The Stock Market’s Biggest Gains Always Happen at the Same Time Each Day

As it turns out, the stock market's biggest moves happen when you are asleep. | Image: AP Photo/Lee Jin-man

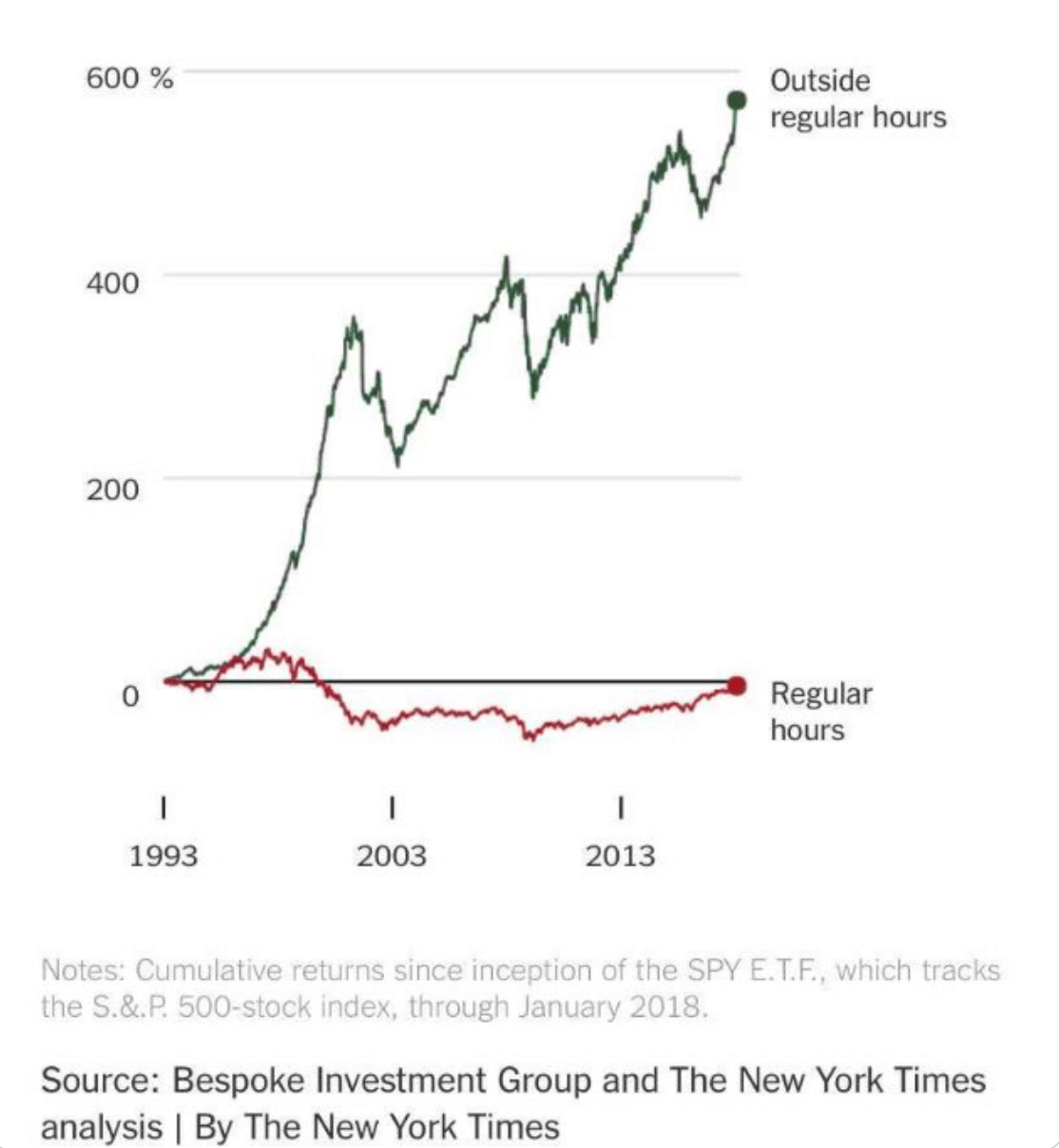

- For more than 20 years, the stock market has made its most significant gains at the same time: overnight.

- After-hours trading for the S&P 500 has generated almost 600% while intraday gains are flat since 1993.

- The phenomenon has been even more pronounced since the great March 2020 selloff.

Timing is everything in the stock market. Buying at the wrong moment is the difference between making money and getting burned.

So, what if you knew exactly when all the biggest gains happened almost every single day?

Well, we can’t be that exact. But this chart, shared by researcher Rich Kleinbauer on Twitter, gets us pretty close. It turns out, all the biggest gains in the U.S. market happen at the same time: overnight.

For almost 20 years, the stock market has returned a big fat zero during daytime hours.

The vast gains have all come in after-hours trading on the futures market.

You’re sleeping through all the biggest stock market gains

The intraday movements have much more volume and noise, but nothing much actually happens. The trend and direction of the market are decided while you’re asleep. As Liz Ann Sonders, Chief Investment Strategist at Charles Schwab put it :

Over history of SPY (back to 1993), nearly all gains have been outside regular hours.

And it’s not just the U.S. A research report from 2018 outlined the same phenomenon in Canada, France, Germany, and Japan.

This after-hours trend became apparent in 2020

The trend has been even more pronounced this year. Just look at S&P 500 returns during the most recent bounce for stocks. Compiled by Lohman Economics, here are the S&P 500 gains for the ten days leading up to May 20 :

- Intraday sessions: +1.75

- Overnight sessions: +89.25

And here’s a more recent chart up until May 26:

Even last week, stock futures drove the price discovery, and the market remained relatively flat once open.

The most significant S&P 500 drops also happen overnight

The same is also true for the downside. When the stock market enters a bear market, all the biggest losses happen overnight. We saw this play out in March when the S&P 500 dropped more than 30%.

Because of the vicious drops in 2020, holding stocks overnight has been the worst possible strategy. On numerous occasions during the March purge, after-hours trading was paused after hitting the 5% limit down circuit breakers.

Why do stocks rise most in after-hours trading?

No-one can pinpoint exactly why, but there are a few theories.

First, there’s much thinner volume in the after-hours futures market. It’s easier for big players to push the market in a particular direction when all the noise of the day is gone.

Second, all corporate earnings reports are released before or after the market opens . These often trigger massive price movements outside of normal trading hours.

Third, we live in a global world where Asian and European traders have access to U.S. futures markets overnight.

Fourth, and maybe most controversial, is that central banks use the overnight markets to inject liquidity. The Federal Reserve, for example, just opened up a $60 billion swap facility in Singapore to provide dollar liquidity in Asia. The Fed has other partnerships across Europe and Asia, which keep liquidity flowing overnight.

Stock markets are eerily predictable, sometimes…

If you track market movements long enough, you begin to see some patterns. The after-hours action is just one of them.

Another is weak action right at the end of the day. Market technician J.C. O’Hara at FBN Securities ran the numbers back in 2015 and found something unusual about trading at the end of the day :

If you were just to buy the last half-hour of each day, you’d be down 2 percent [even in a bull market]

Mark Yusko, founder of Morgan Creek Capital Management, regularly points out a few more odd timing patterns.

In sum, retail traders often flood the market at the open, sending volume into a frenzy. President Trump’s plunge protection team often operate over lunchtime during thin volume in a bid to push markets up again.

And companies typically buy back their own stocks just before 3 p.m. (they have a deadline starting at 3.30 p.m.). ‘Smart money’ players, like hedge funds, often wind up the day with a big buying or selling spree.

Maybe the stock market isn’t so unpredictable after all?