Trump’s Toothless China Bite is All Bark This Stock Market: UBS

U.S.-China tensions are coming to the fore again - but is it a market risk in the year of a recession and an election . | Source: AP Photo/ Jacquelyn Martin File

- UBS does not believe President Trump will push China to the brink of a cold war.

- Morgan Stanley similarly said the Trump administration will want to focus on economic growth ahead of re-election.

- The U.S. stock market will benefit from fewer geopolitical risks in the medium to long-term.

Top European bank UBS does not believe U.S. President Donald Trump will push China to the brink of a “cold war “, playing down fears of an escalating conflict that threatens the stock rally.

Kelvin Tay, UBS Global Wealth Management’s regional chief investment officer, said :

We don’t think the ratcheting up of U.S.-China tensions will be a risk simply because this is (an election) year and the U.S. is in a recession.

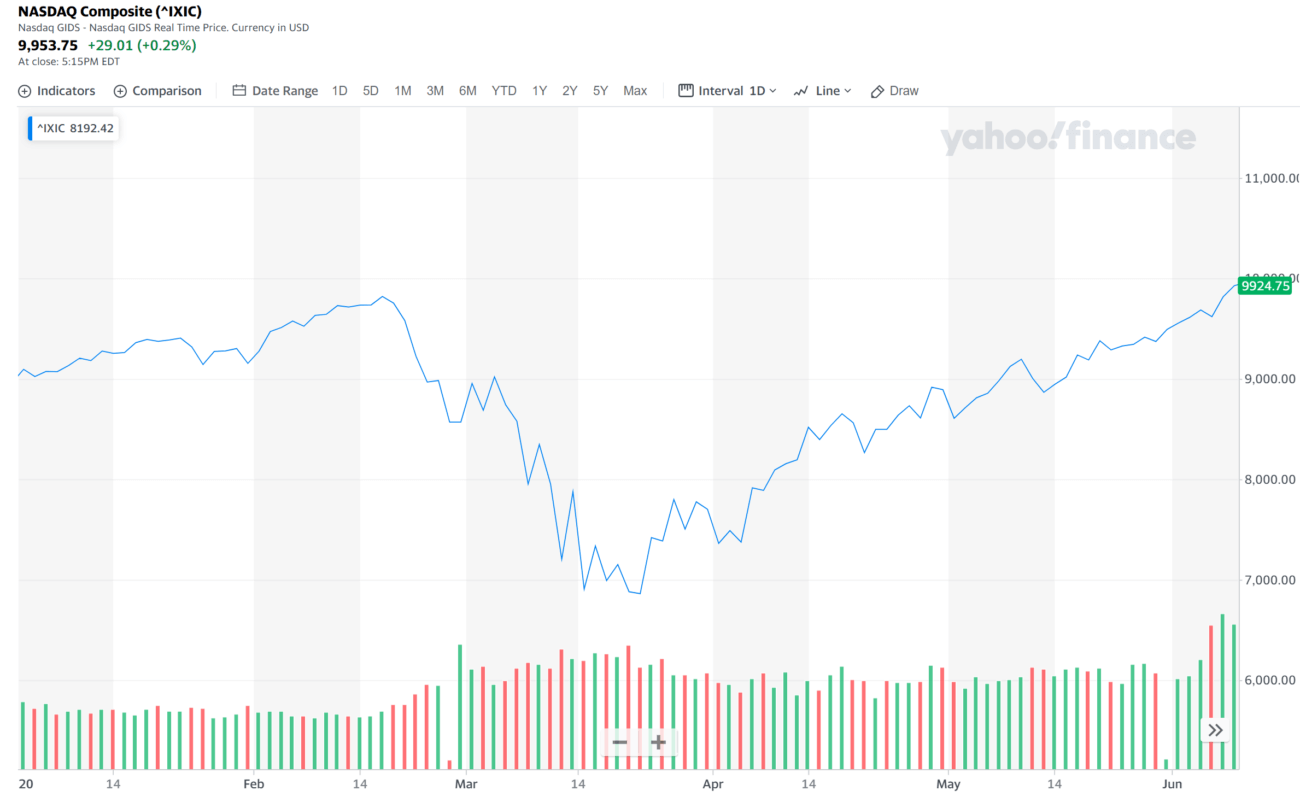

The Nasdaq achieved a new its all-time high on June 9, rising to as high as 10,000 points.

The trend of the stock market shows investors did not consider U.S.-China relations as much of a threat to begin with.

Optimistic projections on the relationship between the two superpowers can recover the confidence of institutional investors in equities.

How Will the Stock Market React?

Economists state that a cold war between the U.S. and China will cause economic redundancies.

Dan Ikenson, Cato Institute’s director of the Herbert A. Stiefel Center for Trade Policy Studies, said :

Many economic redundancies will emerge as the United States and China replicate efforts.

Both nations will offer “threatening sticks” to countries that refuse to be their allies. Such an environment would hinder global economic growth and stability.

In a tense environment equipped with tariffs on exports and restrictions on companies, the U.S. stock market will struggle to maintain upward momentum.

Airlines, travel companies, manufacturers, farms, and semiconductor firms will run into difficulties in dealing with their international consumer base.

In 2015, for instance, China sent 2,028 flights per week to the U.S. and U.S. airlines sent 1,853 flights every week to China.

If the dispute between the U.S. and China escalate to a cold war status, major sectors like the airline industry may crumble.

For Trump, taking such an immense economic risk right before the Presidential election in November is not ideal.

Similarly, Morgan Stanley previously said that it is not in the interest of the U.S. to reinvoke a trade war with China.

Instead, major financial institutions generally believe that the Trump administration will focus on economic recovery and jobs market expansion.

Any action that the U.S. takes will be “largely be symbolic rather than on the tariff front,” Tay emphasized.

Asia Stocks React to Optimistic Projections

Stock market indices in Asia such as Japan’s Nikkei 225 and South Korea’s Kospi are both on the rise.

The predictions of UBS and Morgan Stanley that the U.S.-China tensions will be short-lived are affecting the confidence of investors heading into the third quarter of 2020.

The U.S. stock market has even better conditions than Asia to continue its bull run.

Businesses are benefiting from relaxed financial conditions, the Fed funds rate is at near-zero, and the government is preparing another round of a trillion-dollar stimulus.

The European Central Bank’s (ECB) intent to pursue additional stimulus despite a rejection from Germany could pressure the Federal Reserve to continue providing more liquidity in the near-term.