complete shutdown of the country and to contain the virus outbreak in its early days, placing additional pressure on the U.S. stock market.

Gates warned that even now, there is not enough testing capacity to ensure that the majority of people in the U.S. receive the testing they need.

Gates stated:

In terms of testing, we’re still not creating that capacity and applying it to people in need. The testing thing has got to be organized, has got to be prioritized. That is super, super urgent.

Countries that saw success in passing the peak of coronavirus in the likes of South Korea, Vietnam and Singapore implemented a rigorous and highly efficient testing system to diagnose coronavirus patients as quickly as possible.

But, the U.S. has consistently been criticized for its impractical testing system, with some analysts predicting that widespread testing will not be ready in the immediate future.

Moreover, Balaji Srinivasan, a former Stanford professor, said that at this rate, the U.S. is projected to have the highest number of coronavirus cases over time.

Until the U.S. sees a certain level of stabilization in the new number of coronavirus cases, the stock market is likely to remain rattled by the fear and panic demonstrated by the general public.

Don’t expect a big rally anytime soon

The U.S. stock market has been showing an extreme level of volatility in the past week.

Strategists say that such unprecedented swings in the stock market does not indicate an optimistic short-term trend for stocks. A gradual increase over several weeks would be the ideal scenario for recovery for the U.S. stock market.

The dissatisfaction of investors and the general population toward how the government handled the crisis still remains strong, which would make an extended stock market recovery in the short-term all the more challenging.

Investors, including Craft Ventures partner David Sacks said that the U.S. would have not come to a $6 trillion stimulus package had it spent $100 million on masks and tests.

“The US economy is going to need over $6 trillion in bailouts because we didn’t have about $100 million in masks and tests,” said Sacks.

Now, the U.S. government is focusing on tests and has asked the advice of countries that have contained the outbreak relatively well, but it remains to be seen whether it will convince the markets of stability.