This Is Why the Dow Jones Is Surging to Its Best Week Since 1932

Another bullish day for the Dow 30 was accompanied by another monster rally for Boeing stock. | Source: Scott Olson/Getty Images/AFP

- The Dow Jones rallied again on Thursday. The index is on course for its best week in almost 90 years.

- Fiscal stimulus and comments from Fed Chair Jerome Powell helped boost risk appetite in the stock market.

- Unfortunately, a historically brutal unemployment situation may only get worse.

The Dow Jones kept its stunning rally going on Thursday as Nancy Pelosi stated she had “no doubts” that the $2 trillion fiscal package would be approved by Congress . Further supporting the stock market was Fed Chair Jerome Powell, who assured investors the U.S. central bank would “not run out of ammo.”

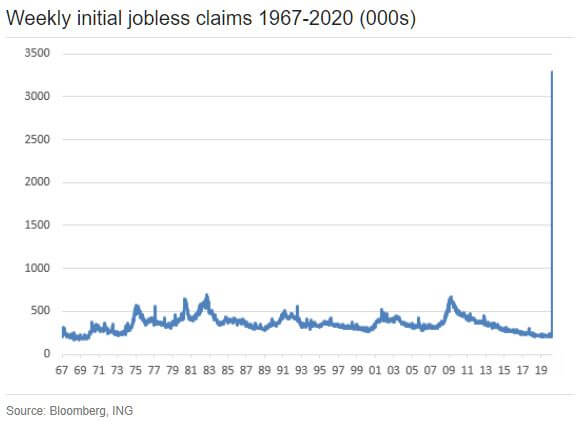

All this political jawboning helped shield the Dow from a historically bad jobless claims number, which spiraled above 3 million – with more pain to come.

Dow Jones on Course for Best Week In 88 Years

All three of the major U.S. stock market indices enjoyed another day of impressive gains:

- The Dow rallied 783.74 points or 3.7% to 21,984.29.

- The S&P 500 jumped 4.16% to 2,578.54.

- The Nasdaq advanced 3.6% to 7,649.83.

Things weren’t so bright in the commodity sector, where the oil price tumbled 6.5%.

Already battered by a brutal supply glut, oil unexpectedly suffered another demand shock after the U.S. government announced it would cancel its strategic purchases due to funding concerns .

The gold price was flat despite the rally in equities. This was primarily the result of a softening U.S. dollar.

Stock Market Priced for Historically Bad Jobless Claims Report

The spread of the coronavirus continues to gather pace in the United States , as confirmed cases now exceed 76,500. Given the current trajectory, the U.S. should comfortably overtake both China (81,750) and Italy (80,500) within a few days.

On the economic data front, the U.S. economy suffered its worst jobless claims data release on record. The 3.28 million applications were more than four times the highest-ever reading from the 1980s.

The Dow shrugged off that report, which was in line with what many forecasts expected.

Looking ahead, the stock market is optimistic that Congress will have to add another stimulus package to its existing measures , which total up to more than $6 trillion if you include lending programs and direct cash injections.

These actions will be essential if the rapid increase in unemployment continues. Despite the stimulus package’s massive price tag, New York Governor Andrew Cuomo criticized the bill, alleging it didn’t do enough to help fund state governments.

ING economist James Knightley believes that several technical issues may have reduced the number of jobless claims , which means the real number was considerably higher than the 3.28 million reported.

Knightley writes,

Pennsylvania reported the highest number of claims (378,900), with Ohio reporting 187,800, Illinois 114,700, California 186,800, and New York 80,300. The latter two states seem low given anecdotal evidence, which may indeed reflect issues with websites crashing and phone lines jammed and a general reluctance of people to stand in line with lots of other claimants in the current environment. We would expect numbers from these states and others to climb in coming weeks, particularly with the number of lockdowns increasing across the US.

Wall Street took comfort in a rare live interview from Federal Reserve Chair Jerome Powell , who was firm on two key points. Unlimited QE is real, and the Federal Reserve has all the ammunition it could ever need to counteract the spread of the coronavirus.

Dow Stocks: Boeing Carries the Index Again

Another bullish day for the Dow 30 was accompanied by another monster rally for Boeing stock.

Optimism that Boeing will receive a government bailout has rescued the stock, which has staged an incredible rally to $180 after bottoming out below $100.

Adding to the positive mood, the aerospace manufacturer revealed plans to resume production of its troubled 737 MAX jet this summer .

Despite the big sell-off in the price of crude oil, the Dow’s big energy companies – Chevron and Exxon Mobil – both traded higher.

Apple climbed above $250 per share, as the most heavily weighted stock in the Dow Jones continued to rebound off its lows.

The only two stocks in the red for the index were Walmart and Dow Inc., who only posted slight losses.