Twitter Stock Breakout Could Spark Monster Bull Run

Unlike other tech giants that have been all over the media, Twitter's stock has been flying under the radar and making some great returns for investors. | Source: REUTERS/Brendan McDermid

Twitter (TWTR) is one of those stocks that has been flying under the radar over the last two years. Unlike other tech giants that have been hogging media attention, Twitter has been quietly making gains.

The social media firm’s net income grew from -$108,063 million in 2017 to $1.206 billion in 2018. In addition, the company is following through its strong performance after surpassing earnings estimates in both the first quarter and second quarter of 2019.

As a result of growing fundamentals, the equity is up by over 50 percent year-to-date. A look at the technicals show that Twitter is just warming up.

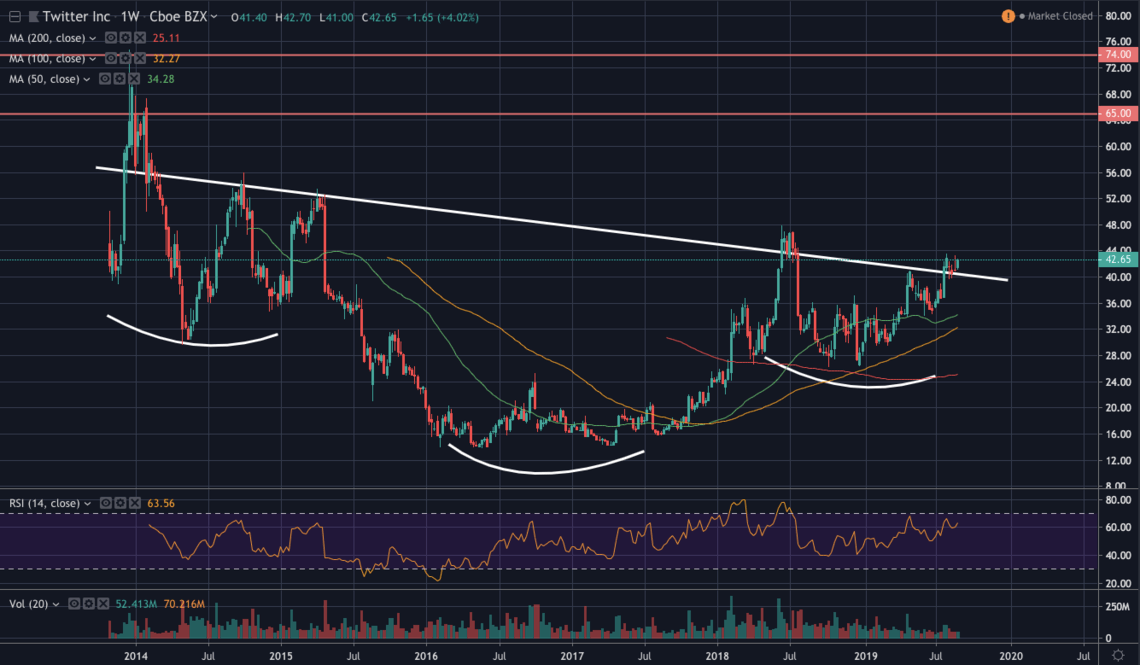

This Stock Powers Through to End Five-Year Downtrend

Not long after its IPO in November 2013, Twitter descended into bear territory. The stock plunged while its peers such as Facebook (FB) went into a steady uptrend. In May 2016, TWTR posted an all-time low of $13.73. That’s a massive devaluation of over 81 percent from the top of $74.73.

Nevertheless, the worst appears to be behind the stock. For the first time since its IPO, the equity has made a bullish breakout to technically conclude its five-year bear market.

A quick look at the weekly chart reveals that TWTR took out the diagonal resistance of $40. This triggered the breakout from a massive inverse head-and-shoulders reversal pattern. The breakout marks the beginning of the stock’s technical uptrend.

Based on the height of the pattern, the immediate target of the breakout is $65. Above that, $74 is next.

Analyst: TWTR Is ‘My Top Pick’ as It Is ‘Undervalued Compared to Its Peers’

The owner of LaDuc Trading , Samantha LaDuc , spoke to CCN.com and shared her thoughts on TWTR. The trader said:

“Not only is the technical chart pattern bullish for TWTR – rising 200% from 2017 but still 40% below all-time-highs – the monetizable user growth along with fundamental EPS and cash flow growth metrics make for a compelling long-term play.”

Todd Butterfield , the owner of the Wyckoff Stock Market Institute , also supports our view. He told CCN.com:

“Twitter has jumped a minor creek and successfully backed up to that creek. Recently, TWTR has also been showing outperformance versus the QQQ during August. We think TWTR will now lead us higher from here.”

From both the fundamental and technical perspectives, it appears that TWTR is a solid pick for long-term investors. This is the case even though Jack Dorsey’s Twitter account was recently hacked.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.