This Bitcoin Chart Destroys the Argument That BTC Can’t Be Money

The bitcoin price is undoubtedly volatile, making it difficult to establish as a true currency. But that's changing as BTC grows more stable. | Source: AFP PHOTO / PHILIPPE LOPEZ

By CCN.com: Every skeptic says the same thing: the bitcoin price is too volatile to be a real currency.

And they’ve got a point. Bitcoin’s huge swings make it risky as an investment and difficult as a day-to-day payment method.

But it’s slowly changing. As more money flows into bitcoin, it’s becoming less volatile. And that means it’s becoming better money.

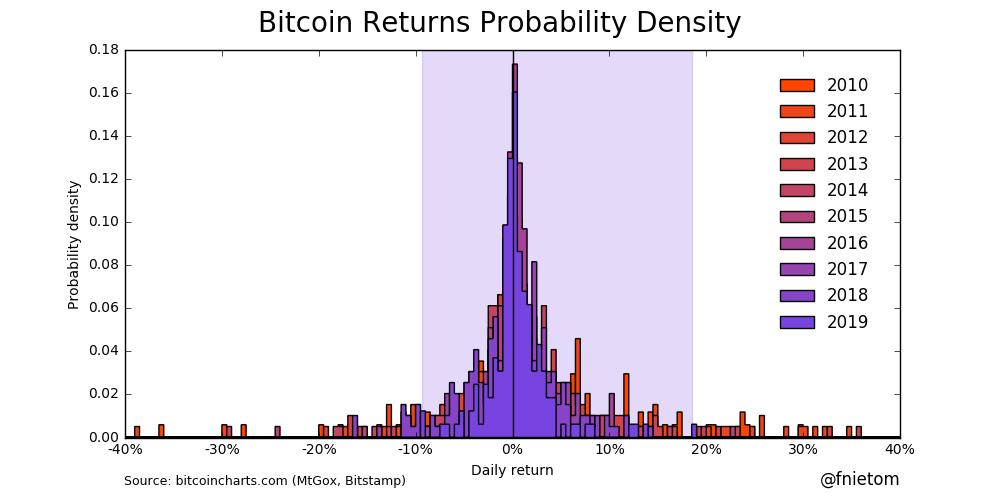

As you can see, the graph shows extreme daily price movements are much less common in 2018 and 2019. BTC is growing more stable.

Bitcoin price swings are “less extreme”

As developer Fernando Nieto, who created the graph, explains:

“Bitcoin volatility is in a clear decline as its monetization advances. Extreme daily returns are less frequent and less extreme than in the past.”

CoinMetrics co-founder Nic Carter recently confirmed the trend , citing standard deviation, a common measure of market volatility.

“Using standard deviation is the overwhelmingly popular way to measure volatility in finance and it shows a decreasing trend.”

Why? More liquidity and dispersion

In simple terms, bitcoin has grown more stable as more money enters the cryptocurrency market. With a larger market capitalization, bigger sums of money are required to move the price. Nieto confirms:

“Volatility is mostly explained by liquidity.”

CoinMetrics also weighed in on BTC’s volatility in its latest newsletter :

“The general trend is that bitcoin is becoming less volatile over time as it matures into a legitimate asset class.”

They believe the growing number of crypto exchanges have played a part in lowering volatility. As the cryptocurrency infrastructure grows, the bitcoin price is no longer reliant on two or three exchanges.

“There is now more dispersion in exchange market share, not less”

7 years until bitcoin “hyper-monetization”

Despite the decline in extreme movements, bitcoin is still volatile when compared to other assets and currencies. The cryptocurrency needs much more stability before it emerges as a viable day-to-day money alternative. As one CCN.com writer asked:

“Why on earth would anyone sell something in exchange for Bitcoin, when the value of that cryptocurrency literally changes moment to moment?”

Nieto believes the stability required for cryptocurrency monetization could take another seven years.

The battle for bitcoin payments

As CCN.com reported, only 1.3 percent of bitcoin transactions in 2019 came from merchants. In other words, almost no one is using crypto to make purchases.

In part, it’s because the price is too volatile. Holders don’t want to spend because they hope the price will go up. Merchants don’t want to accept it in case the price goes down.

That’s a bitter pill for major crypto companies like Coinbase who just issued a debit card in Europe, and Gemini and Flexa who launched the Spedn app.

Over the next decade, that trend will change. Bitcoin will grow more stable, allowing it to become a more viable day-to-day currency.