This Stock Is Up by Over 40% and Likely Has More Upside Potential

You probably never heard of Axon Enterprise Inc. (AAXN). However, in this article are some reasons why you should keep track of this stock. | Source: Shutterstock

Axon Enterprise Inc. (AAXN) is probably a company that you’ve never heard of. However, we’re about to give you some reasons why you should keep track of this stock.

The security company manufactures and sells conducted electrical weapons (popularly known as tasers) for use by law enforcement, military, security contractors, and private citizens. The ability of Axon’s products to protect its users by immobilizing assailants has sparked global demand.

For the second quarter of 2019, the company generated a top line of $99 million, which reflects 25 percent growth year-over-year. According to StreetInsider , international revenues were a huge contributor to the company’s growth as demand skyrocketed in Canada, Australia, France, and the U.K.

As a result, investors are taking notice. AAXN is up by 41.8 percent year-to-date and the stock is poised to continue performing well in the coming months.

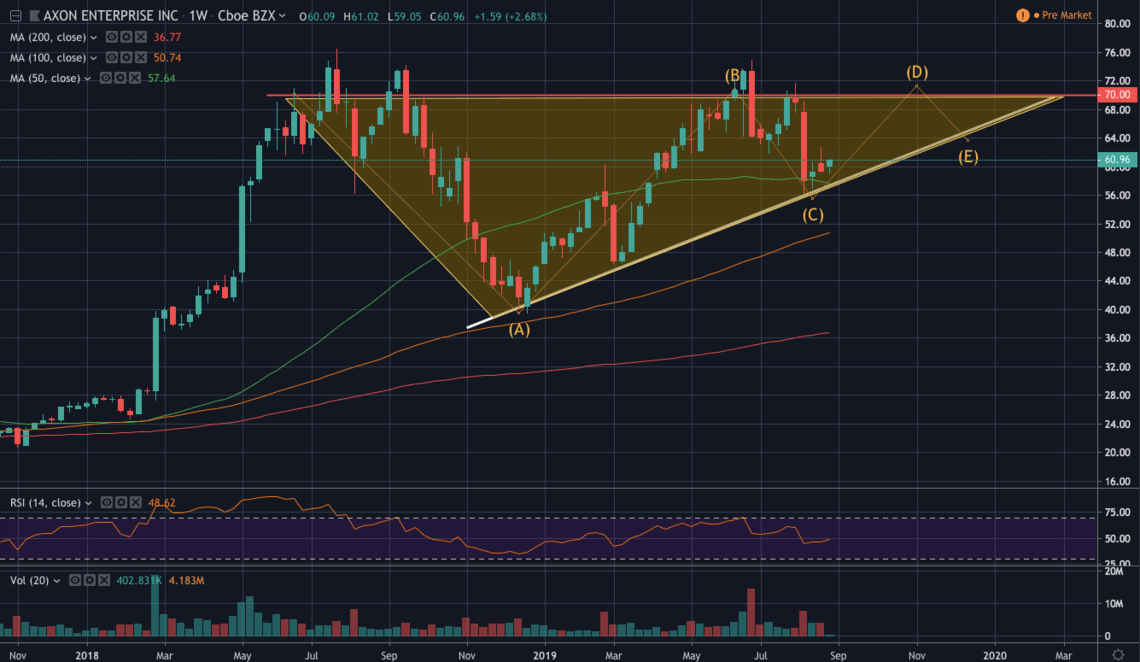

Axon Stock Painting a Large Bullish Continuation Pattern

AAXN has been struggling to take out resistance of $70 since July 2018. However, we think it could be only a matter of time before the bulls finally breach the resistance.

A quick look at the weekly chart reveals that the stock is printing a large ascending triangle pattern. This is a continuation pattern telling us that AAXN is likely to resume its strong uptrend once it takes out the neckline of $70.

Recently, the stock bounced from its diagonal support to generate another bullish higher low. It also helped that the 50-week moving average acted as support. Trader Common King also noticed the technical bounce:

With the stock respecting its diagonal support, it is likely that AAXN will tap resistance of $70 in the coming weeks. After that, it may be due for one more leg down before breaking out of the pattern and resuming its uptrend.

Axon’s Fundamentals Look Healthy

Axon investors won’t have to worry about insolvency issues. According to Yahoo! , the security company is debt-free. It relies 100 percent on equity financing to run operations and fund expansion projects. On top of that, Axon has over $558 million in assets to cover short-term commitments amounting to $166 million.

It also helps that Axon has no direct competitor. Motley Fool writer Brian Feroldi shared this observation in a tweet:

Technical and fundamentals don’t always see eye-to-eye but when they do, you know that there may be a solid investment opportunity for a given stock.